- United States

- /

- Biotech

- /

- NasdaqGS:PBYI

Puma Biotechnology, Inc. (NASDAQ:PBYI) Held Back By Insufficient Growth Even After Shares Climb 26%

Puma Biotechnology, Inc. (NASDAQ:PBYI) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

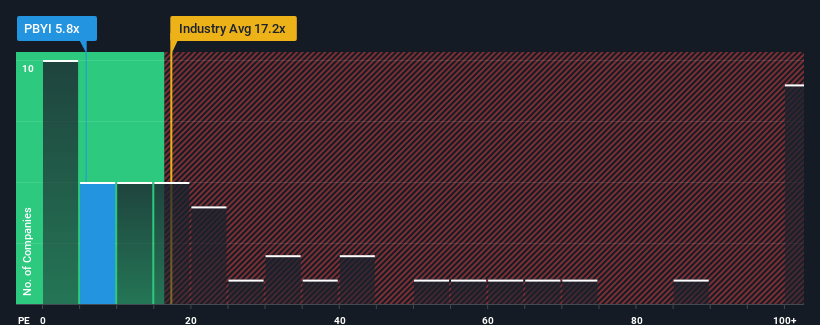

In spite of the firm bounce in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Puma Biotechnology as a highly attractive investment with its 5.8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Puma Biotechnology certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Puma Biotechnology

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Puma Biotechnology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 36% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to slump, contracting by 11% per year during the coming three years according to the dual analysts following the company. With the market predicted to deliver 11% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that Puma Biotechnology's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Even after such a strong price move, Puma Biotechnology's P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Puma Biotechnology's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Puma Biotechnology you should be aware of, and 1 of them is a bit unpleasant.

You might be able to find a better investment than Puma Biotechnology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PBYI

Puma Biotechnology

A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives