- United States

- /

- Tech Hardware

- /

- NasdaqGS:IVAC

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of cautious anticipation, with investors closely watching the Federal Reserve's upcoming decisions and major tech earnings reports, there remains interest in exploring diverse investment opportunities. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These smaller or newer companies can offer a mix of affordability and growth potential when paired with strong financials, making them intriguing options for investors seeking hidden value in quality stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.69 | $11.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8985 | $6.25M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.283 | $10.58M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.73 | $84.93M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.57 | $42M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.11 | $52.57M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.29 | $23.06M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.90 | $79.98M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

FTC Solar (NasdaqCM:FTCI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FTC Solar, Inc. provides solar tracker systems, software, and engineering services across various regions including the United States, Asia, Europe, the Middle East, North Africa, South Africa, and Australia with a market cap of $51.03 million.

Operations: The company generates revenue of $57.35 million from the manufacturing and servicing of solar tracker systems.

Market Cap: $51.03M

FTC Solar, Inc. is navigating the challenges typical of penny stocks with a volatile share price and ongoing unprofitability. Despite its current financial struggles, including a net loss of US$36.37 million over nine months in 2024, the company has secured significant projects such as supplying trackers for Dunlieh Energy's utility-scale solar projects beginning in 2025. Recent strategic moves include appointing Kent James as Chief Commercial Officer to bolster North American operations and raising capital through shelf registration and private placements, indicating efforts to stabilize finances and drive future growth.

- Click here to discover the nuances of FTC Solar with our detailed analytical financial health report.

- Understand FTC Solar's earnings outlook by examining our growth report.

Intevac (NasdaqGS:IVAC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intevac, Inc. designs, develops, and manufactures thin-film processing systems across the United States, Europe, and Asia with a market cap of $94.41 million.

Operations: The company generates revenue primarily from its Thin-Film Equipment (TFE) segment, totaling $65.57 million.

Market Cap: $94.41M

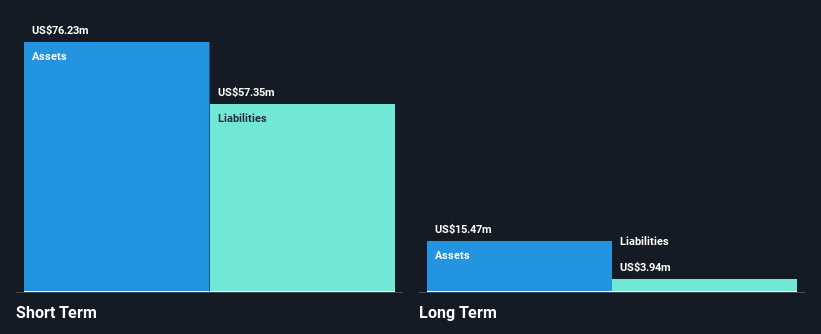

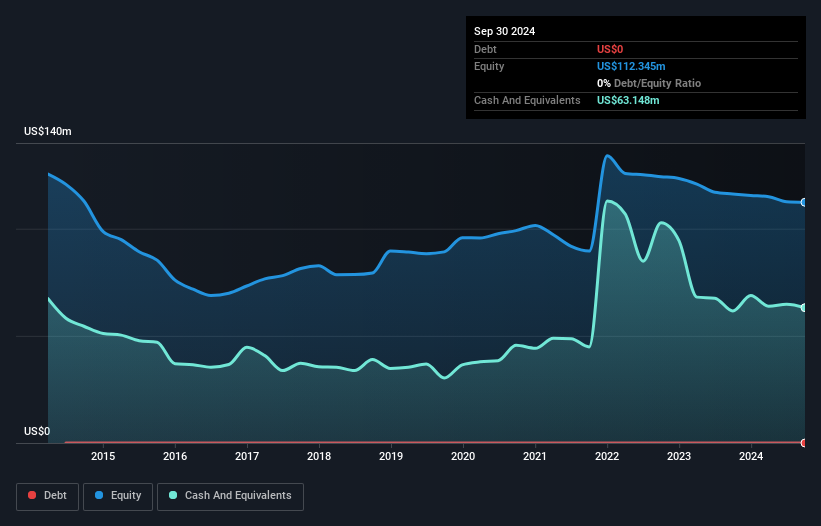

Intevac, Inc. remains unprofitable with a net loss of US$7.04 million over the first nine months of 2024, yet it maintains a strong balance sheet with short-term assets significantly exceeding liabilities and no debt for five years. The company's revenue guidance for 2025 is projected between US$52 million and US$55 million, reflecting disciplined financial management aimed at long-term sustainability. Recent strategic initiatives include forming a Strategic Committee to explore options for enhancing shareholder value, alongside initiating quarterly dividends and completing substantial share buybacks to strengthen investor confidence amidst ongoing challenges.

- Get an in-depth perspective on Intevac's performance by reading our balance sheet health report here.

- Explore Intevac's analyst forecasts in our growth report.

Puma Biotechnology (NasdaqGS:PBYI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company dedicated to developing and commercializing cancer care products both in the United States and internationally, with a market cap of approximately $146.28 million.

Operations: The company generates $243.57 million from its segment focused on the development and commercialization of innovative cancer care products.

Market Cap: $146.28M

Puma Biotechnology's recent developments highlight its dynamic position in the biotech sector. The company reported strong earnings growth, with third-quarter revenue rising to US$80.54 million from US$56.1 million the previous year, and net income reaching US$20.32 million. Its financial health is underpinned by short-term assets exceeding liabilities and more cash than total debt, reflecting prudent fiscal management. Recent inclusion of neratinib in NCCN guidelines for cervical cancer treatment and initiation of a Phase II trial for alisertib demonstrate Puma's commitment to expanding its oncology portfolio, potentially enhancing future revenue streams despite forecasted earnings decline over the next three years.

- Unlock comprehensive insights into our analysis of Puma Biotechnology stock in this financial health report.

- Learn about Puma Biotechnology's future growth trajectory here.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 706 more companies for you to explore.Click here to unveil our expertly curated list of 709 US Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IVAC

Intevac

Engages in the designing, developing, and manufacturing thin-film processing systems in the United States, Europe, and Asia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives