- United States

- /

- Pharma

- /

- NasdaqCM:OPNT

Opiant Pharmaceuticals'(NASDAQ:OPNT) Share Price Is Down 41% Over The Past Three Years.

It is doubtless a positive to see that the Opiant Pharmaceuticals, Inc. (NASDAQ:OPNT) share price has gained some 73% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 41% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for Opiant Pharmaceuticals

Given that Opiant Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

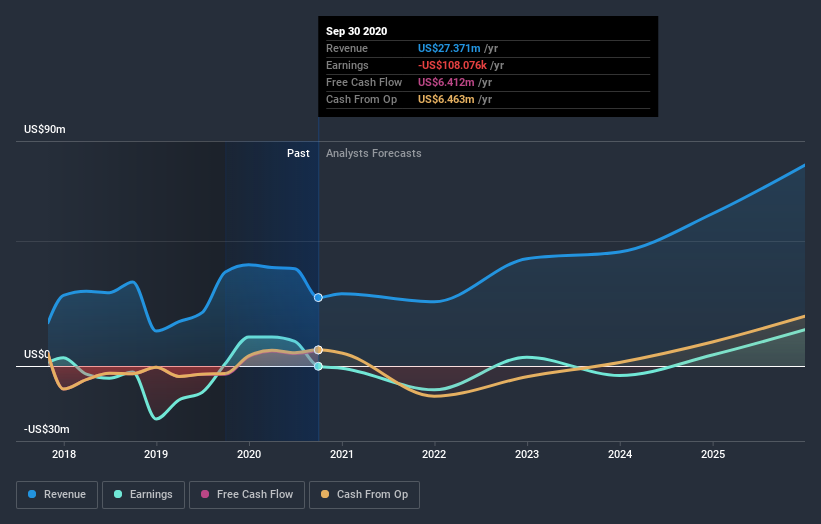

Over three years, Opiant Pharmaceuticals grew revenue at 15% per year. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 12% per year. This implies the market had higher expectations of Opiant Pharmaceuticals. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Opiant Pharmaceuticals' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 27% in the last year, Opiant Pharmaceuticals shareholders lost 3.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Opiant Pharmaceuticals better, we need to consider many other factors. Take risks, for example - Opiant Pharmaceuticals has 3 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Opiant Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Opiant Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OPNT

Opiant Pharmaceuticals

Opiant Pharmaceuticals, Inc., a specialty pharmaceutical company, develops medicines for addictions and drug overdose.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives