- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Should Neurocrine Biosciences' (NBIX) KINECT-HD2 Data and New Leadership Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Earlier this month, Neurocrine Biosciences announced the appointment of Mike Sibley as Senior Vice President and General Manager of its Neuropsychiatry franchise, while also presenting three-year KINECT-HD2 study data on INGREZZA at the 2025 MDS International Congress of Parkinson’s Disease and Movement Disorders in Honolulu.

- The new long-term clinical results reinforce the established safety and efficacy of INGREZZA in adults with Huntington’s disease, alongside the company strengthening its commercial leadership team.

- We’ll explore how the latest INGREZZA data and leadership changes may influence Neurocrine Biosciences’ future growth and product positioning.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Neurocrine Biosciences Investment Narrative Recap

To be a shareholder in Neurocrine Biosciences, you need confidence in the sustained expansion of INGREZZA and successful product launches across its CNS pipeline, even as pricing pressure mounts from expanded Medicare contracting and payer scrutiny. While the positive three-year INGREZZA study data and Mike Sibley’s appointment highlight progress in product leadership and clinical profile, these updates do not materially shift the immediate catalyst of driving robust prescription growth or ease the persistent risk of reimbursement headwinds and competitive threats to INGREZZA's market share.

The most relevant recent event is the release of KINECT-HD2’s long-term safety and efficacy data for INGREZZA in adults with Huntington’s disease, supporting its established clinical profile. This complements recent payer access and volume growth initiatives, potentially reinforcing the product’s position amid rising industry pressure on drug pricing and reimbursement.

However, investors should also be aware that, despite encouraging clinical results, persistent pricing and access challenges remain top of mind for the company…

Read the full narrative on Neurocrine Biosciences (it's free!)

Neurocrine Biosciences' narrative projects $3.8 billion in revenue and $976.5 million in earnings by 2028. This requires 14.6% yearly revenue growth and a $628.2 million earnings increase from the current $348.3 million.

Uncover how Neurocrine Biosciences' forecasts yield a $168.25 fair value, a 23% upside to its current price.

Exploring Other Perspectives

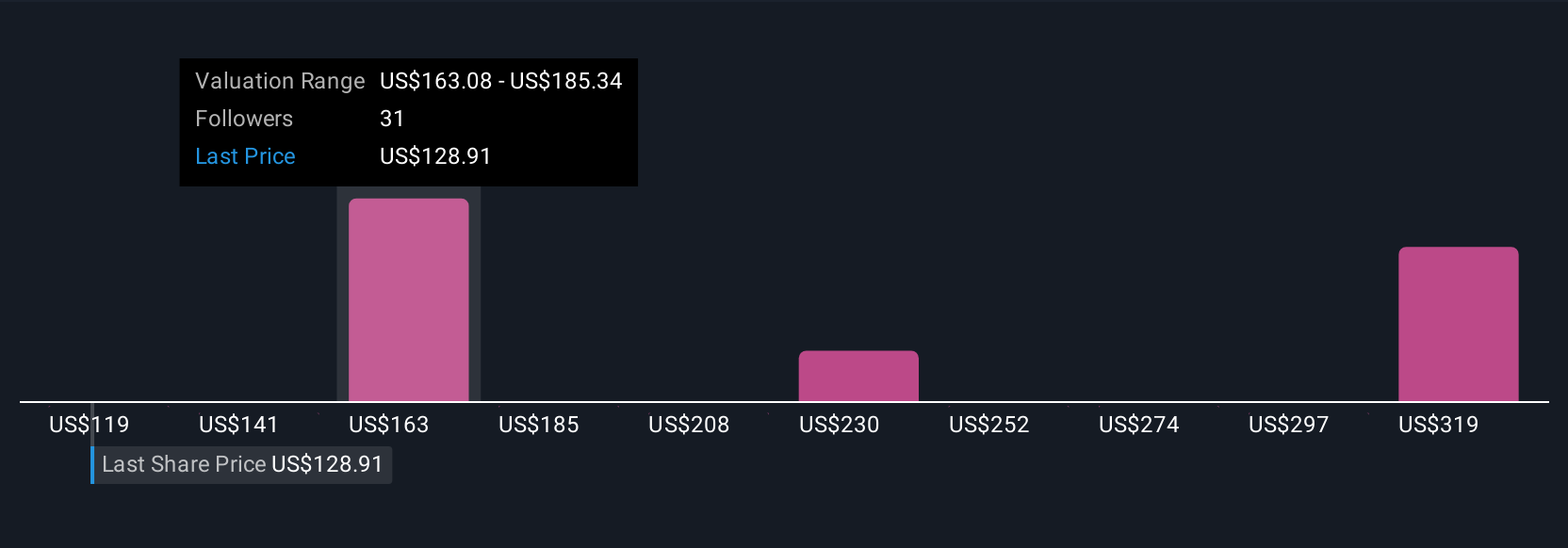

Seven different fair value estimates from the Simply Wall St Community for Neurocrine Biosciences range from US$118.58 to US$311.71 per share. With increased payer scrutiny potentially putting pressure on prescription growth, these varied views highlight just how differently investors assess future risks and opportunities.

Explore 7 other fair value estimates on Neurocrine Biosciences - why the stock might be worth over 2x more than the current price!

Build Your Own Neurocrine Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neurocrine Biosciences research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Neurocrine Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neurocrine Biosciences' overall financial health at a glance.

No Opportunity In Neurocrine Biosciences?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives