- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

Did KT-621’s Phase 1 Results and Dupilumab Comparison Just Shift Kymera Therapeutics' (KYMR) Investment Narrative?

Reviewed by Simply Wall St

- In September 2025, Kymera Therapeutics announced at major European conferences that its oral STAT6 degrader KT-621 achieved rapid and sustained STAT6 degradation with a favorable safety profile in Phase 1 trials. The company also presented new preclinical findings showing KT-621’s potential to fully block Th2 signaling and initiate follow-on clinical trials targeting multiple inflammatory diseases.

- One distinct insight is KT-621 not only matched but in some biomarker measures surpassed dupilumab, a leading therapy, in early-stage testing, highlighting its potential competitive positioning in atopic dermatitis and asthma treatment pipelines.

- We’ll now examine how KT-621’s positive early results and expanded clinical plans shape Kymera’s investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kymera Therapeutics Investment Narrative Recap

Being a Kymera Therapeutics shareholder means believing in the potential for transformative oral therapies targeting STAT6 and other immunology pathways, with KT-621 at the forefront. The recent Phase 1 results provide momentum for KT-621 as the company advances toward pivotal Phase 2b trials, clearly supporting the most important near-term catalyst of clinical progress, but ongoing financial losses and high R&D spending remain immediate risks that cannot be overlooked.

The most relevant recent announcement is the positive Phase 1 trial data for KT-621, including deep STAT6 degradation and biomarker results that not only compare favourably with dupilumab but suggest a competitive edge in early studies. These findings underpin Kymera’s upcoming milestones, particularly the planned late-2025 and early-2026 clinical readouts, which are expected to impact future development and investor sentiment.

In contrast, investors should be aware of the rising competition in the STAT6 space and what that could mean for...

Read the full narrative on Kymera Therapeutics (it's free!)

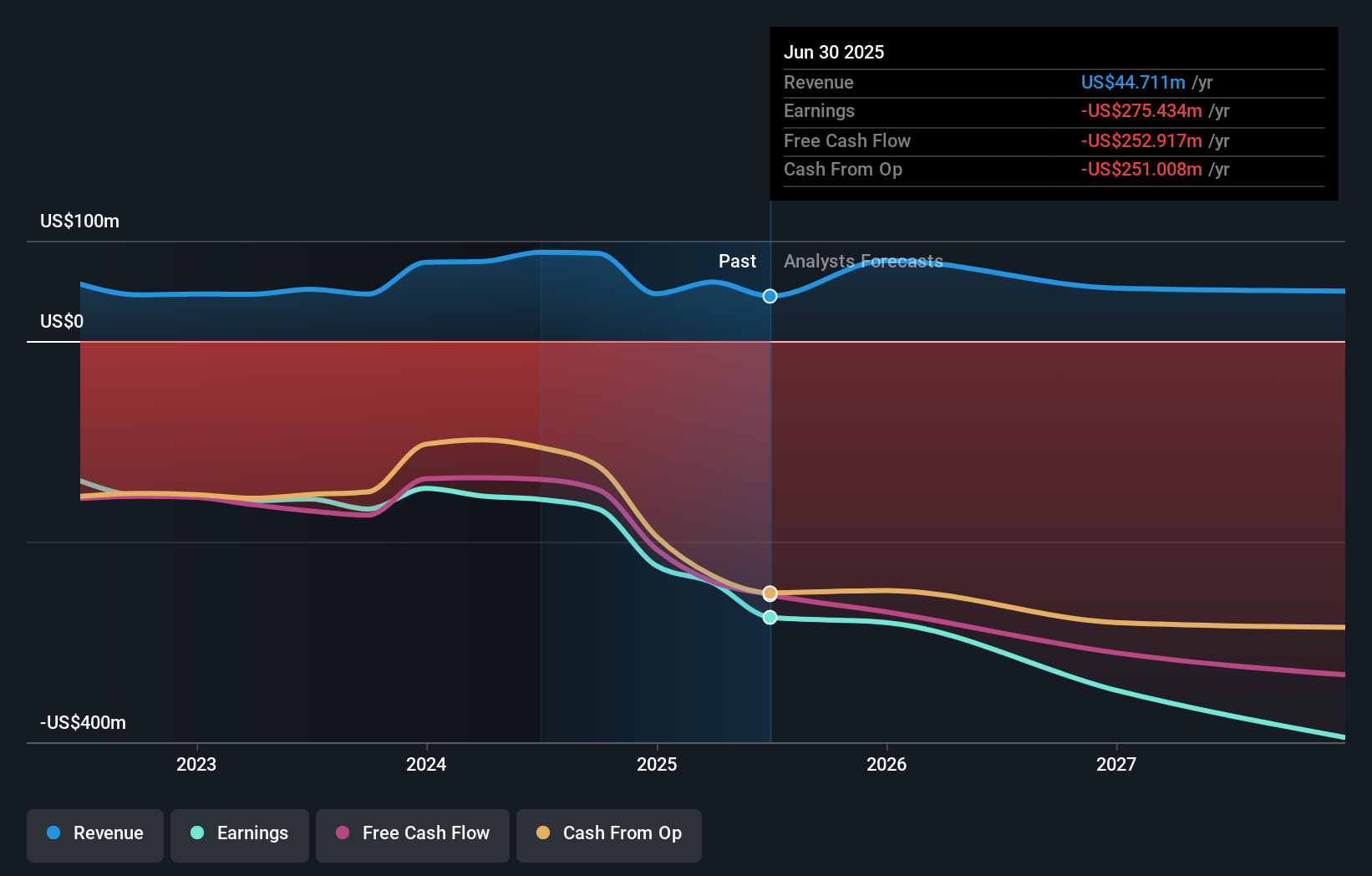

Kymera Therapeutics' narrative projects $82.2 million revenue and $13.0 million earnings by 2028. This requires 20.4% yearly revenue growth and a $236.9 million earnings increase from -$223.9 million today.

Uncover how Kymera Therapeutics' forecasts yield a $71.94 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have provided 1 fair value estimate for Kymera, all at US$71.94 per share. With KT-621’s clinical progress a key catalyst, market participants may see expanding views as data from pivotal trials arrive.

Explore another fair value estimate on Kymera Therapeutics - why the stock might be worth as much as 46% more than the current price!

Build Your Own Kymera Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kymera Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Kymera Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kymera Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KYMR

Kymera Therapeutics

A clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives