- United States

- /

- Biotech

- /

- NasdaqGM:NTLA

Intellia Therapeutics (NTLA): Valuation in Focus Following Phase 3 HAELO Trial Enrollment Milestone

Reviewed by Kshitija Bhandaru

If you have been tracking Intellia Therapeutics (NTLA), you probably noticed the sharp jump in its share price lately. The company just announced it has finished enrolling patients in its pivotal global Phase 3 HAELO trial for lonvoguran ziclumeran, a key candidate for hereditary angioedema. With top-line study data expected next year and a submission for U.S. approval targeted for the second half of 2026, this milestone stands out not just as a clinical accomplishment, but as a clear step toward potential commercialization. This is something the market is watching closely.

This achievement arrives in a year marked by both volatility and renewed momentum for Intellia. The stock is still down over 28% in the past year, yet it has posted a strong recovery recently, with shares climbing nearly 30% following the enrollment news and up 69% over the past 3 months. Intellia’s pipeline has picked up recognized regulatory designations across the U.S. and Europe, further fueling hopes for its gene-editing technology. Recent conference presentations have kept investors engaged, but it is this clinical progress that appears to be shifting sentiment.

After the bounce in the stock this month, the question is straightforward: is Intellia an overlooked opportunity at current levels, or is all the promise for lonvoguran ziclumeran already reflected in its price?

Most Popular Narrative: 54.3% Undervalued

According to the most widely followed narrative, Intellia Therapeutics could be meaningfully undervalued compared to its projected future growth and profitability.

Improving financial discipline, as evidenced by successful restructuring, declining GAAP operating expenses, and a robust cash runway into the first half of 2027, enables Intellia to absorb increased R&D investment. This supports pipeline expansion and the development of commercial infrastructure without dilutive fundraising, protecting net margins and improving future earnings visibility.

Curious about what is really powering this bullish outlook? Unusually aggressive growth targets, optimistic margin projections, and a hefty profit multiple are at the core of this narrative. Want to see which ambitious assumptions the future price tag relies on? Dig into the full narrative to discover the drivers behind this eye-popping valuation.

Result: Fair Value of $34.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting competition from RNA and gene therapy rivals or setbacks in late-stage trials could quickly cool the bullish narrative around Intellia.

Find out about the key risks to this Intellia Therapeutics narrative.Another View: Valuation Based on Sales

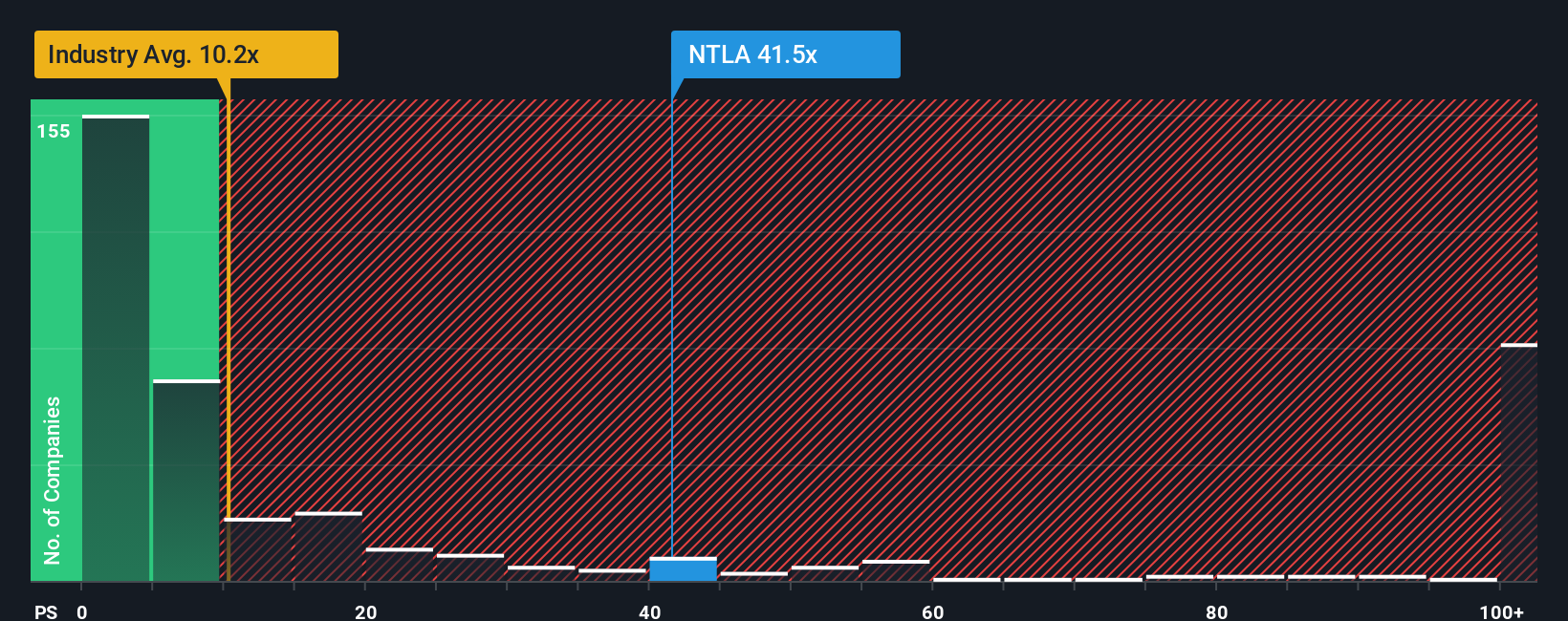

Taking a step back from future growth projections, a look at Intellia's valuation against its current sales tells a different story. This method suggests the shares are expensive compared to industry norms. Does this pricing already reflect much of the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Intellia Therapeutics to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Intellia Therapeutics Narrative

If you see things differently or want to put your own analysis to the test, you can easily construct your personal take in just a few minutes. Do it your way.

A great starting point for your Intellia Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your investment journey stop here. Some of the market’s most exciting opportunities can be found by targeting high-growth niches or untapped sectors using the right tools.

- Uncover hidden winners with strong balance sheets and rapid growth by checking out penny stocks with strong financials, which could be tomorrow’s breakout stories.

- Boost your potential for steady income and portfolio stability by selecting stocks through our list of dividend stocks with yields > 3%, all offering yields above 3%.

- Tap into cutting-edge advancements in healthcare by using our screener focused on healthcare AI stocks, where artificial intelligence is reshaping medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NTLA

Intellia Therapeutics

A clinical-stage gene editing company, focuses on the development of curative genome editing treatments.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives