- United States

- /

- Biotech

- /

- NasdaqGM:NRIX

Nurix Therapeutics, Inc. (NASDAQ:NRIX) Shares May Have Slumped 25% But Getting In Cheap Is Still Unlikely

Unfortunately for some shareholders, the Nurix Therapeutics, Inc. (NASDAQ:NRIX) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop has obliterated the annual return, with the share price now down 3.2% over that longer period.

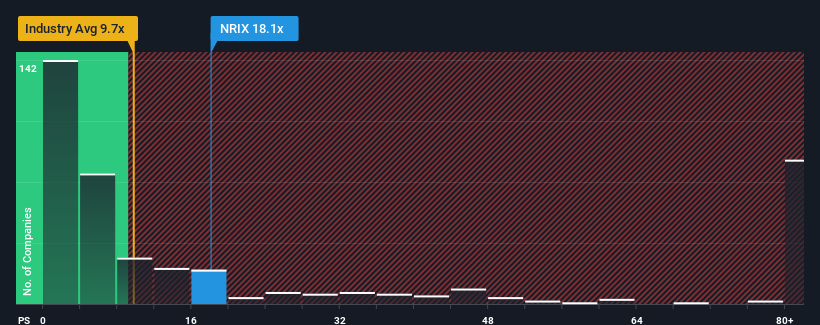

Although its price has dipped substantially, Nurix Therapeutics may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 18.1x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 9.7x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Nurix Therapeutics

What Does Nurix Therapeutics' Recent Performance Look Like?

Nurix Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nurix Therapeutics.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Nurix Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. Even so, admirably revenue has lifted 83% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 140% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Nurix Therapeutics' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Nurix Therapeutics' P/S

Nurix Therapeutics' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Nurix Therapeutics trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Nurix Therapeutics is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nurix Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NRIX

Nurix Therapeutics

A clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and antibody therapies for the treatment of cancer, inflammatory conditions, and other diseases.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives