- United States

- /

- Media

- /

- NasdaqCM:SGRP

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The U.S. stock market has recently seen a rebound, with investor attention shifting to earnings reports and the Federal Reserve's policy meeting. For those willing to explore beyond large-cap stocks, penny stocks—often representing smaller or emerging companies—can present unique opportunities in today's market landscape. Although the term "penny stocks" might seem outdated, these investments remain relevant as they can offer surprising value and potential for growth when backed by solid financial health.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.22M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.49M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2874 | $10.58M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $49.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.03 | $60.21M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $23.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8893 | $80.06M | ★★★★★☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hydrofarm Holdings Group (NasdaqCM:HYFM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hydrofarm Holdings Group, Inc. manufactures and distributes controlled environment agriculture equipment and supplies in the United States and Canada, with a market cap of $29.36 million.

Operations: The company generates revenue of $200.16 million from the distribution and manufacturing of controlled environment agriculture equipment and supplies.

Market Cap: $29.36M

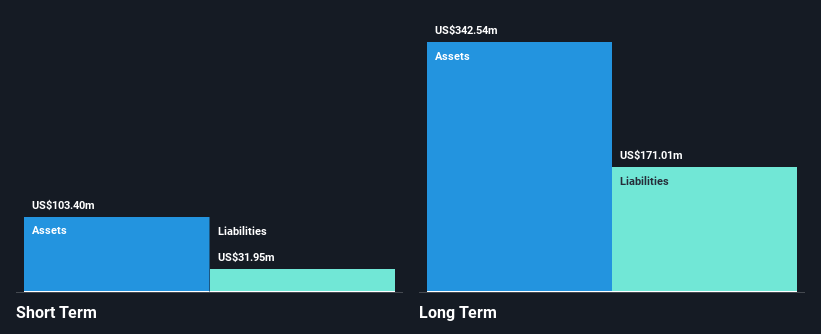

Hydrofarm Holdings Group, with a market cap of US$29.36 million, faces significant challenges as it remains unprofitable and is not expected to achieve profitability in the next three years. Despite reducing its debt to equity ratio from 340.6% to 47.8% over five years, the company struggles with long-term liabilities exceeding short-term assets by US$67.6 million. Recent earnings reports show declining sales and persistent net losses, though losses have slightly narrowed year-over-year. While trading at good value compared to peers, volatility remains high and cash runway is limited if growth continues at historical rates.

- Navigate through the intricacies of Hydrofarm Holdings Group with our comprehensive balance sheet health report here.

- Gain insights into Hydrofarm Holdings Group's future direction by reviewing our growth report.

SPAR Group (NasdaqCM:SGRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SPAR Group, Inc. offers merchandising and brand marketing services across the Americas, Asia-Pacific, Europe, Middle East, and Africa with a market cap of $43.82 million.

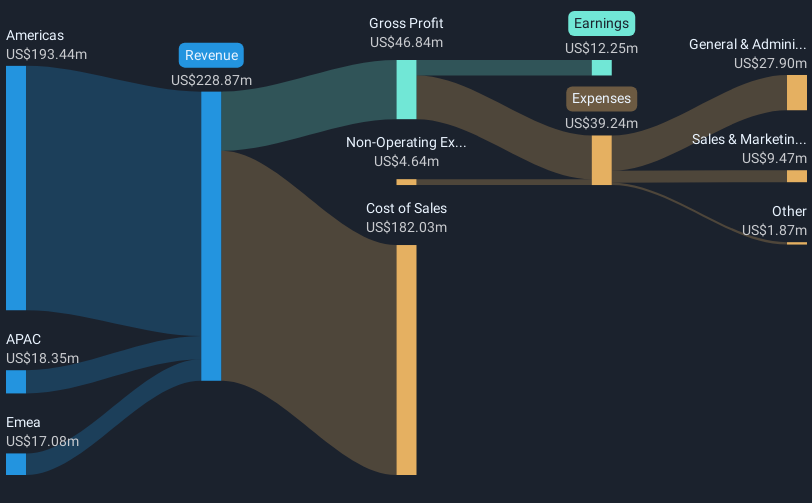

Operations: The company's revenue is derived from three main regions: APAC with $18.35 million, EMEA contributing $17.08 million, and the Americas generating $193.44 million.

Market Cap: $43.82M

SPAR Group, Inc., with a market cap of US$43.82 million, has shown significant earnings growth over the past five years but faced a challenging third quarter in 2024 with sales dropping to US$37.79 million from US$67.33 million the previous year, resulting in a net loss of US$0.144 million. Despite this setback, SPAR's strong financial position is underscored by its satisfactory net debt to equity ratio of 4.1% and outstanding return on equity at 40%. The company’s short-term assets comfortably cover both short and long-term liabilities, indicating solid liquidity management amidst volatile earnings performance.

- Get an in-depth perspective on SPAR Group's performance by reading our balance sheet health report here.

- Assess SPAR Group's future earnings estimates with our detailed growth reports.

PMV Pharmaceuticals (NasdaqGS:PMVP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PMV Pharmaceuticals, Inc. is a precision oncology company focused on discovering and developing small molecule and tumor-agnostic therapies for p53 mutations in cancer, with a market cap of approximately $70.89 million.

Operations: PMV Pharmaceuticals does not report any revenue segments.

Market Cap: $70.89M

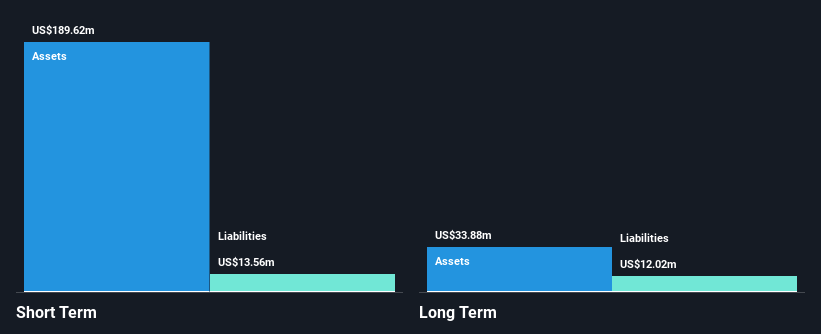

PMV Pharmaceuticals, Inc., with a market cap of US$70.89 million, is pre-revenue and currently unprofitable, yet it holds a robust cash position with short-term assets of US$189.6 million exceeding both short-term and long-term liabilities. The company remains debt-free and has not significantly diluted shareholders over the past year. Despite its negative return on equity, PMV's experienced management team supports its strategic direction in precision oncology. Recent filings for a US$200 million shelf registration suggest potential capital raising efforts to bolster development activities further. Analysts expect significant stock price appreciation, although profitability is not anticipated within the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of PMV Pharmaceuticals.

- Explore PMV Pharmaceuticals' analyst forecasts in our growth report.

Summing It All Up

- Click here to access our complete index of 713 US Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SPAR Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SGRP

SPAR Group

Provides merchandising and brand marketing services in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives