- United States

- /

- Pharma

- /

- NasdaqGM:OCS

Oculis Holding (OCS) Advances Privosegtor to Registrational Trials After FDA Meeting Will Innovation Leadership Strengthen?

Reviewed by Sasha Jovanovic

- Oculis Holding AG recently announced the advancement of Privosegtor into registrational trials for acute optic neuritis and non-arteritic anterior ischemic optic neuropathy following a positive FDA meeting, and plans to showcase its late-stage pipeline at major ophthalmology conferences, including Eyecelerator and the American Academy of Ophthalmology Annual Meeting in Orlando.

- This sequence of regulatory progress and high-profile presentations marks a pivotal point for Oculis as it seeks to reinforce its leadership in innovative ophthalmic therapies.

- We'll explore how the FDA-aligned clinical plans for Privosegtor could reshape Oculis Holding's investment narrative in ophthalmology innovation.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Oculis Holding's Investment Narrative?

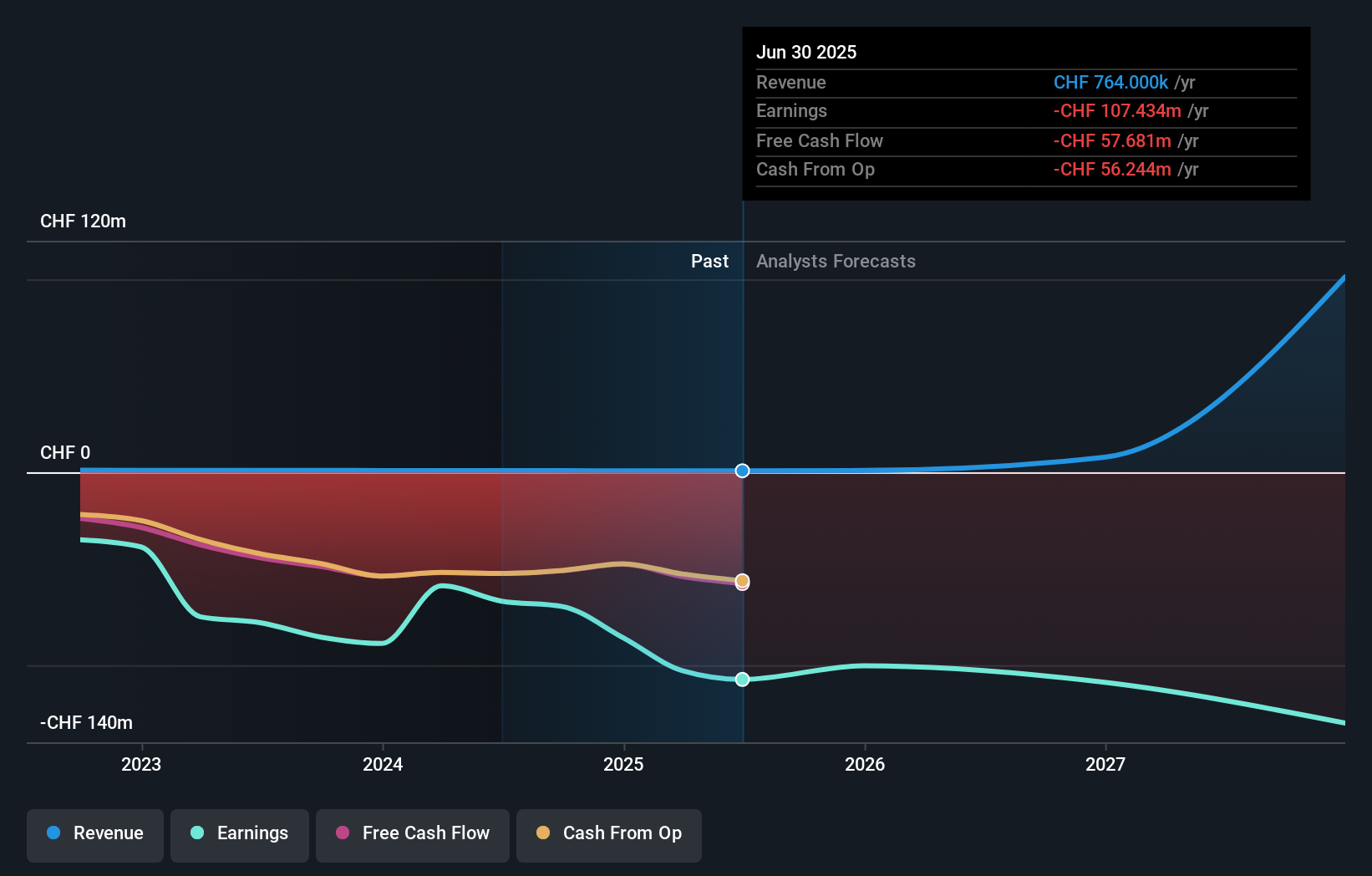

For anyone considering Oculis Holding, the big picture centers on believing in the company’s ability to translate its late-stage ophthalmology pipeline into future revenue, despite ongoing losses and heavy investment in clinical progress. The recent advancement of Privosegtor into registrational trials, following positive FDA feedback, could accelerate key catalysts, like regulatory milestones and clinical data readouts, impacting sentiment and near-term valuation. Showcasing this progress at flagship ophthalmology meetings boosts Oculis’s profile just as it gears up for potentially pivotal results from multiple late-stage studies. However, this positive momentum arrives alongside persistent risks: the company remains deeply unprofitable, and its management team’s brief tenure signals execution uncertainty. Unpredictable regulatory outcomes, reliance on successful trial recruitment, and the need for additional funding remain important for anyone weighing whether the recent news changes the risk-reward equation. While this step forward is promising, it doesn’t immediately resolve financial and commercialization challenges facing the business.

Yet, the pace of operating losses and leadership turnover remain key questions to watch.

Exploring Other Perspectives

Explore another fair value estimate on Oculis Holding - why the stock might be worth just $42.30!

Build Your Own Oculis Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oculis Holding research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oculis Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oculis Holding's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCS

Oculis Holding

A clinical-stage biopharmaceutical company, develops drug candidates to treat ophthalmic diseases in Switzerland, Iceland, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives