- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX) Valuation in Focus After Expanded Sanofi Collaboration and New Milestone Payments

Reviewed by Kshitija Bhandaru

Novavax (NVAX) recently announced an expanded license agreement with Sanofi. The agreement gives Sanofi broader rights to use Novavax’s Matrix-M adjuvant in its pandemic influenza vaccine program. The deal includes potential milestone payments and royalties.

See our latest analysis for Novavax.

News of the expanded deal with Sanofi seems to have reignited some momentum in Novavax’s stock, which delivered an impressive 1-month share price return of nearly 20%. This run comes after a tough stretch, with the 12-month total shareholder return still deep in negative territory. While short-term enthusiasm is building, long-term shareholders remain underwater.

If this surge in biotech news has you watching the sector more closely, now is the perfect time to explore other healthcare innovators with our See the full list for free.

With the stock trading at a notable discount to analyst price targets but still carrying hefty long-term losses, investors are left to weigh whether Novavax represents a true turnaround opportunity or if the market has already factored in future upside.

Most Popular Narrative: 24.3% Undervalued

With Novavax closing at $9.46 and the most popular narrative assigning fair value at $12.50, the current price sits well below perceived value. Investors and analysts are closely watching for execution on recently announced partnerships, as these factors drive the bullish scenario detailed below.

The successful commercialization of the R21 Matrix-M malaria vaccine, already deployed in 12 African countries with over 20 million doses sold, showcases the potential for expanding sales in underserved infectious disease markets. This is likely to increase both revenues and operating leverage through economies of scale.

Wondering why Novavax’s story is turning heads among market watchers? There is a bold set of assumptions behind this fair value. Achievable revenue in new geographies, shifting cost structures, and aggressive margin forecasts could all be driving the optimism. Want to know what expectations must be met to justify this price target? The full narrative breaks down the numbers and the high-stakes logic behind this valuation.

Result: Fair Value of $12.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on partner-driven revenues and heavy dependence on COVID-19 demand mean that success is far from guaranteed for Novavax’s bullish outlook.

Find out about the key risks to this Novavax narrative.

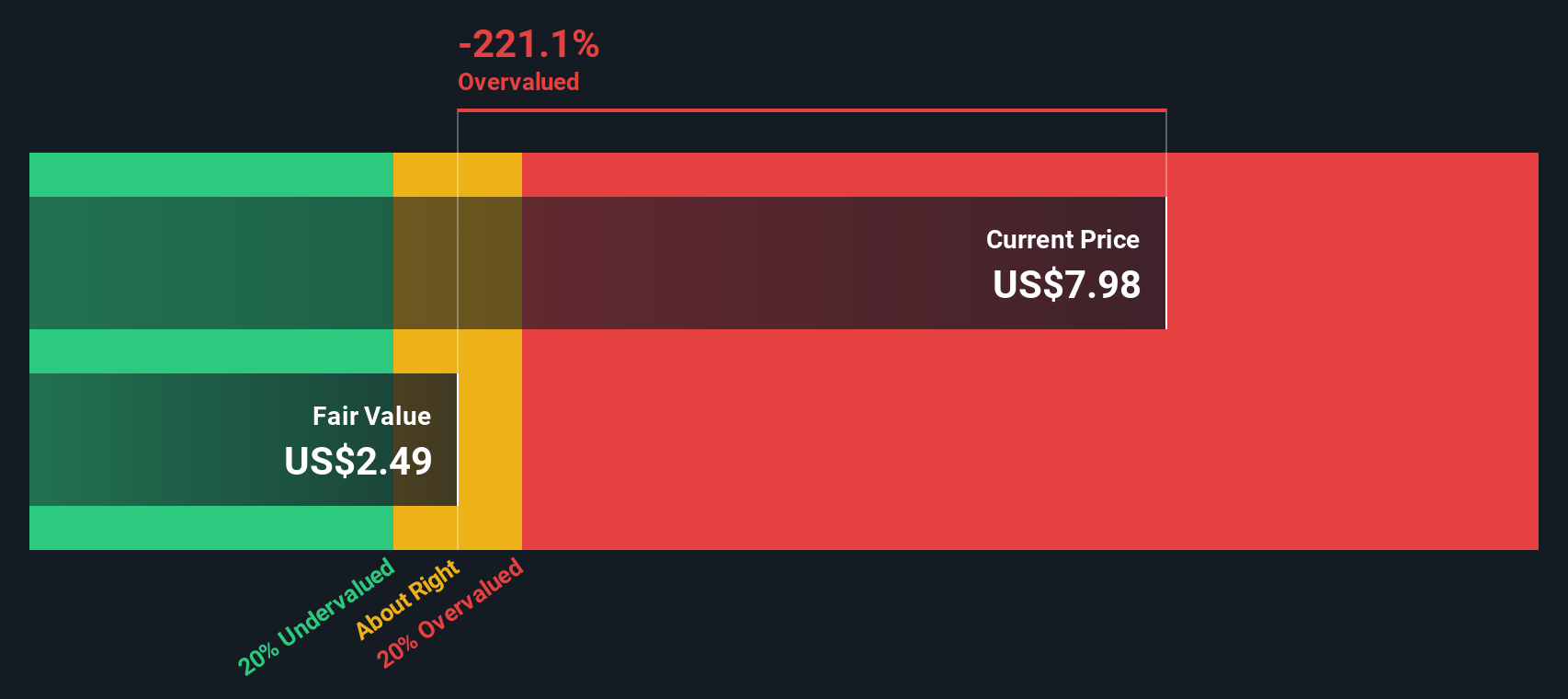

Another View: SWS DCF Model Sends a Different Signal

While analysts see Novavax as trading below fair value, our SWS discounted cash flow (DCF) model tells a different story. According to this approach, the current share price is actually above its intrinsic value. Could the market be getting ahead of itself, or are analysts too optimistic about future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If you want a different perspective or believe your own insights reveal something new, it takes under three minutes to build your own view and see how it stacks up, so go ahead, Do it your way

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by. Use the Simply Wall Street Screener to target stocks with unique growth, value, and income potential that match your investing style.

- Uncover attractive yields by targeting these 19 dividend stocks with yields > 3%, which can bring reliable income potential to your portfolio.

- Pinpoint untapped tech leaders using these 26 quantum computing stocks, designed to identify companies working to transform tomorrow’s industries.

- Spot compelling value opportunities with these 886 undervalued stocks based on cash flows and get a head start on market trends others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives