- United States

- /

- Biotech

- /

- NasdaqGM:NTLA

Intellia Therapeutics (NTLA): Revisiting Valuation After Analyst Upgrades and Hereditary Angioedema Program Milestones

Reviewed by Kshitija Bhandaru

Intellia Therapeutics (NTLA) shares have attracted attention after several brokerages, including JMP Securities and Zacks, upgraded the stock. The moves come as the company’s hereditary angioedema program logs new milestones, and investor interest remains high.

See our latest analysis for Intellia Therapeutics.

The buzz around Intellia Therapeutics has been matched by a remarkable share price rally, with momentum accelerating thanks to positive trial updates, high-profile investor buys, and broker upgrades. The numbers tell the story: after more than doubling over the past month with a 30-day share price return of 114.7%, Intellia’s near-term performance stands in stark contrast to its more modest one-year total shareholder return of 32% and longer-term declines. With the share price last closing at $24.52, optimism seems to be on the upswing as confidence builds around its gene-editing pipeline and milestone progress.

If you want to scout other biotech stocks on the move, our tailored list is a great place to start. See the full list for free.

But with such dramatic gains in a short span and a share price that remains well below average analyst targets, the question now becomes whether Intellia is still undervalued or if the market has already priced in all the expected growth.

Most Popular Narrative: 28.1% Undervalued

With Intellia Therapeutics’ last close at $24.52 and the most followed narrative placing fair value around $34, the gap signals the market may not be factoring in projected growth and milestones just yet. Investors are weighing robust topline momentum and clinical achievements as keys to future valuation.

Growing patient and physician enthusiasm for Intellia's lead in vivo CRISPR therapies is driving faster-than-expected enrollment across multiple late-stage clinical trials (including an expanded 1,200-patient ATTR cardiomyopathy study and strong uptake in HAE). This momentum is positioning the company to achieve meaningful clinical readouts and regulatory milestones ahead of prior guidance. It also advances timelines to potential commercialization, supporting the prospect of long-term revenue growth.

Want to see what powers this bold price target? There’s a striking forecast for runaway revenue gains and a future profit margin not typical for biotech. Wondering which ambitious growth numbers and key transformation milestones justify such a large upside? The full narrative reveals the crucial assumptions shaping this valuation call.

Result: Fair Value of $34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition from rival gene therapies or clinical trial setbacks could quickly disrupt Intellia’s trajectory and challenge even the most optimistic outlook.

Find out about the key risks to this Intellia Therapeutics narrative.

Another View: Market Ratios Tell a Different Story

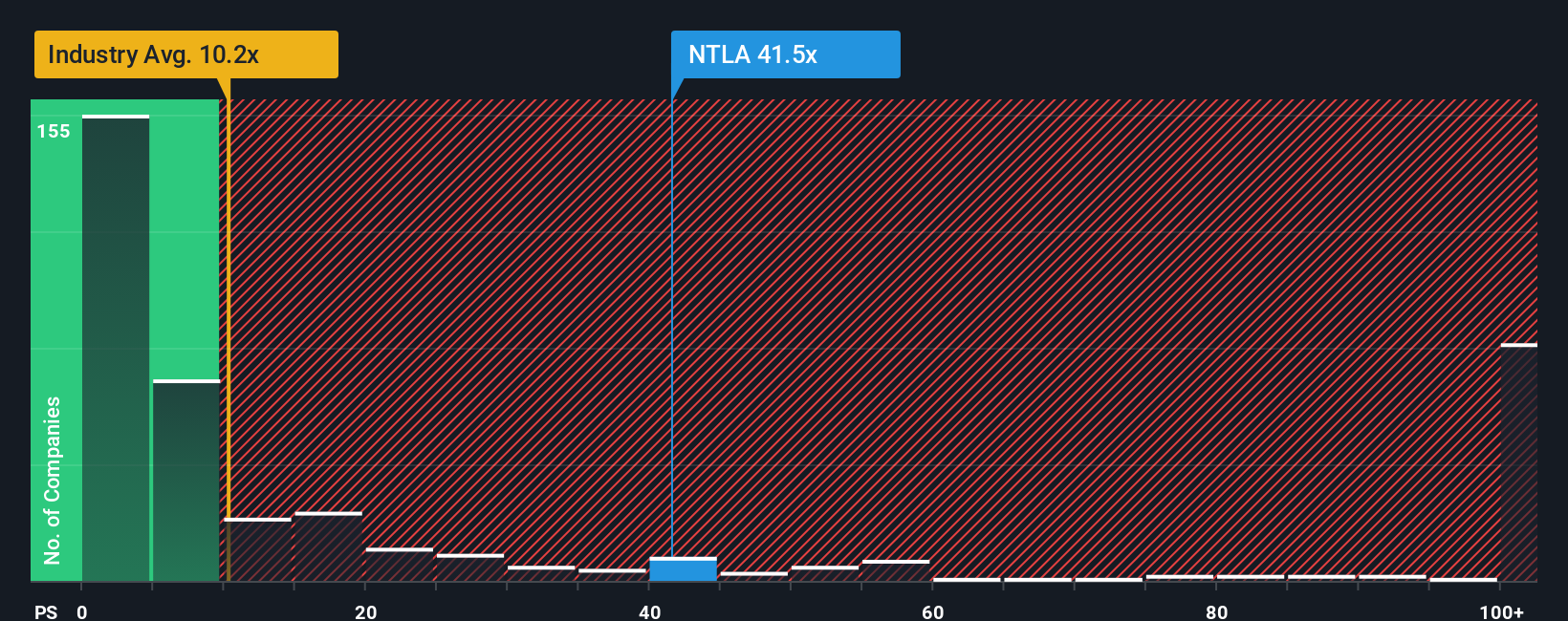

Looking beyond the analyst-driven fair value, Intellia’s current price-to-sales ratio of 49.8x stands well above the US biotech sector average of 10.1x and the peer average of 17.8x. This steep premium suggests the market is already pricing in exceptional future growth, which raises the risk if expectations cool or milestones disappoint. Does this leave less room for upside, or could breakthrough results reward the risk takers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intellia Therapeutics Narrative

If you think the story looks different from your perspective or want to dive into the numbers on your own terms, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Intellia Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your investment research with Simply Wall Street’s Screener. Give yourself every chance for success by acting now and finding untapped opportunities before others do.

- Uncover high-yield potential by targeting these 19 dividend stocks with yields > 3% that generate income beyond the market average.

- Spot the next tech leaders with these 24 AI penny stocks as they push the boundaries of artificial intelligence innovation.

- Start building your portfolio around real potential by tracking these 898 undervalued stocks based on cash flows that offer strong upside based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NTLA

Intellia Therapeutics

A clinical-stage gene editing company, focuses on the development of curative genome editing treatments.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives