- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

US High Growth Tech Stocks to Watch

Reviewed by Simply Wall St

As the U.S. stock market navigates a complex landscape marked by recent gains in major indices like the Dow Jones Industrial Average, which added over 400 points amid mixed economic signals such as a decline in private payrolls and anticipated Federal Reserve rate cuts, investors are keenly observing high-growth tech stocks that could offer opportunities despite broader market uncertainties. In this context, identifying promising tech stocks involves assessing their potential for innovation and growth within an evolving economic environment where factors like AI advancements and consumer demand shifts play significant roles.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Pelthos Therapeutics | 48.34% | 110.99% | ★★★★★☆ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Workday | 11.18% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.83% | 45.89% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Rumble (RUM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rumble Inc. operates video sharing platforms and cloud services across the United States, Canada, and internationally with a market capitalization of $2.58 billion.

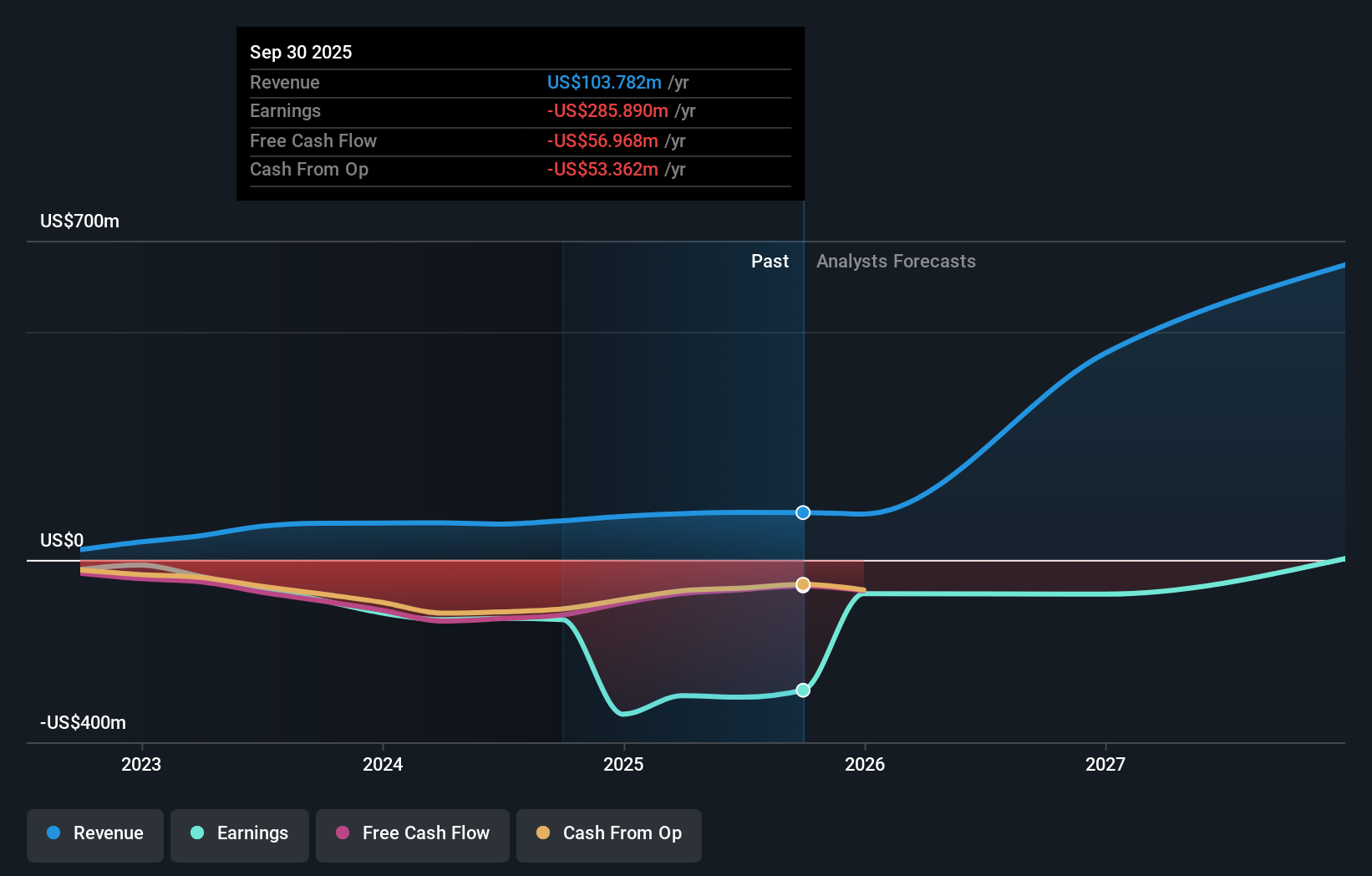

Operations: Rumble Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $103.78 million. The company focuses on video sharing platforms and cloud services across various regions, including the United States and Canada.

Rumble, a company in the Interactive Media and Services sector, has demonstrated notable revenue growth at 52.5% annually, outpacing the US market average of 10.5%. Despite current unprofitability, earnings are expected to surge by approximately 84.3% per year over the next three years, signaling potential for profitability ahead. Recent strategic moves include a partnership with Cleveland Browns for cloud services and an acquisition aimed at enhancing AI infrastructure capabilities with Northern Data. These initiatives not only expand Rumble's service offerings but also position it strategically within high-growth tech domains where AI and cloud services are increasingly critical.

- Unlock comprehensive insights into our analysis of Rumble stock in this health report.

Assess Rumble's past performance with our detailed historical performance reports.

Natera (NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally and has a market cap of approximately $32.88 billion.

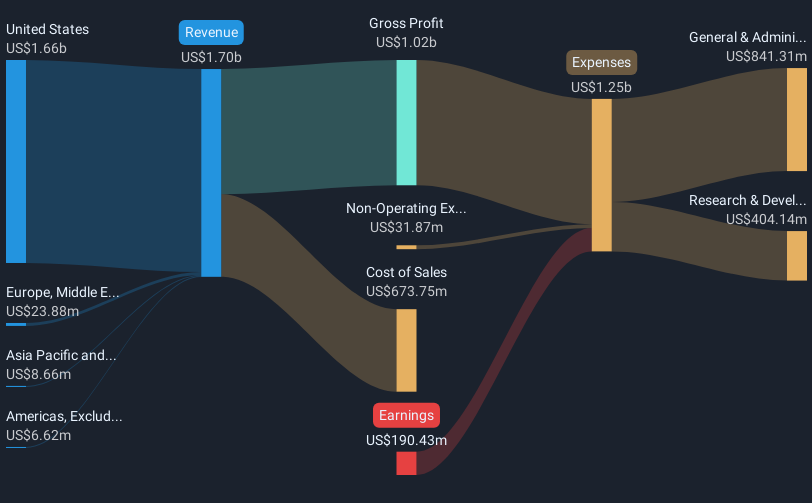

Operations: The company generates revenue primarily from the development and commercialization of molecular testing services, amounting to approximately $2.12 billion.

Natera, Inc. stands out in the high-growth tech landscape, particularly with its recent advancements and strategic integrations in healthcare technology. The company recently raised its 2025 revenue forecast by $160 million to between $2.18 billion and $2.26 billion, reflecting robust demand for its innovative diagnostic solutions like Signatera. These tests are increasingly integrated into clinical workflows through platforms such as Flatiron Health's OncoEMR®, enhancing utility and accessibility for healthcare providers across the U.S. Moreover, Natera's commitment to R&D is evident from its substantial investment in expanding the Fetal Focus test and ongoing clinical trials aimed at validating the efficacy of these pioneering genetic tests in real-world settings—underscoring a forward-thinking approach that could redefine patient management in oncology and prenatal care sectors.

Klaviyo (KVYO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Klaviyo, Inc. is a technology company offering a software-as-a-service platform globally, with a market cap of approximately $8.67 billion.

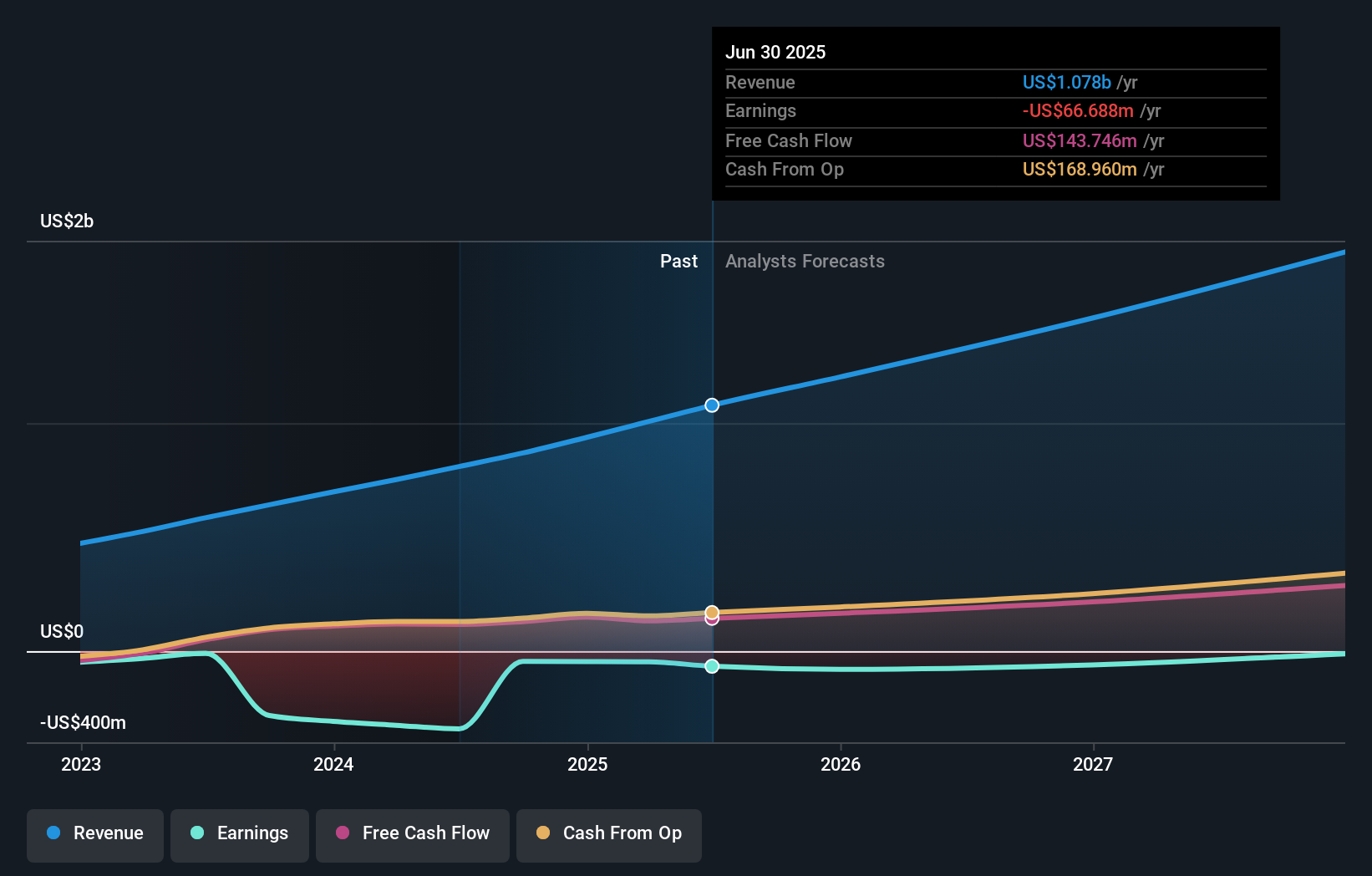

Operations: The company generates revenue primarily from its internet software segment, amounting to approximately $1.15 billion.

Klaviyo's recent pivot towards an AI-first B2C CRM platform underscores its innovative stride, particularly with the launch of Marketing Agent and Customer Agent, which autonomously manage marketing campaigns and customer service. This strategic move is reflected in their robust financial performance with a 23% to 24% revenue growth forecast for Q4 2025, pushing annual expectations to between $1.215 billion and $1.219 billion—a significant leap from previous figures. Despite current unprofitability, Klaviyo's aggressive R&D focus is setting the stage for future profitability, aligning with an anticipated annual revenue growth rate of 17.5%. This approach not only enhances customer interaction through AI but also solidifies Klaviyo’s position in a competitive tech landscape where integration of AI in CRM systems is becoming crucial for consumer engagement and retention.

- Take a closer look at Klaviyo's potential here in our health report.

Explore historical data to track Klaviyo's performance over time in our Past section.

Taking Advantage

- Take a closer look at our US High Growth Tech and AI Stocks list of 75 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026