- United States

- /

- Biotech

- /

- NasdaqGS:OYST

Companies Like Oyster Point Pharma (NASDAQ:OYST) Are In A Position To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Oyster Point Pharma (NASDAQ:OYST) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Oyster Point Pharma

How Long Is Oyster Point Pharma's Cash Runway?

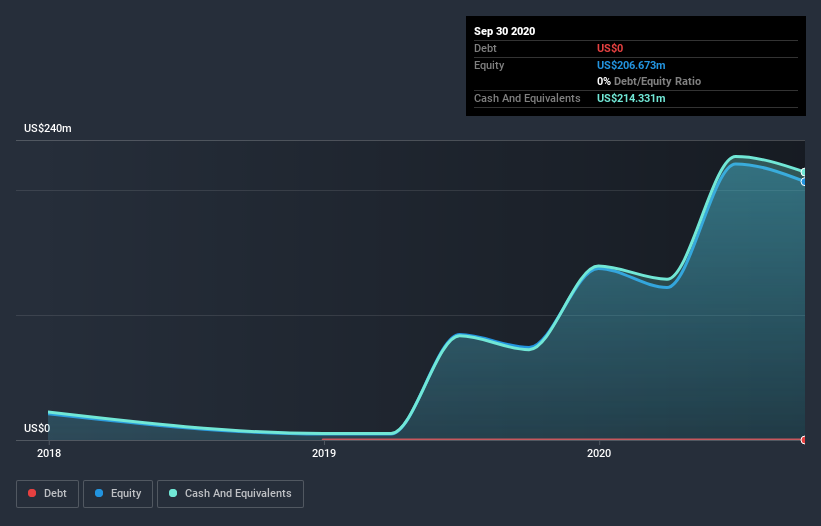

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2020, Oyster Point Pharma had cash of US$214m and no debt. In the last year, its cash burn was US$54m. Therefore, from September 2020 it had 3.9 years of cash runway. Importantly, though, analysts think that Oyster Point Pharma will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Is Oyster Point Pharma's Cash Burn Changing Over Time?

Oyster Point Pharma didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. During the last twelve months, its cash burn actually ramped up 90%. Oftentimes, increased cash burn simply means a company is accelerating its business development, but one should always be mindful that this causes the cash runway to shrink. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Oyster Point Pharma To Raise More Cash For Growth?

While Oyster Point Pharma does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Oyster Point Pharma has a market capitalisation of US$528m and burnt through US$54m last year, which is 10% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Oyster Point Pharma's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Oyster Point Pharma's cash burn. For example, we think its cash runway suggests that the company is on a good path. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. One real positive is that analysts are forecasting that the company will reach breakeven. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 2 warning signs for Oyster Point Pharma that investors should know when investing in the stock.

Of course Oyster Point Pharma may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Oyster Point Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:OYST

Oyster Point Pharma

Oyster Point Pharma, Inc., a commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of pharmaceutical therapies to treat ophthalmic diseases in the United States.

Slightly overvalued with limited growth.