- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

Niagen Bioscience, Inc.'s (NASDAQ:NAGE) 25% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Niagen Bioscience, Inc. (NASDAQ:NAGE) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 113% in the last twelve months.

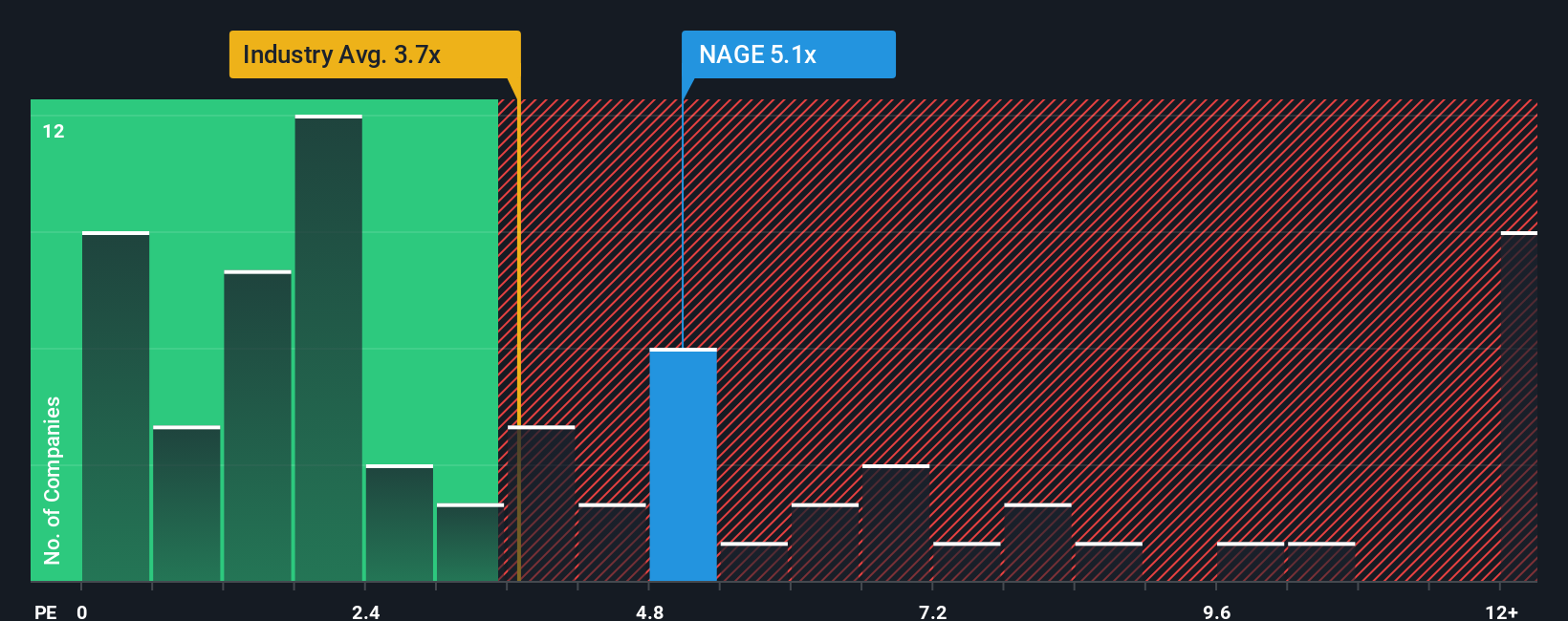

Although its price has dipped substantially, you could still be forgiven for thinking Niagen Bioscience is a stock not worth researching with a price-to-sales ratios (or "P/S") of 5.1x, considering almost half the companies in the United States' Life Sciences industry have P/S ratios below 3.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Niagen Bioscience

How Has Niagen Bioscience Performed Recently?

With revenue growth that's superior to most other companies of late, Niagen Bioscience has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Niagen Bioscience's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Niagen Bioscience?

The only time you'd be truly comfortable seeing a P/S as high as Niagen Bioscience's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. Pleasingly, revenue has also lifted 68% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 19% over the next year. With the industry only predicted to deliver 6.2%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Niagen Bioscience's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Niagen Bioscience's P/S

There's still some elevation in Niagen Bioscience's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Niagen Bioscience maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Niagen Bioscience with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Niagen Bioscience's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)