- United States

- /

- Biotech

- /

- NasdaqGS:LXRX

Strong week for Lexicon Pharmaceuticals (NASDAQ:LXRX) shareholders doesn't alleviate pain of five-year loss

Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) shareholders should be happy to see the share price up 30% in the last month. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Like a ship taking on water, the share price has sunk 79% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

The recent uptick of 27% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Lexicon Pharmaceuticals

Lexicon Pharmaceuticals wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Lexicon Pharmaceuticals saw its revenue shrink by 89% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 12% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

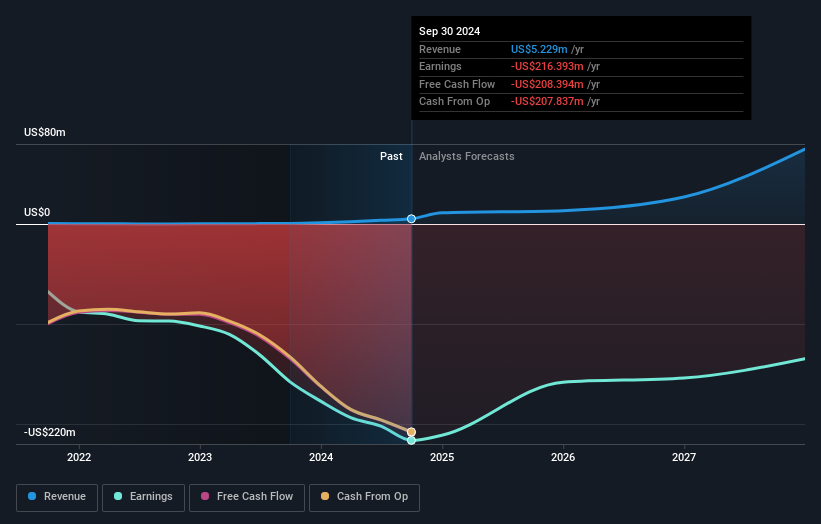

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Lexicon Pharmaceuticals shareholders are down 40% for the year, but the market itself is up 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Lexicon Pharmaceuticals better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Lexicon Pharmaceuticals (including 1 which can't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Lexicon Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LXRX

Lexicon Pharmaceuticals

A biopharmaceutical company, focuses on the discovery, development, and commercialization of pharmaceutical products for the treatment of human disease.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives