- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Moderna (NasdaqGS:MRNA) Begins Phase 1 Study on Novel Cancer Therapy Candidate

Reviewed by Simply Wall St

Moderna (NasdaqGS:MRNA) initiated the dosing for its innovative mRNA-4106 cancer therapy in a Phase 1 trial, signaling ongoing advancements in their oncology pipeline. However, the company's stock experienced a 3% decline over the last week. This movement contrasts with broader market trends, as major indexes such as the S&P 500 and Nasdaq saw gains. Moderna's decline could have been moderated by these recent clinical developments amidst a rising market, emphasizing the complex interplay between company-specific news and broader market sentiment. Overall, the stock's performance did not fully align with the broader upward market trajectory.

Buy, Hold or Sell Moderna? View our complete analysis and fair value estimate and you decide.

The announcement of Moderna's progress with its mRNA-4106 cancer therapy could influence future growth narratives by enhancing its oncology pipeline and potential revenue streams. Currently, high development costs and uncertainties in product approval remain challenges. Over a five-year period, Moderna's total shareholder returns have shown a decrease of 64.73%, reflecting the long-term volatility and challenges the company faces. In contrast, Moderna's recent one-year performance lagged behind the US Biotechs industry, emphasizing a need for sustained improvements.

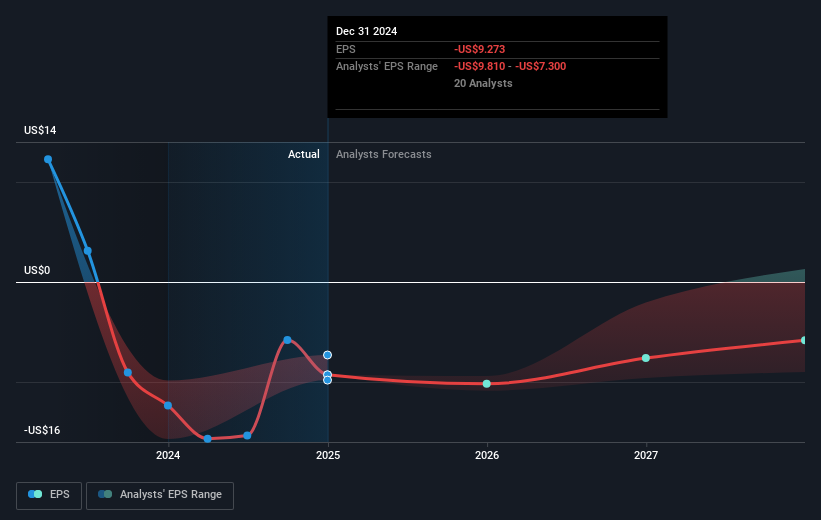

Revenue forecasts hinge on successful product market entries and continued advancements like the mRNA-4106 trial, which could diversify revenue streams. Earnings forecasts remain negative, with analysts not expecting profitability within the next three years. The company's price movement, despite recent declines, positions its current share price significantly below the consensus analyst price target of US$46.96, suggesting a potential upside if the company's strategic directions materialize effectively. Nevertheless, it is important to assess these forecasts alongside current operational and market conditions to determine their feasibility.

Evaluate Moderna's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Moderna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives