- United States

- /

- Biotech

- /

- NasdaqGS:LVTX

Investors Aren't Buying LAVA Therapeutics N.V.'s (NASDAQ:LVTX) Revenues

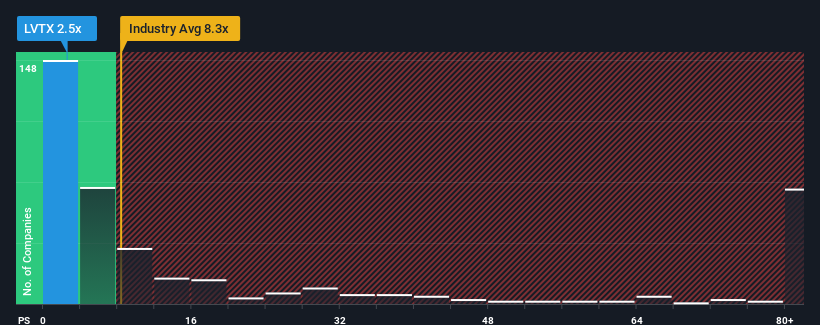

You may think that with a price-to-sales (or "P/S") ratio of 2.5x LAVA Therapeutics N.V. (NASDAQ:LVTX) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 8.3x and even P/S above 43x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for LAVA Therapeutics

What Does LAVA Therapeutics' P/S Mean For Shareholders?

Recent times haven't been great for LAVA Therapeutics as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think LAVA Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start .Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as LAVA Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 77% gain to the company's top line. The latest three year period has also seen an excellent 124% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 100% per annum during the coming three years according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 172% per annum, which paints a poor picture.

In light of this, it's understandable that LAVA Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that LAVA Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, LAVA Therapeutics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for LAVA Therapeutics you should be aware of.

If these risks are making you reconsider your opinion on LAVA Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade LAVA Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LVTX

LAVA Therapeutics

Operates as a clinical-stage immuno-oncology company that focuses on developing cancer treatments.

Flawless balance sheet slight.

Market Insights

Community Narratives