- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:REFR

Research Frontiers And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market sees fluctuations with major indices like the S&P 500 and Nasdaq hitting new records, investors are increasingly exploring diverse investment opportunities. Penny stocks, despite their old-fashioned name, remain a relevant area for those looking to uncover potential value in smaller or newer companies. By focusing on firms with solid financials and growth potential, investors can find promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.90 | $417.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.88 | $694.39M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.21 | $206.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.90 | $56.46M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.90 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.44 | $583.11M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.957485 | $6.94M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.65 | $86.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.58 | $10.25M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Research Frontiers (REFR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Research Frontiers Incorporated, with a market cap of $63.26 million, develops and markets technology and devices for controlling light flow globally.

Operations: The company generates revenue of $1.22 million from its segment focused on developing and marketing technology and devices to control light flow.

Market Cap: $63.26M

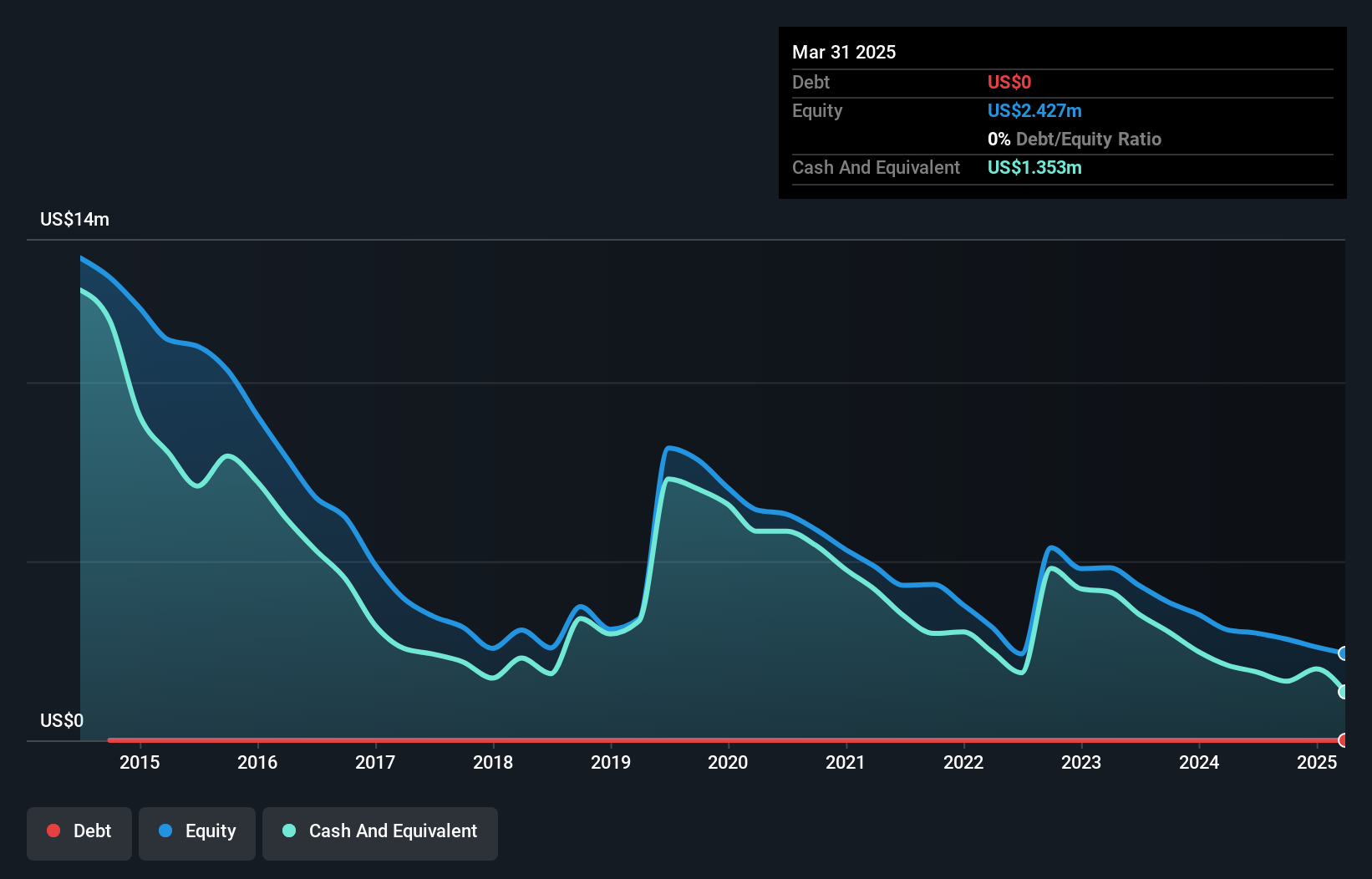

Research Frontiers, with a market cap of US$63.26 million, focuses on light control technology but remains unprofitable with limited revenue at US$1.22 million. Despite its financial challenges, the company has no debt and maintains a sufficient cash runway for over a year. A key development is its collaboration with Gauzy Ltd., supplying SPD smart glass technology for General Motors' Cadillac CELESTIQ, marking significant progress in automotive applications. This partnership highlights potential growth opportunities in the automotive sector as SPD technology gains traction among premium vehicle manufacturers like Ferrari and Mercedes-Benz.

- Jump into the full analysis health report here for a deeper understanding of Research Frontiers.

- Gain insights into Research Frontiers' past trends and performance with our report on the company's historical track record.

Hyperfine (HYPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hyperfine, Inc. is a health technology company focused on producing, supplying, servicing, and commercializing magnetic resonance imaging (MRI) products with a market cap of $164.23 million.

Operations: The company generates revenue from its Medical Imaging Systems segment, amounting to $10.80 million.

Market Cap: $164.23M

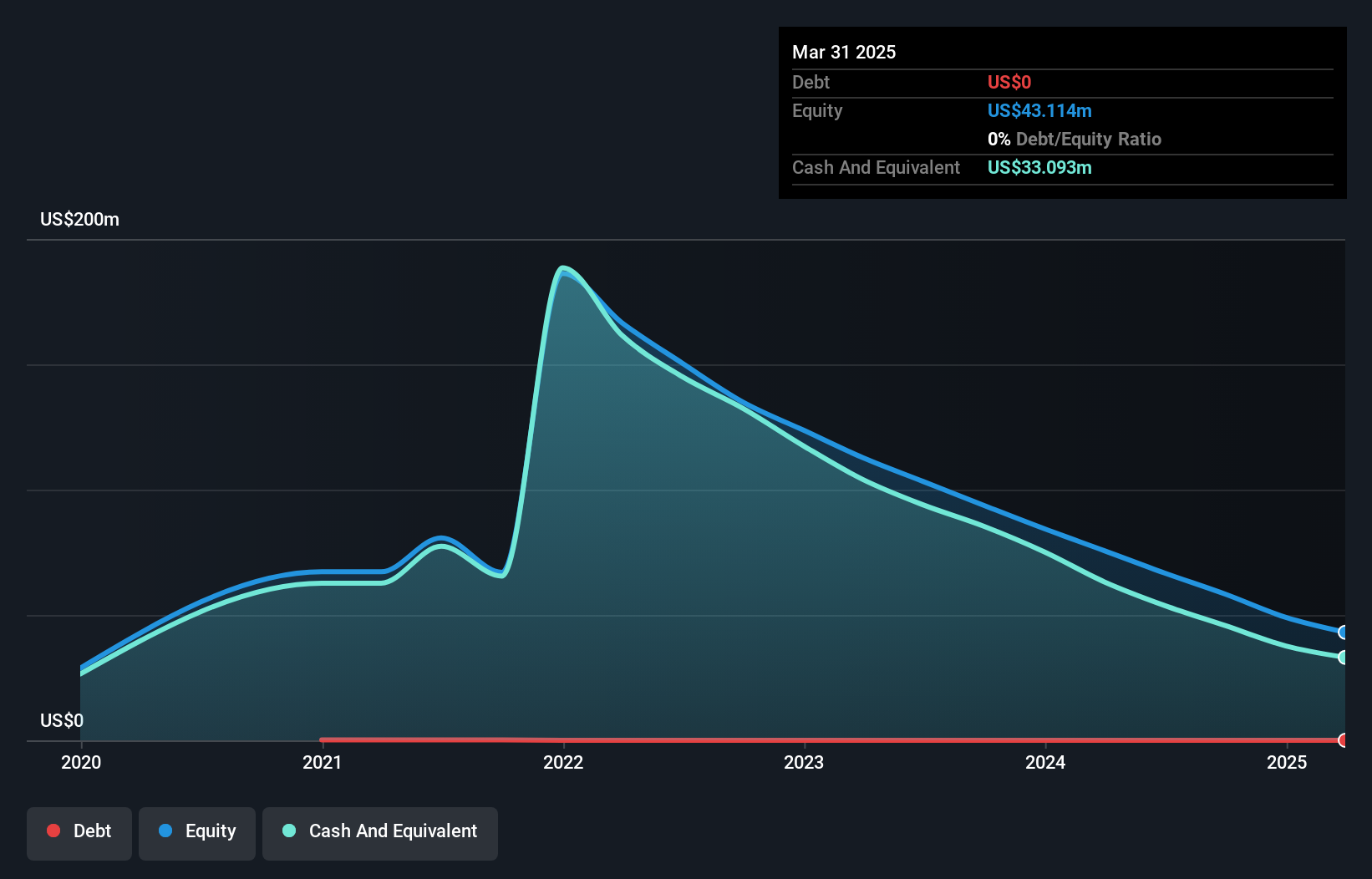

Hyperfine, Inc., with a market cap of US$164.23 million, is navigating the penny stock space with its innovative portable MRI technology. Despite being unprofitable and having less than a year of cash runway, Hyperfine's short-term assets exceed both its short-term and long-term liabilities. Recent product developments include the launch of the PULSE platform and UKCA approval for Optive AI software, enhancing international reach and image quality for its Swoop system. These advancements support Hyperfine's strategy to expand in outpatient neurology markets and emergency settings, aiming to address barriers in conventional MRI access while driving commercial adoption globally.

- Click to explore a detailed breakdown of our findings in Hyperfine's financial health report.

- Review our growth performance report to gain insights into Hyperfine's future.

Maravai LifeSciences Holdings (MRVI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Maravai LifeSciences Holdings, Inc. is a life sciences company that offers products facilitating the development of drug therapies, vaccines, cell and gene therapies, and diagnostics across various regions globally with a market cap of approximately $850.35 million.

Operations: The company's revenue is generated from two main segments: Nucleic Acid Production, contributing $155.58 million, and Biologics Safety Testing, accounting for $64.25 million.

Market Cap: $850.35M

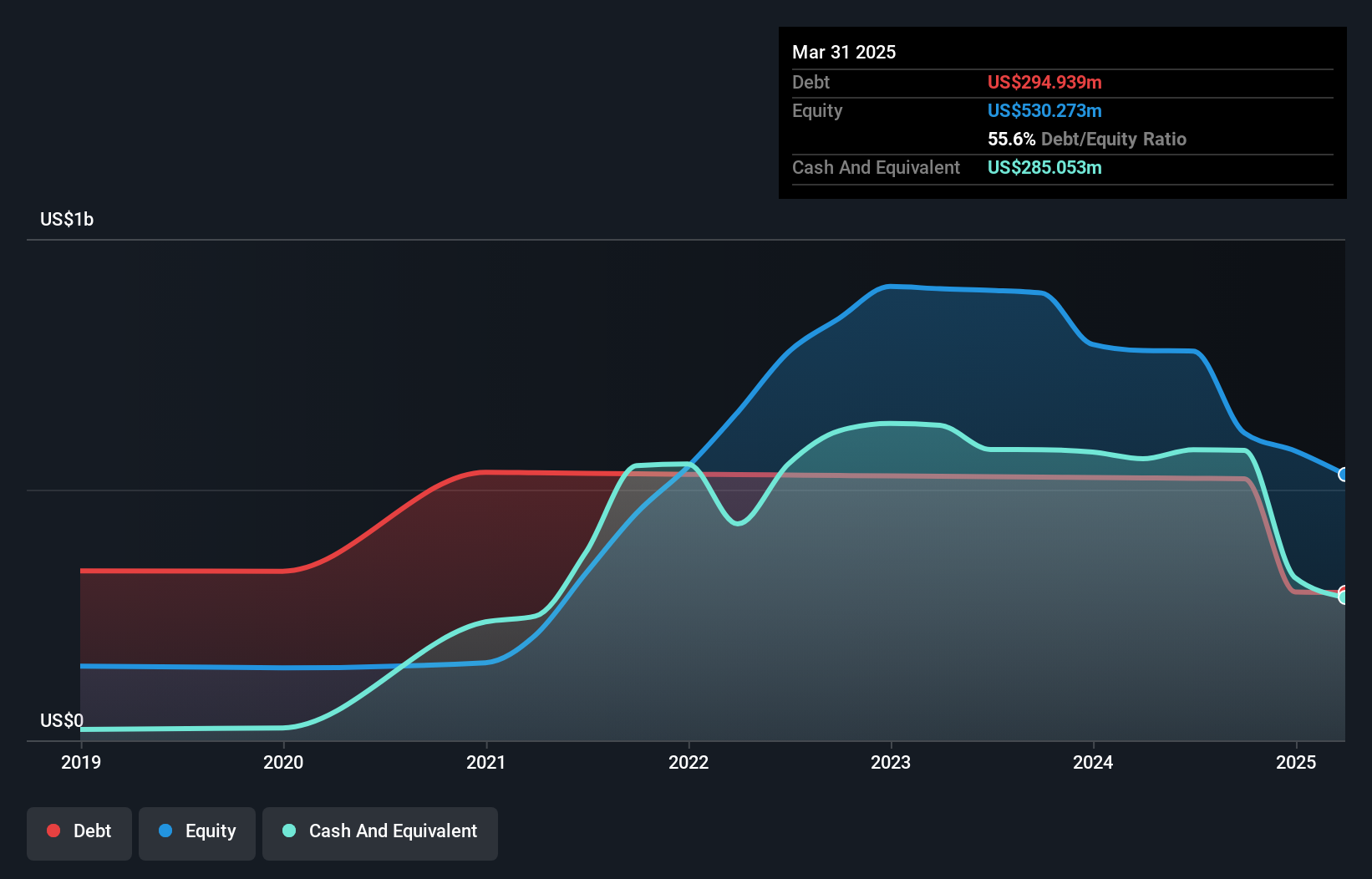

Maravai LifeSciences Holdings, Inc., with a market cap of approximately US$850.35 million, is experiencing significant challenges within the penny stock sector. The company has reported declining revenues and increased losses, with a net loss of US$39.59 million in Q2 2025 compared to the previous year. Recent organizational restructuring aims to reduce operating costs but involves substantial workforce reductions and estimated restructuring costs between US$8 million and US$9 million. Despite unprofitability, Maravai's short-term assets cover both its short-term and long-term liabilities, while its debt levels have decreased over the past five years to a satisfactory net debt-to-equity ratio.

- Click here and access our complete financial health analysis report to understand the dynamics of Maravai LifeSciences Holdings.

- Assess Maravai LifeSciences Holdings' future earnings estimates with our detailed growth reports.

Taking Advantage

- Navigate through the entire inventory of 363 US Penny Stocks here.

- Seeking Other Investments? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:REFR

Research Frontiers

Together with other subsidiary, engages in the development and marketing of technology and devices to control the flow of light worldwide.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives