- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX): Assessing Valuation After Japan Vaccine Approval and Takeda Milestone Payment

Reviewed by Simply Wall St

Novavax (NVAX) has been in the spotlight after its COVID-19 vaccine, Nuvaxovid, secured regulatory approval in Japan. This approval unlocked a milestone payment from partner Takeda and set up Novavax to receive royalties from upcoming Nuvaxovid sales during the vaccination season. What makes this event stand out is the improved collaboration agreement between the two companies, aiming to boost Novavax's presence and commercial opportunity in Japan. Japan is an important market for any global vaccine player.

This fresh momentum comes after a challenging period for Novavax, with the share price down 34% over the past year and dropping 11% in the past month alone. However, the stock has bounced back 36% over the past 3 months, suggesting that recent news, including upgrades to its partnership with Takeda and milestones like the one just announced, may be shifting sentiment. Other recent developments, like presentations at major healthcare conferences, have added to the company’s visibility, but it is clear that business fundamentals are in the spotlight.

After a volatile stretch and this milestone payment, is Novavax now trading at a discount that undervalues its future, or is the market already betting on more growth ahead?

Most Popular Narrative: 31.5% Undervalued

According to the most widely followed narrative, Novavax is considered significantly undervalued, with its fair value set well above the current share price. This perspective argues that, despite sharp projected declines in revenue and earnings, future opportunities and partnerships may not be fully appreciated by the market.

"Partnership with Sanofi has de-risked commercial execution for Nuvaxovid and opened doors for future milestone and royalty streams, particularly as Sanofi develops and commercializes COVID-influenza combination vaccines, which could meaningfully boost Novavax's recurring revenue and net margins."

Wondering what justifies such a bullish target? There is one controversial set of numbers behind this model, driven by bold assumptions about future earnings and strategic collaborations. Will shrinking profit margins and declining revenues really deliver on this high valuation? Get the full picture by dissecting the narrative’s core financial logic and see for yourself what analysts are betting on.

Result: Fair Value of $12.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued reliance on partners and a potential downturn in COVID vaccine demand remain key risks that could challenge Novavax’s bullish outlook.

Find out about the key risks to this Novavax narrative.Another View: Discounted Cash Flow Model

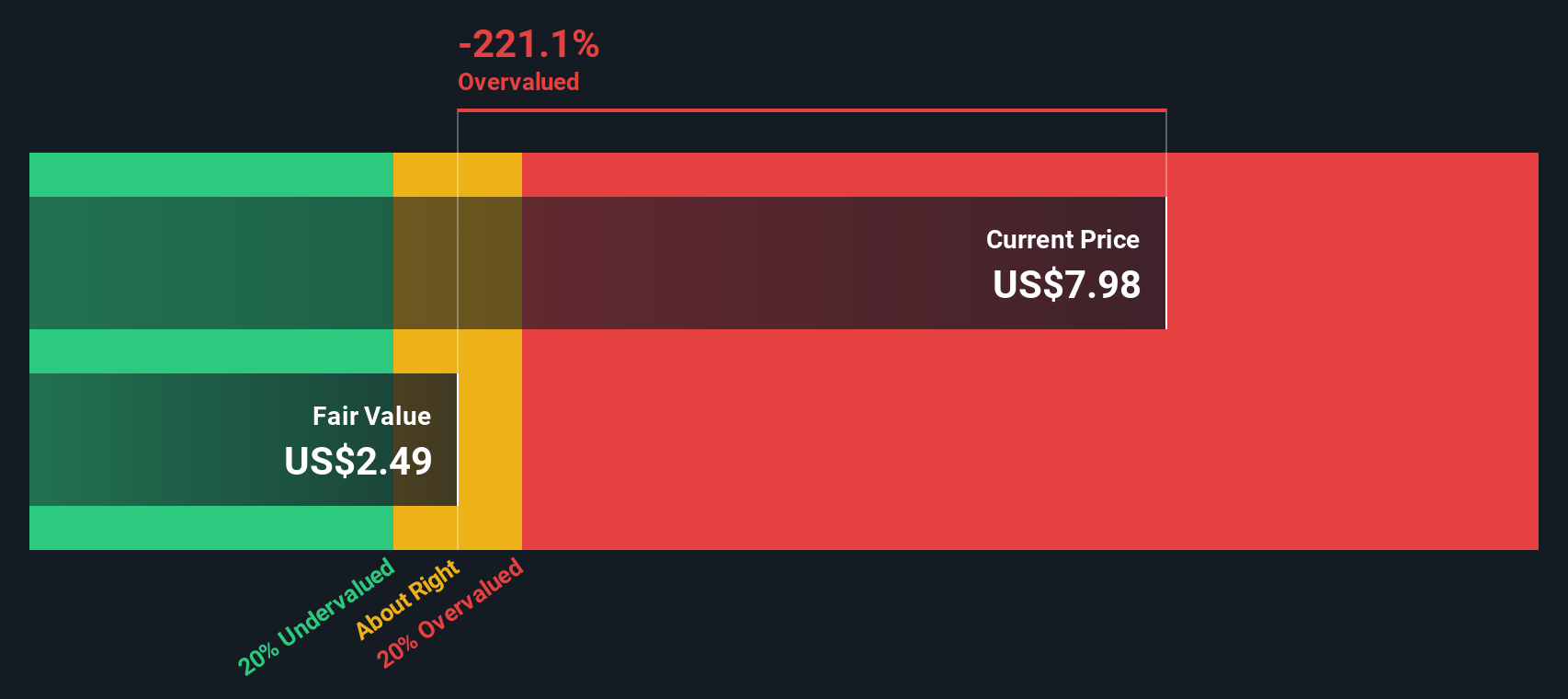

While the analyst consensus points to a potential undervaluation, our DCF model suggests Novavax may be trading above its estimated fair value. Are the market’s hopes too high? Or is the DCF being too pessimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Novavax Narrative

If you prefer to follow your own insights or want to challenge these assumptions, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take your next step with confidence and broaden your investing game using unique stock themes you may not have considered. These opportunities are easy to access and might just change your strategy.

- Spot bargains before the crowd by targeting undervalued stocks based on cash flows to reveal companies whose share prices may not reflect their true earning power.

- Ride the innovation wave by checking out AI penny stocks that are shaping the future with game-changing artificial intelligence breakthroughs.

- Boost your passive income with smart picks from dividend stocks with yields > 3%. Focus on stocks with solid yields above 3% and proven stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives