Last Update04 Oct 25Fair value Decreased 11%

Analysts have revised Kymera Therapeutics' fair value target down to approximately $64 from $72. This adjustment is based on updated models that reflect mixed expectations for growth as well as newly anticipated milestones for KT-621 clinical progress.

Analyst Commentary

Recent Street research provides a nuanced view of Kymera Therapeutics' outlook, with analysts highlighting both positive growth drivers and areas of caution as the company advances its clinical programs.

Bullish Takeaways

- Bullish analysts have raised price targets on Kymera shares, attributing increased valuations to the progression of KT-621, particularly as it moves into key Phase 2 studies in late 2025.

- Updated models now reflect higher confidence in the KT-621 program. Expectations are for approximately $1.9 billion in peak adjusted sales, signifying greater conviction in the asset’s long-term commercial potential.

- Early clinical data for KT-621 has been described as encouraging, especially given the interest in oral therapies for inflammation and immunology. The upcoming proof-of-concept data is viewed as a potential catalyst for meaningful stock upside.

- The estimated probability of approval (PoA) for the KT-621 program has been adjusted upward. This reflects increased confidence as the clinical timeline advances and milestones are anticipated.

Bearish Takeaways

- Despite optimism around KT-621, some analysts caution that Kymera remains an early, clinical-stage biotech. This introduces inherent risks regarding execution and the ability to achieve anticipated milestones.

- While valuation has increased, meaningful further upside is closely tied to favorable near-term clinical data readouts. These are not guaranteed and could impact future growth prospects if results underwhelm.

- The company’s pipeline outside of KT-621 is less highlighted in analyst commentary, suggesting that valuation relies heavily on the success of one program. This introduces concentration risk.

What's in the News

- Positive Phase 1 clinical trial results for KT-621, Kymera's first-in-class oral STAT6 degrader, will be featured at both the European Academy of Dermatology & Venereology (EADV) Congress in Paris and the European Respiratory Society (ERS) Congress in Amsterdam. (Key Developments)

- New preclinical data demonstrated KT-621's compelling activity in disease-relevant models, showing performance that is comparable to or better than dupilumab in modulating key biomarkers and AD-relevant gene expression. (Key Developments)

- In healthy volunteer studies, KT-621 achieved rapid, deep, and prolonged STAT6 degradation in both blood and skin, with complete degradation observed at higher multiple ascending doses. (Key Developments)

- KT-621 was well-tolerated in Phase 1 studies, with a safety profile that matched placebo. (Key Developments)

- Ongoing clinical development includes the BroADen Phase 1b trial in moderate to severe atopic dermatitis patients, with results expected in the fourth quarter of 2025. Two Phase 2b studies in atopic dermatitis and asthma are planned to begin in late 2025 and early 2026, respectively. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target, or fair value estimate, has fallen significantly from $71.94 to approximately $64.

- Discount Rate has risen modestly, moving from 6.47 percent to 6.79 percent. This reflects a slightly higher risk profile.

- Revenue Growth assumptions have shifted from a positive 20.43 percent to a near-zero or flat projection at -0.15 percent. This indicates much more tempered growth expectations.

- Net Profit Margin forecast has risen slightly from 15.87 percent to 16.11 percent.

- Future P/E (price-to-earnings ratio) has increased sharply, from 410.75x to 950.93x. This signals a higher implied valuation relative to projected earnings.

Key Takeaways

- Advancing clinical programs and strategic partnerships could increase market share and positively impact future revenue and earnings.

- Solid cash runway supports focused R&D investments, potentially boosting long-term growth without immediate financing pressures.

- High R&D expenses and reliance on partnerships pose risks to Kymera's long-term financial health and ability to maintain a leadership position in their sector.

Catalysts

About Kymera Therapeutics- Together with its subsidiary, a clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

- Kymera Therapeutics plans to advance its STAT6 and TYK2 programs into several clinical stages, which could potentially increase future revenue due to the expansion into new treatment markets and therapeutic areas.

- The anticipated Phase II and III trials for their immunology pipeline aim to deliver biologics-like efficacy in oral form, which could enhance net margins by reducing manufacturing costs associated with biologics and potentially capturing a larger market share.

- The collaboration with Sanofi on the IRAK4 program, with expanded Phase II trials, positions Kymera to fast-track toward pivotal trials, potentially accelerating time-to-market and impacting future earnings positively.

- The company's strategy to introduce at least one new IND per year could expand their pipeline steadily, offering opportunities for revenue growth from licensing deals or partnerships.

- With a significant cash runway extending into mid-2027, Kymera can support its R&D activities without immediate pressure for additional financing, allowing focused investment in high-potential programs that could drive long-term earnings growth.

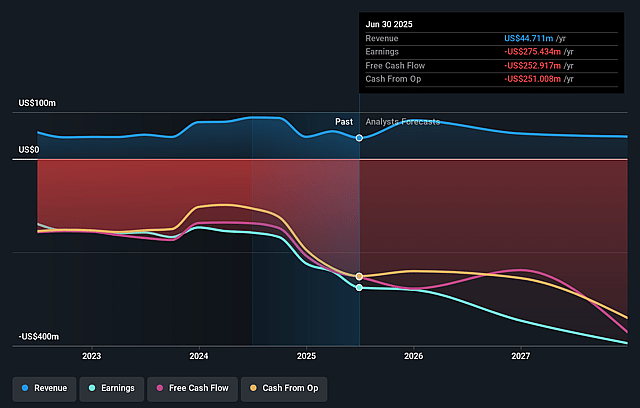

Kymera Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kymera Therapeutics's revenue will grow by 20.4% annually over the next 3 years.

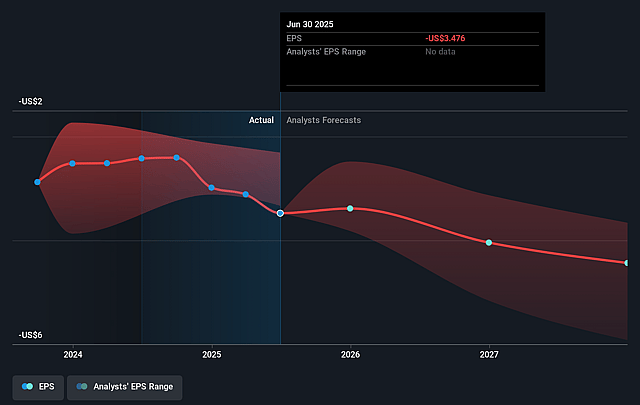

- Analysts are not forecasting that Kymera Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Kymera Therapeutics's profit margin will increase from -475.6% to the average US Biotechs industry of 15.9% in 3 years.

- If Kymera Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $13.0 million (and earnings per share of $0.17) by about May 2028, up from $-223.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 410.7x on those 2028 earnings, up from -9.8x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 5.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

Kymera Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to a video format for financial updates may not significantly impact investor perception or the company’s market value, and does not directly address any operational or financial performance issues.

- Competition in the STAT6 space has increased, which may impact Kymera's ability to maintain its leadership position and could affect future revenue streams.

- Although significant progress is being made with partners like Sanofi, reliance on partnerships exposes Kymera to risks if partners face challenges in advancing clinical trials, potentially impacting future earnings.

- The financial performance shows high R&D expenses with $71.8 million spent in the fourth quarter alone, which could strain resources and impact net margins if new drugs don't reach successful commercialization.

- Despite a significant cash balance, the projected cash runway into mid-2027 suggests that sustained high operational costs could pose a risk to long-term financial health if projected clinical milestones or revenue targets are not met.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $57.667 for Kymera Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $97.0, and the most bearish reporting a price target of just $41.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $82.2 million, earnings will come to $13.0 million, and it would be trading on a PE ratio of 410.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $33.69, the analyst price target of $57.67 is 41.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.