- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Does the Recent Rare Earths News Move the Needle for Neurocrine Biosciences Valuation?

Reviewed by Bailey Pemberton

Thinking about what to do with Neurocrine Biosciences stock right now? You are not alone. With the shares recently closing at $137.35, plenty of investors are sitting on the fence, wondering if it is time to buy, hold, or maybe even lock in some profits. If you have watched the price over the last week or month, you might notice a dip, with the stock down 1.5% over the last seven days and 3.2% for the past month. Despite this, the longer view still looks strong, with the stock up 18.0% over one year and an impressive 36.4% over five years. These numbers suggest the market is gradually warming to Neurocrine's potential, and while there are bigger forces at play, such as changes in global rare-earth regulations that send ripples through the biotech and tech worlds, Neurocrine’s moves seem more about company-specific factors than global headlines right now.

For investors focused on valuation, here is a number to consider: Neurocrine hits 3 out of 6 undervaluation checks on a standard scoring system, giving the company a valuation score of 3. This puts it somewhere in the middle, not extremely cheap but not overpriced based on the fundamentals we will soon dig into. Next, we will break down what that valuation score really means and walk through the different approaches analysts use to pin down a stock’s worth. And don’t worry, we will also touch on a smarter, more insightful way to think about valuation that could make all the difference for your decision-making.

Approach 1: Neurocrine Biosciences Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model takes a forward-looking approach by estimating all the cash Neurocrine Biosciences is expected to generate in the future, and then discounts those amounts back to today's dollars. This method helps investors understand a company’s intrinsic value based on its ability to produce free cash flow over time.

For Neurocrine, the latest reported Free Cash Flow stands at $531.5 Million. Analysts forecast that this figure will grow steadily over the coming years, with estimates reaching $1,263.9 Million by 2029. According to projections, analyst-driven until 2029 and then extrapolated further, Neurocrine’s cash generation capacity appears solid and poised for continued expansion, all measured in US Dollars.

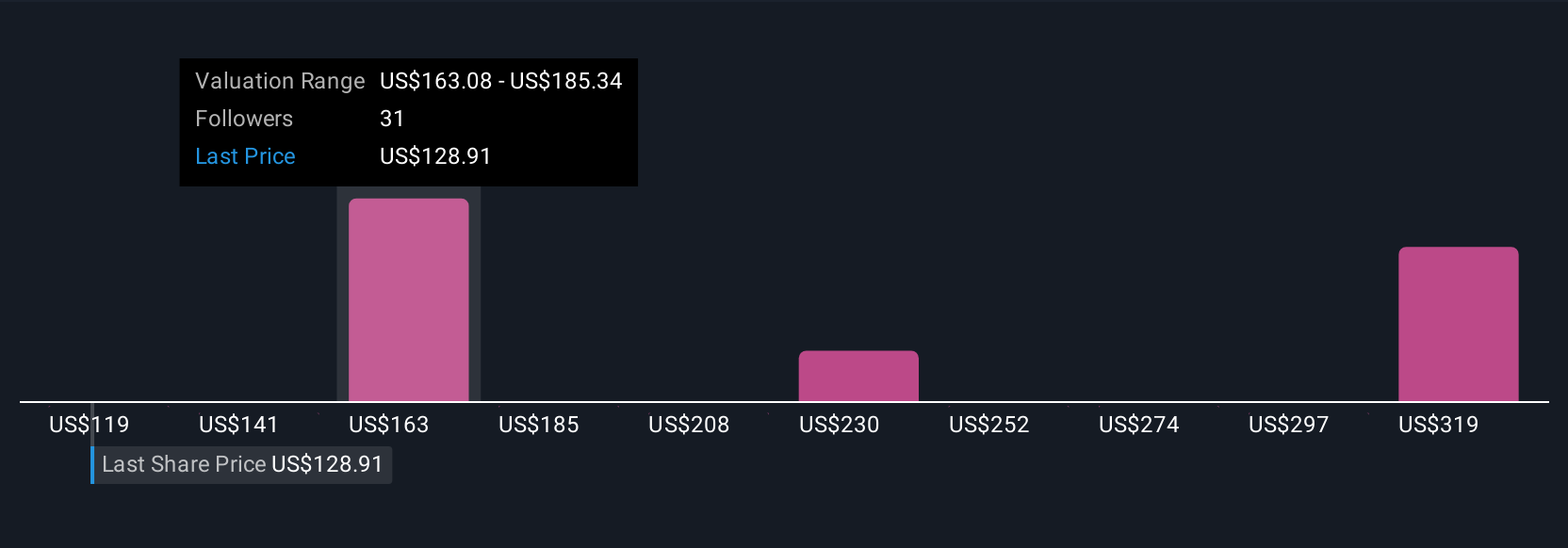

Based on these future cash flow projections, the DCF model arrives at an intrinsic value of $312.12 per share. Compared to the current trading price of $137.35, this suggests the stock is trading at a 56.0% discount to its estimated fair value, which may indicate a significant margin and substantial potential upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Neurocrine Biosciences is undervalued by 56.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Neurocrine Biosciences Price vs Earnings (PE)

For profitable companies like Neurocrine Biosciences, the Price-to-Earnings (PE) ratio is often considered the go-to valuation tool. That is because the PE reflects how much investors are willing to pay for each dollar of actual profit, making it particularly relevant when a company posts consistent earnings.

It is important to remember that what is considered a "normal" or "fair" PE ratio can vary, depending not only on the company’s past growth, but also on how much growth is expected ahead and the perceived riskiness of those future earnings. A higher PE can signal anticipation of robust growth or a lower risk profile, while a lower PE may suggest market skepticism or lower expected growth.

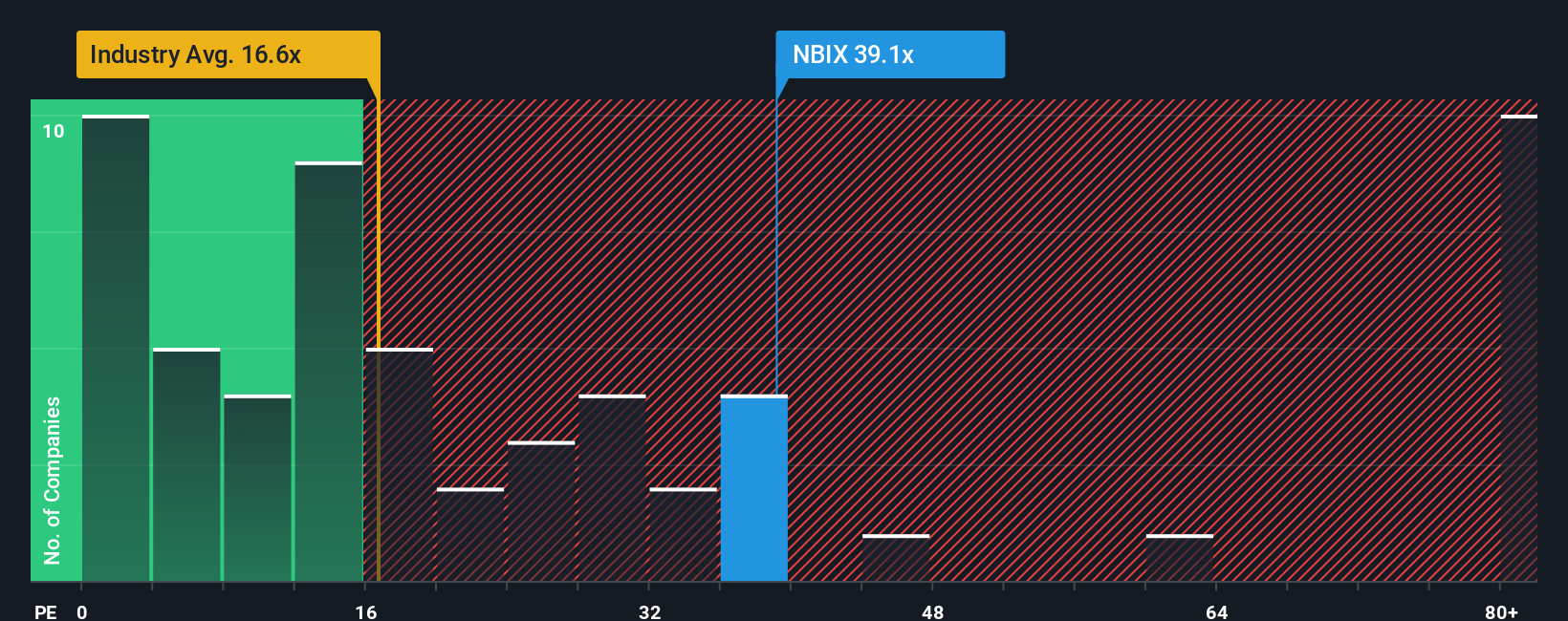

Currently, Neurocrine trades at a PE ratio of 39.1x. For context, the average PE among its peers sits at 16.9x, and the broader biotechnology industry average is 16.6x. These comparisons might lead an investor to believe Neurocrine is expensive at first glance.

This is where Simply Wall St’s proprietary "Fair Ratio" metric comes in. The Fair Ratio takes into account key company specifics such as expected earnings growth, profit margins, risk factors, and market cap, alongside industry fundamentals, to establish what a justifiable PE ratio should be. This approach is more sophisticated than simply looking at peer or industry averages, as it ensures factors unique to Neurocrine are reflected.

For Neurocrine, the Fair Ratio is calculated at 23.7x. Compared to the actual multiple of 39.1x, the stock appears to be trading well above what is suggested as fair, meaning it could be overvalued on an earnings basis alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Neurocrine Biosciences Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an approach that goes beyond pure numbers, allowing you to tie a company's story and outlook to your own perspective and directly to its estimated fair value by specifying forecasts like future revenues, profit margins, and risk factors. Narratives make the investment process easier by linking the “why” behind a stock (its pipeline, earnings potential, or regulatory news) to your own forecast and valuation, turning abstract data into a coherent, personal investment thesis.

On Simply Wall St's Community page, millions of investors can effortlessly create and update their own Neurocrine Biosciences Narratives, adjusting assumptions as new information such as earnings results or FDA approvals arrives. Narratives then automatically calculate a Fair Value based on your scenario, letting you quickly see whether the stock price is above or below your target, and making it clear when to act.

For example, some investors see significant future gains and arrive at a fair value of $244.80 per share, while more cautious perspectives reflect recent risks and valuate at $168.25. Your own assumptions, plugged into a Narrative, will tell your unique story and guide your next move with Neurocrine Biosciences.

Do you think there's more to the story for Neurocrine Biosciences? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives