- United States

- /

- Biotech

- /

- NasdaqCM:LJPC

Industry Analysts Just Upgraded Their La Jolla Pharmaceutical Company (NASDAQ:LJPC) Revenue Forecasts By 18%

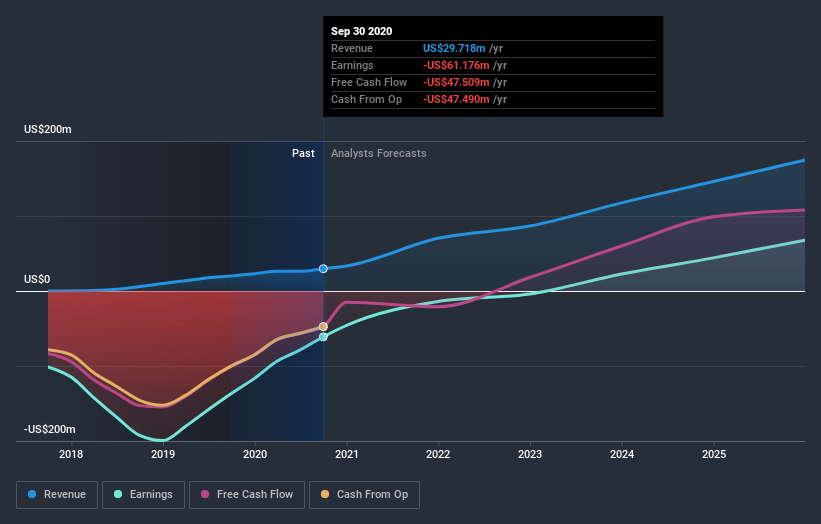

Celebrations may be in order for La Jolla Pharmaceutical Company (NASDAQ:LJPC) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for next year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. The market may be pricing in some blue sky too, with the share price gaining 30% to US$5.35 in the last 7 days. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

After the upgrade, the twin analysts covering La Jolla Pharmaceutical are now predicting revenues of US$70m in 2021. If met, this would reflect a huge 136% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 72% to US$0.63. Yet before this consensus update, the analysts had been forecasting revenues of US$60m and losses of US$0.81 per share in 2021. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to next year's revenue estimates, while at the same time reducing their loss estimates.

View our latest analysis for La Jolla Pharmaceutical

Despite these upgrades, the analysts have not made any major changes to their price target of US$10.92, implying that their latest estimates don't have a long term impact on what they think the stock is worth. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic La Jolla Pharmaceutical analyst has a price target of US$20.00 per share, while the most pessimistic values it at US$4.75. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that La Jolla Pharmaceutical's rate of growth is expected to accelerate meaningfully, with the forecast 136% revenue growth noticeably faster than its historical growth of 66% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 20% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that La Jolla Pharmaceutical is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses next year, perhaps suggesting La Jolla Pharmaceutical is moving incrementally towards profitability. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at La Jolla Pharmaceutical.

Better yet, La Jolla Pharmaceutical is expected to break-even soon - within the next few years - according to analyst forecasts, which would be a momentous event for shareholders. For more information, you can click through to our free platform to learn more about these forecasts.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade La Jolla Pharmaceutical, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LJPC

La Jolla Pharmaceutical

La Jolla Pharmaceutical Company engages in the development and commercialization of therapies that improve outcomes in patients suffering from life-threatening diseases.

Reasonable growth potential and fair value.

Market Insights

Community Narratives