- United States

- /

- Biotech

- /

- NasdaqCM:ORGO

Why Investors Shouldn't Be Surprised By Organogenesis Holdings Inc.'s (NASDAQ:ORGO) Low P/S

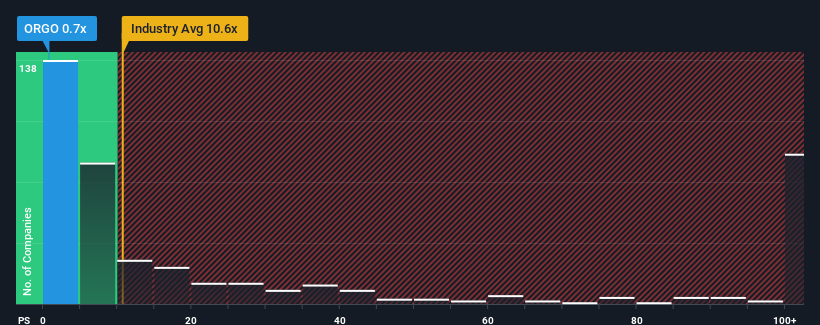

Organogenesis Holdings Inc.'s (NASDAQ:ORGO) price-to-sales (or "P/S") ratio of 0.7x might make it look like a strong buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.6x and even P/S above 75x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Organogenesis Holdings

How Has Organogenesis Holdings Performed Recently?

While the industry has experienced revenue growth lately, Organogenesis Holdings' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Organogenesis Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Organogenesis Holdings' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 2.0% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 1.6% as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 133% growth forecast for the broader industry.

With this in consideration, its clear as to why Organogenesis Holdings' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Organogenesis Holdings' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Organogenesis Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Organogenesis Holdings with six simple checks.

If you're unsure about the strength of Organogenesis Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ORGO

Organogenesis Holdings

A regenerative medicine company, develops, manufactures, and commercializes products for the advanced wound care, and surgical and sports medicine markets in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives