- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NasdaqGS:NVAX) And Takeda Amend Collaboration For SARS-CoV-2 Vaccine In Japan

Reviewed by Simply Wall St

Novavax (NasdaqGS:NVAX) recently amended its collaboration agreement with Takeda, enhancing its revenue potential through a new upfront payment structure and future royalties. These developments, along with the appointment of Charles Newton to the board, signal a strategic shift towards strengthening the company's market position. This comes at a time when the broader market has experienced moderate volatility, with minor shifts amid ongoing tariff discussions and a Federal Reserve meeting, maintaining resilience in the face of mixed earnings reports. Novavax's price move aligns with market trends, suggesting that recent corporate activities may have bolstered investor confidence.

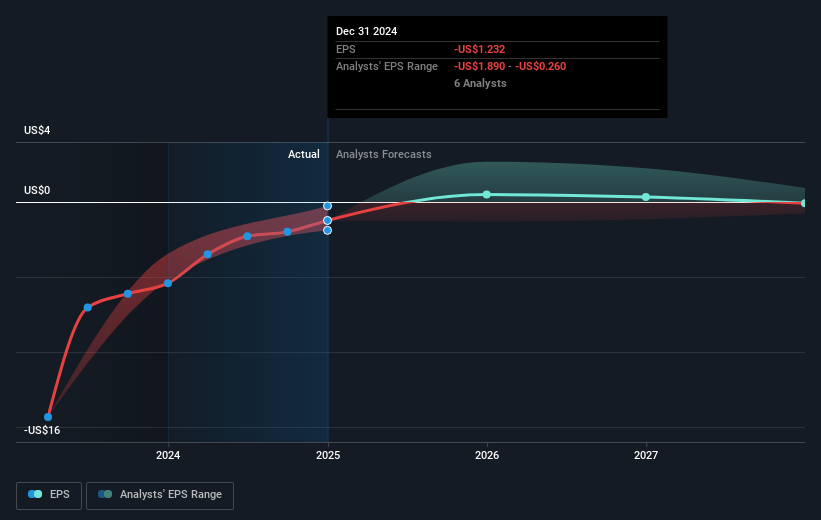

The recent amendment to Novavax's agreement with Takeda and the appointment of Charles Newton to the board reflect shifts that could influence both revenue and earnings forecasts. The upfront payment structure and anticipated future royalties have the potential to enhance Novavax's revenue streams, although the reliance on partners like Sanofi brings associated risks. This collaboration is expected to drive revenue growth through milestone payments and royalties, amid efforts to streamline costs and boost profitability. However, these strategies underscore the company's dependency on external partners for stable revenue generation.

Over the past year, Novavax's shares have delivered a total return of 31.72%, revealing a contrast with the general market's performance which returned 8.2% and the US Biotechs industry that posted a decline of 7.6%. Despite the share price being significantly below its fair value estimate at US$24 and the current trading price of US$6.42, analysts remain divided, with consensus suggesting a price target of US$15.17. This target is considerably above the current market price, highlighting potential upward momentum if revenue streams and earnings stabilize as projected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives