- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Moderna (NasdaqGS:MRNA) Declines 19% Over A Week Amid Market Volatility

Reviewed by Simply Wall St

Moderna (NasdaqGS:MRNA) experienced a significant decline of 19% over the past week. This drop can largely be attributed to broader market turbulence, amplified by the steep fall in major indices such as the Dow, S&P 500, and Nasdaq, which collectively entered into correction or bear market territories due to escalating trade tensions and tariff uncertainties. As a biotechnology company, Moderna shares may have faced additional pressures amidst general concerns about economic growth and increased market volatility. On a market-wide level, investors reacted defensively, pulling back from riskier investments, which likely influenced Moderna's steep decline.

You should learn about the 1 weakness we've spotted with Moderna.

The recent decline in Moderna's share price aligns with broader market trends, potentially exacerbating existing concerns about the company's focus on diversifying beyond COVID-19 products. While short-term volatility is significant, Moderna's longer-term performance reflects a 21.19% decline over the past five years, highlighting ongoing challenges in maintaining investor confidence. Over the past year, Moderna underperformed the US Biotechs industry, returning less than the industry's 14.6% decline, and lagging behind the US market's 3.4% decline. The divergence between short-term market pressures and long-term performance could impact investor sentiment and strategy as the company seeks stability through revenue diversification and operational efficiency.

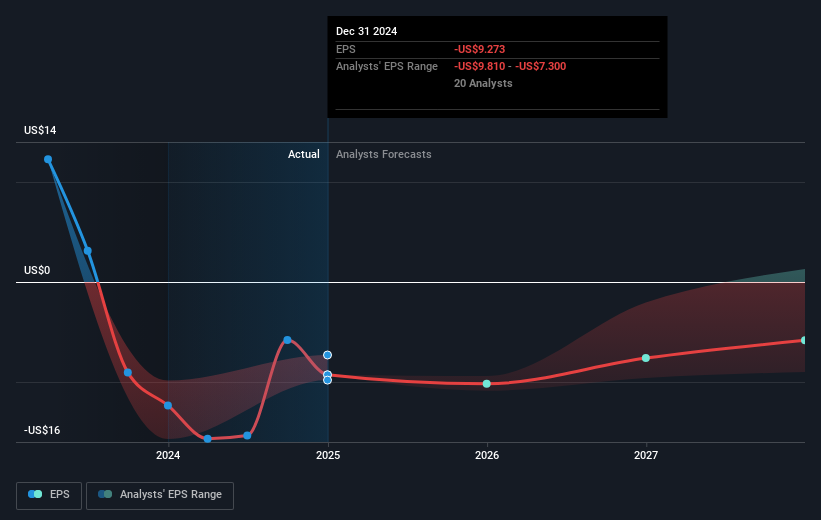

In terms of revenue and earnings forecasts, recent market volatility can potentially affect Moderna's future financial outlook. With analysts not expecting profitability within the next three years, persistent concerns about declining COVID-19 product sales and increased operational costs may linger. The company's emphasis on launching new vaccines in diverse therapeutic areas is critical to mitigating these challenges. As of now, the current share price of US$27.16 sits at a significant discount compared to the average analyst price target of US$52.35, suggesting potential upside if Moderna can achieve its revenue diversification goals. However, this is contingent on successfully navigating approval hurdles and market uptake uncertainties. Investors should closely monitor these developments and assess their potential impact on Moderna's projected earnings and growth trajectories.

Understand Moderna's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives