- United States

- /

- Biotech

- /

- NasdaqCM:OCGN

Ocugen (NASDAQ:OCGN shareholders incur further losses as stock declines 12% this week, taking three-year losses to 82%

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Ocugen, Inc. (NASDAQ:OCGN); the share price is down a whopping 82% in the last three years. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 30% in the last year. Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Ocugen

Ocugen isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Ocugen saw its revenue grow by 88% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 22% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

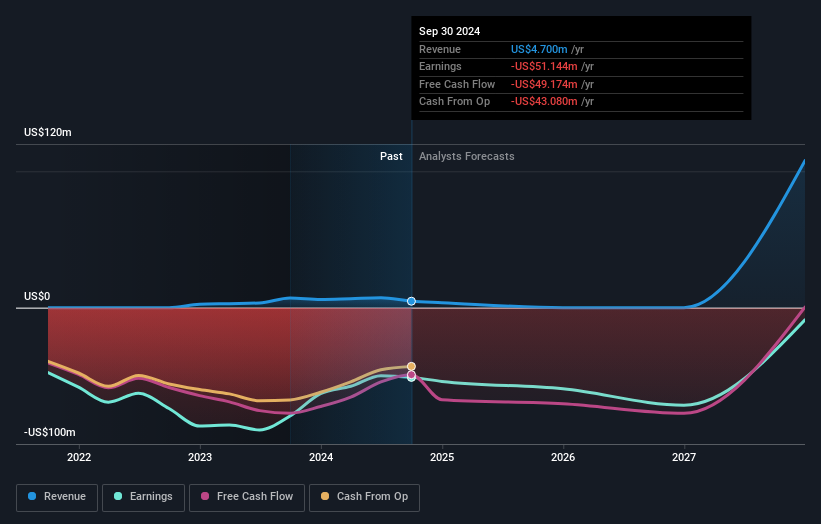

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Ocugen's financial health with this free report on its balance sheet.

A Different Perspective

Ocugen shareholders are down 30% for the year, but the market itself is up 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Ocugen that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OCGN

Ocugen

A clinical-stage biopharmaceutical company, focuses on discovering, developing, and commercializing novel gene and cell therapies and vaccines that improve patients’ health.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives