- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

What Do Recent Novavax Gains Mean After the Sanofi Partnership Announcement?

Reviewed by Bailey Pemberton

If you have been eyeing Novavax lately, you are definitely not alone. Investors are talking about this vaccine maker again, especially after the stock posted an eye-catching 10.6% gain over the last week and a solid 27.8% jump for the last 30 days. At first glance, these short-term pops might look like positive momentum, especially for anyone who has ridden out Novavax’s painful declines over the last year, or even over the past five years, where the stock is down a staggering 91.5%.

So, what is driving this renewed interest? Much of it comes down to shifting risk perceptions across the vaccine sector. Specialized biotech names like Novavax are getting a second look as the wider vaccine market evolves. Investors appear to be recalibrating their bets as market developments shift, weighing newfound growth potential against old uncertainties.

If you are trying to decide what to do with Novavax now, valuation is the heart of the matter. At present, Novavax scores a 3 out of 6 on our value checklist, marking it as undervalued in half of the key areas we watch. That raises an intriguing question: is the market missing something, or are the risks just as real as the opportunities?

Let us break down what those valuation metrics reveal. More importantly, let us explore a better way to think about Novavax’s true worth by the end of this article.

Why Novavax is lagging behind its peers

Approach 1: Novavax Discounted Cash Flow (DCF) Analysis

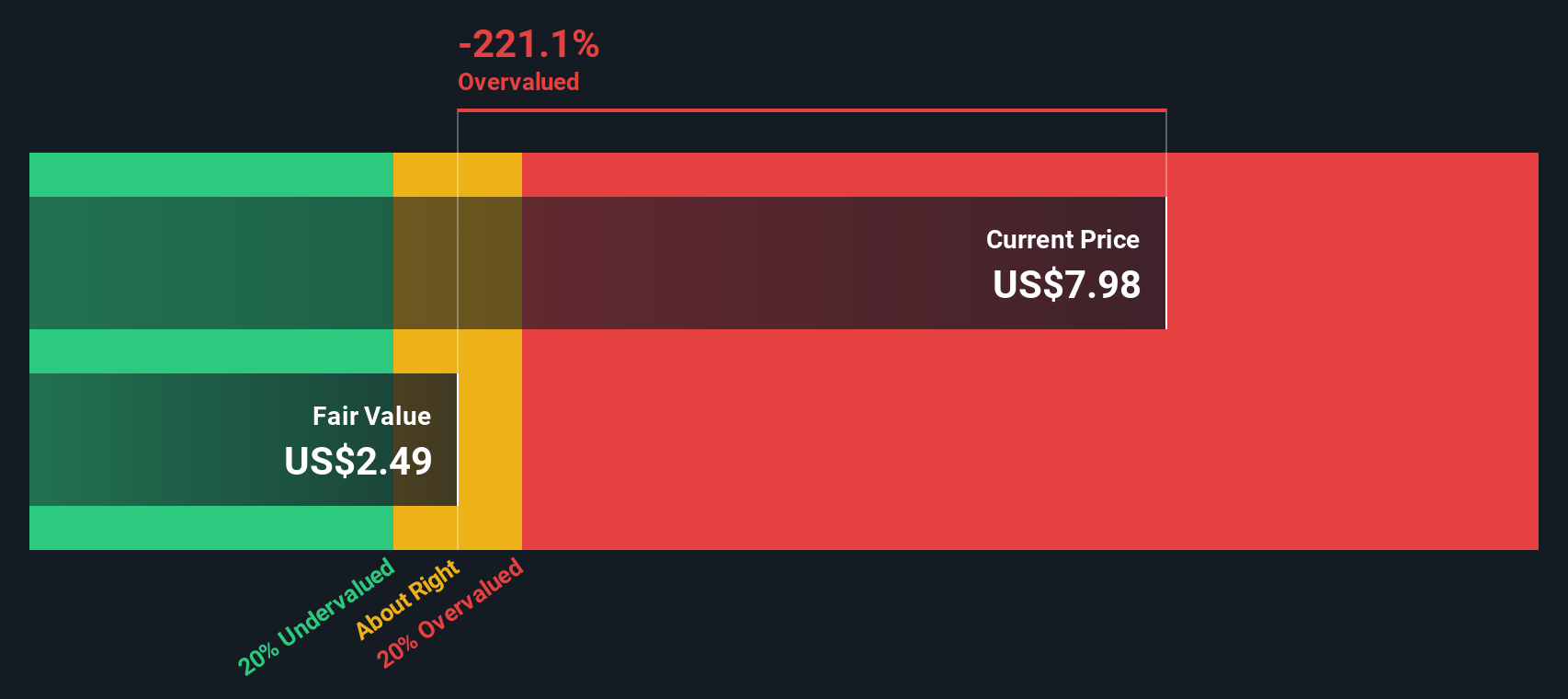

A Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to today's value. This is done to account for the time value of money, capturing how much future profits are worth in current dollars.

For Novavax, the most recent reported Free Cash Flow (FCF) sits at -$668.4 Million. While this negative figure reflects the company's recent challenges, projections suggest a dramatic turnaround. Analyst estimates show Novavax may generate a positive FCF of $76 Million by 2029. These projections extend further through extrapolation, with expected numbers gradually normalizing in the next decade.

Based on all projected and discounted cash flows, the estimated intrinsic value for Novavax shares is $2.48. Compared to the current market price, the stock appears to be a dramatic 282.0% overvalued on DCF analysis. This means the current share price is much higher than what the company’s future cash flow potential seems to justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novavax may be overvalued by 282.0%. Find undervalued stocks or create your own screener to find better value opportunities.

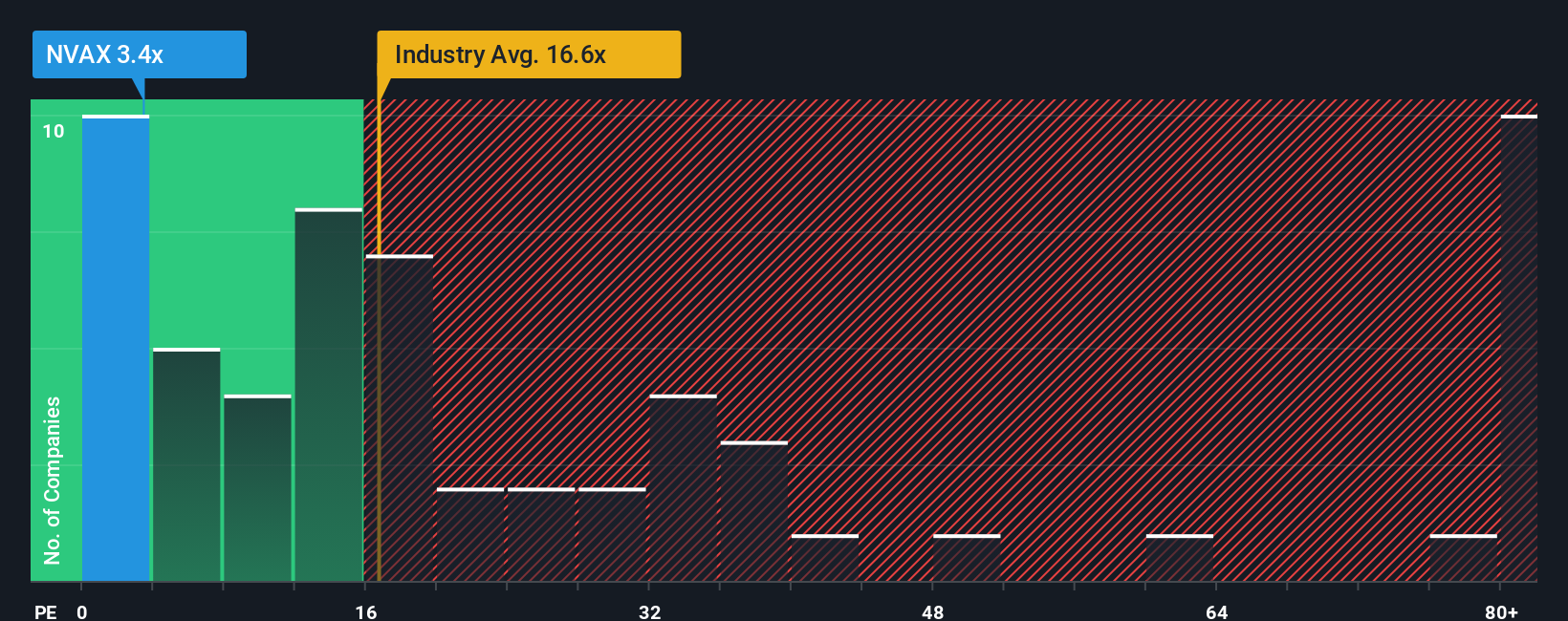

Approach 2: Novavax Price vs Earnings

For companies that are profitable, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. This simple yet powerful metric compares a company’s current share price to its earnings per share, making it easy to see how much investors are paying for each dollar of profit. The “right” PE ratio can depend on how quickly a company is expected to grow and just how much risk investors are willing to accept. Generally, firms with strong growth outlooks or lower risk profiles command higher PE ratios, while slower-growing or riskier businesses trade at lower multiples.

Right now, Novavax trades at a PE ratio of 3.63x. For context, the average PE ratio among peer biotechs is 53.10x and the broader industry average sits at 16.74x. At first glance, Novavax’s low PE ratio stands out in a sector where most companies demand a far higher valuation for their profits.

However, straight comparisons can be misleading. This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio weighs more than just profit; it factors in Novavax’s earnings growth prospects, industry characteristics, profit margins, market capitalization and the specific risks attached to the business. This makes it a more grounded and holistic measure than the industry or peer average alone.

Novavax’s Fair PE Ratio registers at 10.55x. Comparing this to the current PE of 3.63x shows that Novavax is trading well below what would be considered fair given its outlook and risk profile. This suggests the market may be underestimating the company’s future potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

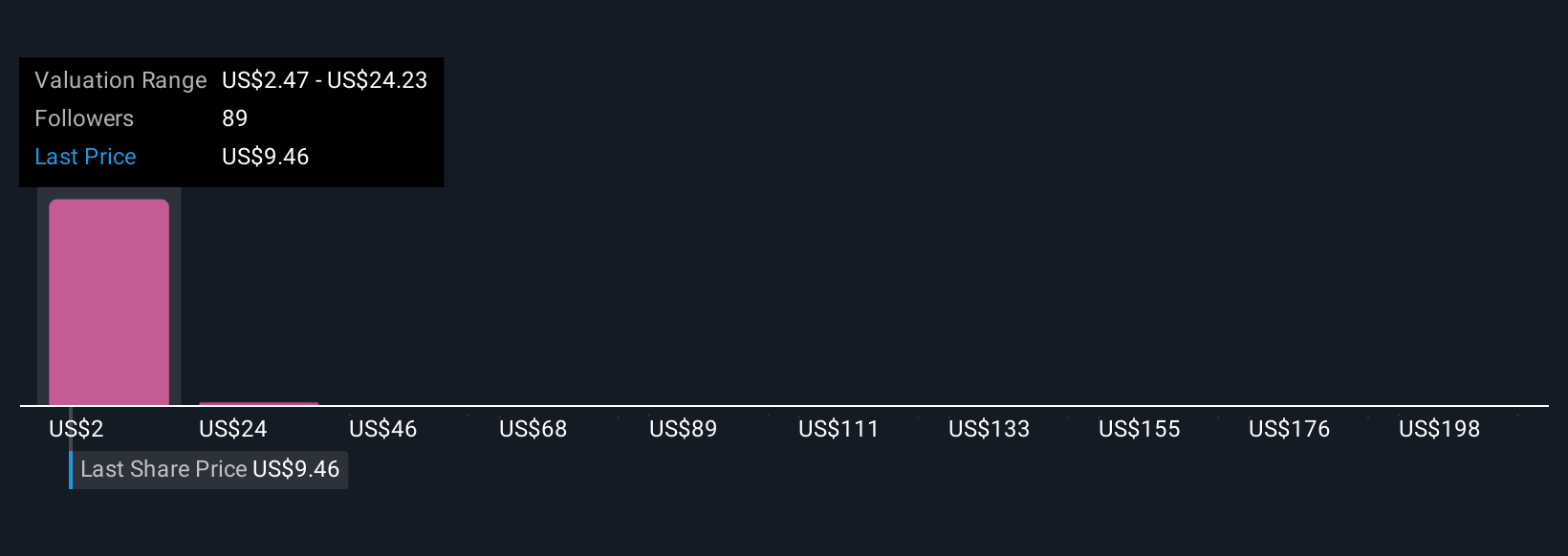

Upgrade Your Decision Making: Choose your Novavax Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your perspective on a company’s story, describing how you connect what the business does, the numbers you expect it to achieve over time, and what you believe those numbers are worth today. On Simply Wall St’s platform, Narratives are an easy and accessible tool, available to all investors on the Community page. They allow you to link your unique take on Novavax’s future, such as its ability to commercialize new vaccines, secure partners, or manage regulatory risks, with a financial forecast and a calculated fair value.

Narratives make investment decisions more dynamic and personal by automatically comparing your Fair Value to the current share Price. This guides you on whether to buy, hold, or sell, and they are updated whenever new data, earnings, or industry news emerges, so your outlook evolves in real time. For Novavax, two investors could look at the same facts and reach different conclusions. One Narrative might assume robust partner execution and a future share price of $25.00, while another focuses on execution risks and targets just $6.00. This approach allows you to quickly see how your viewpoint stacks up against others and make adjustments as new information becomes available.

Do you think there's more to the story for Novavax? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives