- United States

- /

- Pharma

- /

- NasdaqCM:LQDA

Stronger‑Than‑Expected Yutrepia Sales Might Change The Case For Investing In Liquidia (LQDA)

Reviewed by Sasha Jovanovic

- Earlier in 2025, Liquidia Technologies reported strong third-quarter results, with its pulmonary arterial hypertension therapy Yutrepia delivering sales that surpassed market expectations.

- On the same day, General Counsel Russell Schundler sold shares and exercised options under a pre-set Rule 10b5-1 plan, highlighting routine insider activity alongside operational momentum.

- Next, we’ll explore how Yutrepia’s stronger-than-expected performance shapes Liquidia’s investment narrative despite a recent 3.93% one-day share price decline.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Liquidia's Investment Narrative?

To own Liquidia, you have to believe Yutrepia can evolve from a launch story into a durable pulmonary arterial hypertension franchise that eventually supports profitability. The latest quarter’s stronger-than-expected Yutrepia sales, and the step-change in revenue to US$54.34 million, strengthen that case by showing early commercial traction, even as the stock slipped 3.93% in a single session. In the near term, the key catalysts remain continued Yutrepia uptake and evidence that recent revenue momentum is repeatable rather than a one-off spike. The 10b5-1 insider sale by the General Counsel looks routine and, in my view, is unlikely to alter the core thesis or the risk profile. The larger questions are whether Liquidia can manage ongoing losses, justify its rich sales multiple, and fund growth without putting too much pressure on shareholders.

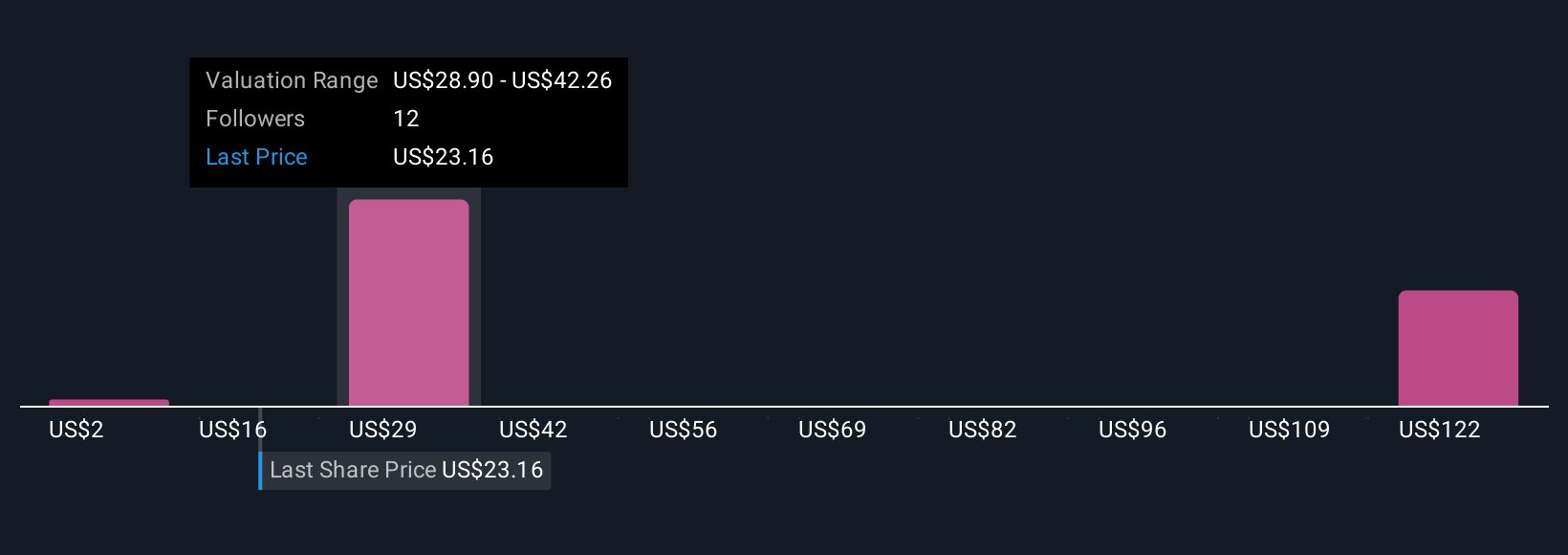

However, one financial risk could matter more to shareholders than the recent insider selling. Despite retreating, Liquidia's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Liquidia - why the stock might be worth less than half the current price!

Build Your Own Liquidia Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liquidia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liquidia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liquidia's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LQDA

Liquidia

A biopharmaceutical company, develops, manufactures, and commercializes various products for unmet patient needs in the United States.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026