- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

MannKind (MNKD) Pipeline Expansion: Assessing Valuation After New United Therapeutics Collaboration

Reviewed by Simply Wall St

If you have been watching MannKind (MNKD), the company just shook things up. MannKind announced it is expanding its global license and collaboration agreement with United Therapeutics, bringing an additional development product under its wing. This means MannKind will be using its proprietary Technosphere platform to formulate a new investigational molecule, with the potential to earn $5 million upfront, up to $35 million in milestone payments, and 10% royalties if the product reaches market. For investors, this is not just a routine business update; it signals momentum behind MannKind’s technology and opens new doors for its pipeline.

This development comes at an intriguing time for MannKind shareholders. Over the past month, shares have gained an impressive 58%, building on strong three-year and five-year returns. At the same time, the stock is still down roughly 9% over the past year, and returns year-to-date remain in the red. This blend of recent upside and longer-term volatility makes the current moment feel like a potential turning point, especially as investors react to both the license expansion and a spate of upcoming conference appearances by MannKind’s leadership.

The question now is simple: does the recent jump reflect MannKind’s true worth, or is the market already baking in more future growth than is justified?

Most Popular Narrative: 43.4% Undervalued

The most widely followed narrative sees MannKind as significantly undervalued, implying strong upside if expectations are met in the coming years. It draws on detailed projections for revenue, margins, and market expansion to support this view.

Afrezza's continued double-digit prescription growth, international expansion efforts, upcoming pediatric indication launch, and a broadened salesforce footprint are set to accelerate market penetration amid a rising global diabetes burden and an aging population. These factors directly support revenue and earnings growth. Multiple late-stage pipeline programs (inhaled clofazimine for NTM and nintedanib DPI for IPF) are progressing toward key regulatory and clinical milestones. They benefit from expedited pathways and growing unmet need in chronic respiratory diseases, with the potential to significantly diversify and expand future revenues.

What is powering this “undervalued” thesis? The secret sauce is an ambitious set of growth assumptions for MannKind’s revenue, profit margin, and pipeline success. This narrative suggests plenty of fuel for a rally, but the real drivers may surprise you. Curious to see which bold financial projections are behind this target? The numbers are more aggressive than you might think, so get ready to unpack the core ingredients of this high-stakes valuation case.

Result: Fair Value of $9.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, MannKind’s reliance on key products and ongoing challenges in expanding Afrezza’s market share could slow growth if these hurdles persist.

Find out about the key risks to this MannKind narrative.Another View: How MNKD Stacks Up on Earnings

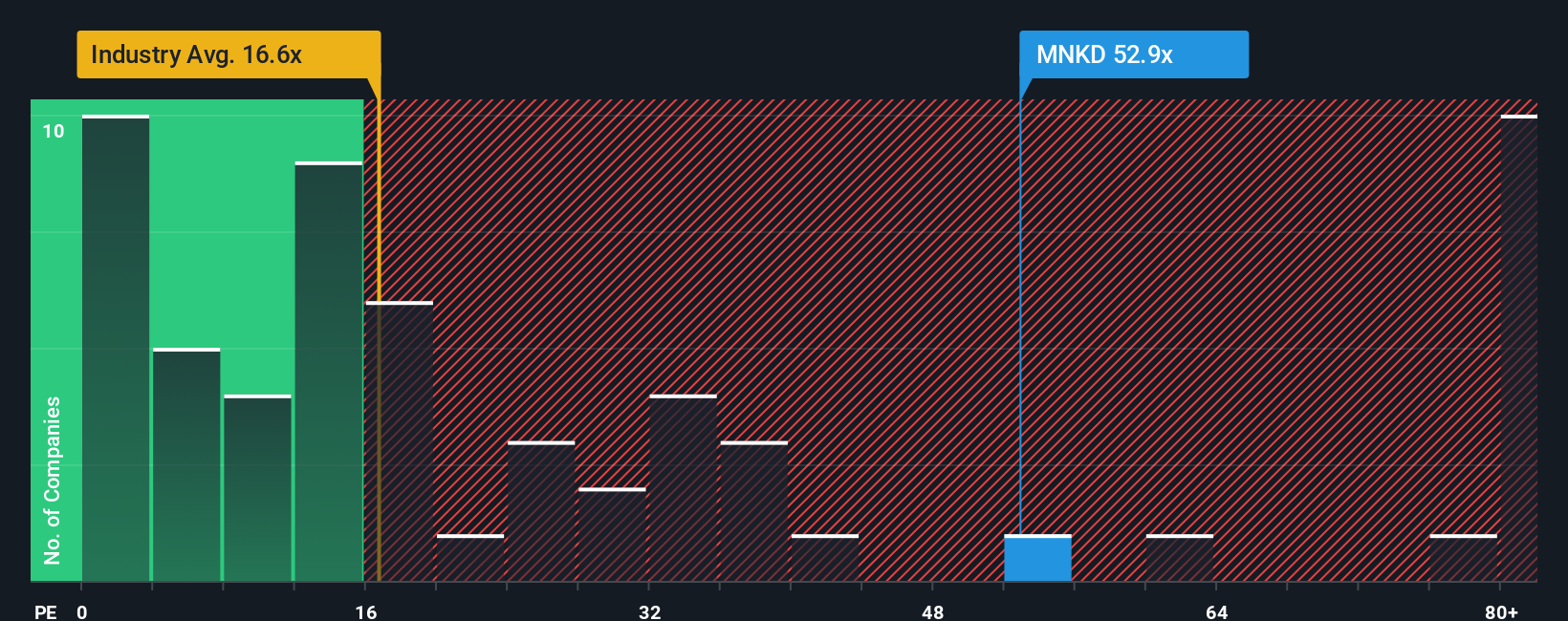

While the earlier fair value estimate focuses on future earnings growth, looking at MannKind’s current valuation from an earnings perspective tells a different story. By this method, MannKind appears far more expensive than the broader biotech industry. Could the market be overlooking risks, or is it betting big on future breakthroughs?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MannKind Narrative

If you think there’s more to the story or want to do your own digging, it’s simple to put together your own take on MannKind’s outlook in just a few minutes. Do it your way.

A great starting point for your MannKind research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next market winner slip through your fingers. Use our Screener to spot powerful trends, emerging opportunities, and resilient performers you might miss elsewhere.

- Target strong cash-flow plays and uncover value hidden in plain sight with our tailored list of undervalued stocks based on cash flows.

- Get ahead of the curve by filtering for cutting-edge companies shaping healthcare with the latest advances in artificial intelligence using our pick of healthcare AI stocks.

- Boost your income potential and ensure greater stability by checking out our curated group of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion