- United States

- /

- Life Sciences

- /

- NasdaqGM:OABI

Market Participants Recognise OmniAb, Inc.'s (NASDAQ:OABI) Revenues Pushing Shares 38% Higher

OmniAb, Inc. (NASDAQ:OABI) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

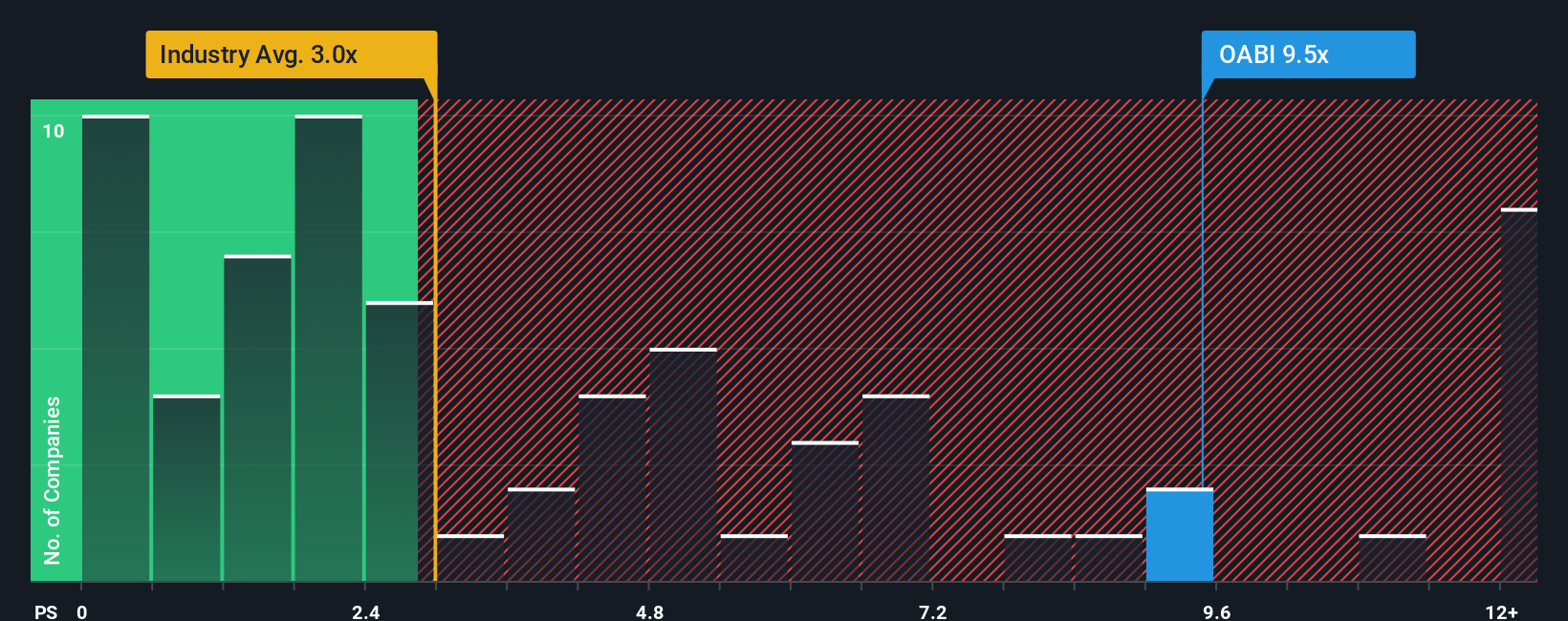

Since its price has surged higher, you could be forgiven for thinking OmniAb is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.5x, considering almost half the companies in the United States' Life Sciences industry have P/S ratios below 3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for OmniAb

How Has OmniAb Performed Recently?

Recent times have been advantageous for OmniAb as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OmniAb.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like OmniAb's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 29% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 29% per annum over the next three years. That's shaping up to be materially higher than the 7.1% per year growth forecast for the broader industry.

In light of this, it's understandable that OmniAb's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From OmniAb's P/S?

OmniAb's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of OmniAb's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - OmniAb has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on OmniAb, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:OABI

OmniAb

A biotechnology company, licenses discovery research technology to pharmaceutical and biotech companies, and academic institutions to enable the discovery of therapeutics in the United States, Europe, Japan, China, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives