- United States

- /

- Biotech

- /

- NasdaqGM:ORKA

Is Oruka Therapeutics’ (ORKA) Fundraising Spree a Sign of Strategic Flexibility or Underlying Caution?

Reviewed by Sasha Jovanovic

- Oruka Therapeutics has recently filed two major shelf registrations exceeding US$1.25 billion and announced a US$200 million follow-on equity offering for its common stock, aiming to strengthen its financial position.

- This significant fundraising drive underscores the company's focus on boosting operational flexibility and supporting potential growth opportunities.

- We'll now explore how these capital-raising efforts enhance Oruka Therapeutics' investment narrative, particularly its drive to increase financial flexibility.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Oruka Therapeutics' Investment Narrative?

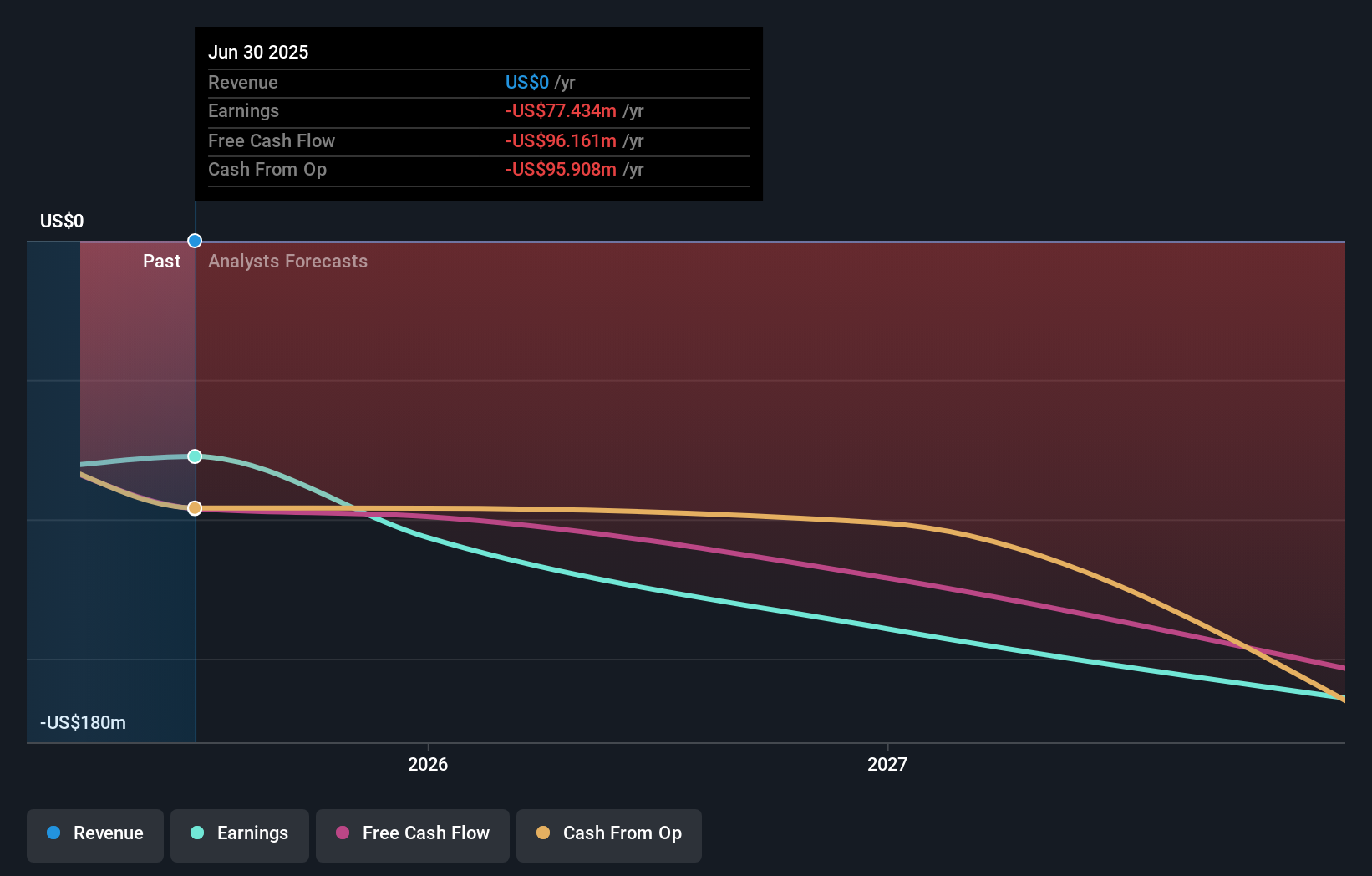

For investors considering Oruka Therapeutics, the big picture centres on faith in the company's ability to translate its dermatology-focused pipeline, highlighted by ORKA-001’s promising early trial data, into future commercial success. The recent US$1.25 billion shelf registrations and the US$200 million follow-on equity raise significantly improve Oruka’s short-term financial flexibility, which could directly impact the company’s ability to advance mid-stage clinical programs and manage escalating R&D costs. This fresh capital may offset some immediate funding risk that previously overshadowed Oruka’s main catalysts, particularly the readout of upcoming clinical trial data. However, the increased pace of equity issuance also brings dilution risk into sharper focus, especially with the company remaining unprofitable and with no expected revenue in the near term. While these moves reduce the likelihood of near-term funding gaps, they do not eliminate execution risks in clinical and regulatory milestones, which remain key value drivers and risks for the stock. Yet, how this capital will be deployed and whether it translates to sustained momentum will be a major question moving forward.

Still, with dilution risk heightened, investors should keep an eye out for changes in shareholder value.

Exploring Other Perspectives

Explore another fair value estimate on Oruka Therapeutics - why the stock might be worth just $42.62!

Build Your Own Oruka Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oruka Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oruka Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oruka Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ORKA

Oruka Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing novel monoclonal antibody therapeutics for psoriasis (PsO), and other inflammatory and immunology (I&I) indications.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives