- United States

- /

- Software

- /

- NasdaqGS:INTA

Exploring 3 High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with major indices like the S&P 500 and Nasdaq setting fresh records despite concerns over a government shutdown and unexpected job losses, investors are increasingly focusing on high-growth opportunities within the tech sector. In this dynamic environment, identifying promising tech stocks involves assessing their potential for innovation and scalability in light of current economic conditions and broader market sentiment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.33% | 23.81% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Circle Internet Group | 28.31% | 82.83% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Intapp (INTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., delivers AI-powered solutions across the United States, the United Kingdom, and internationally with a market cap of $3.36 billion.

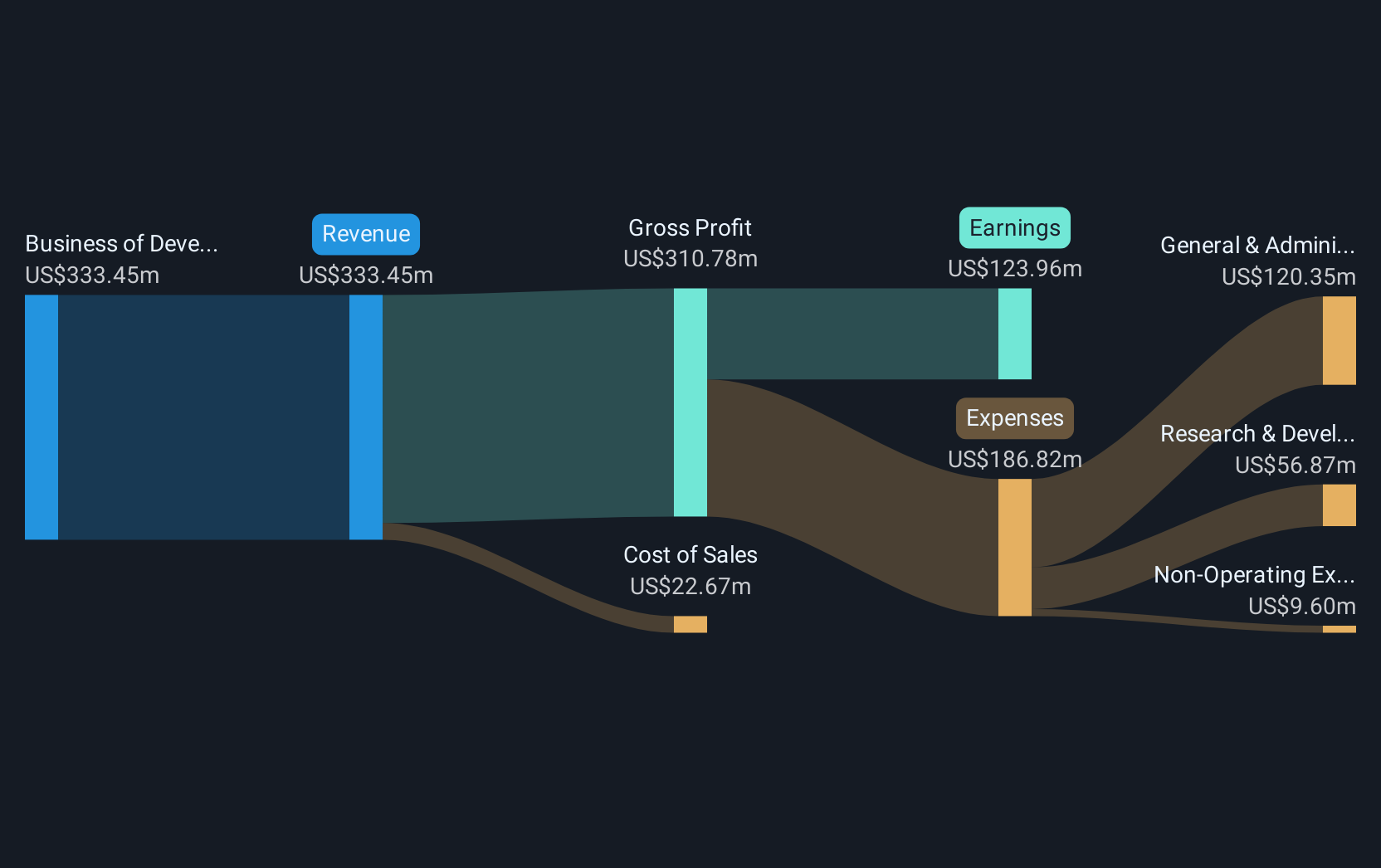

Operations: Intapp focuses on providing AI-powered solutions, generating revenue primarily from its Software & Programming segment, which amounts to $504.12 million.

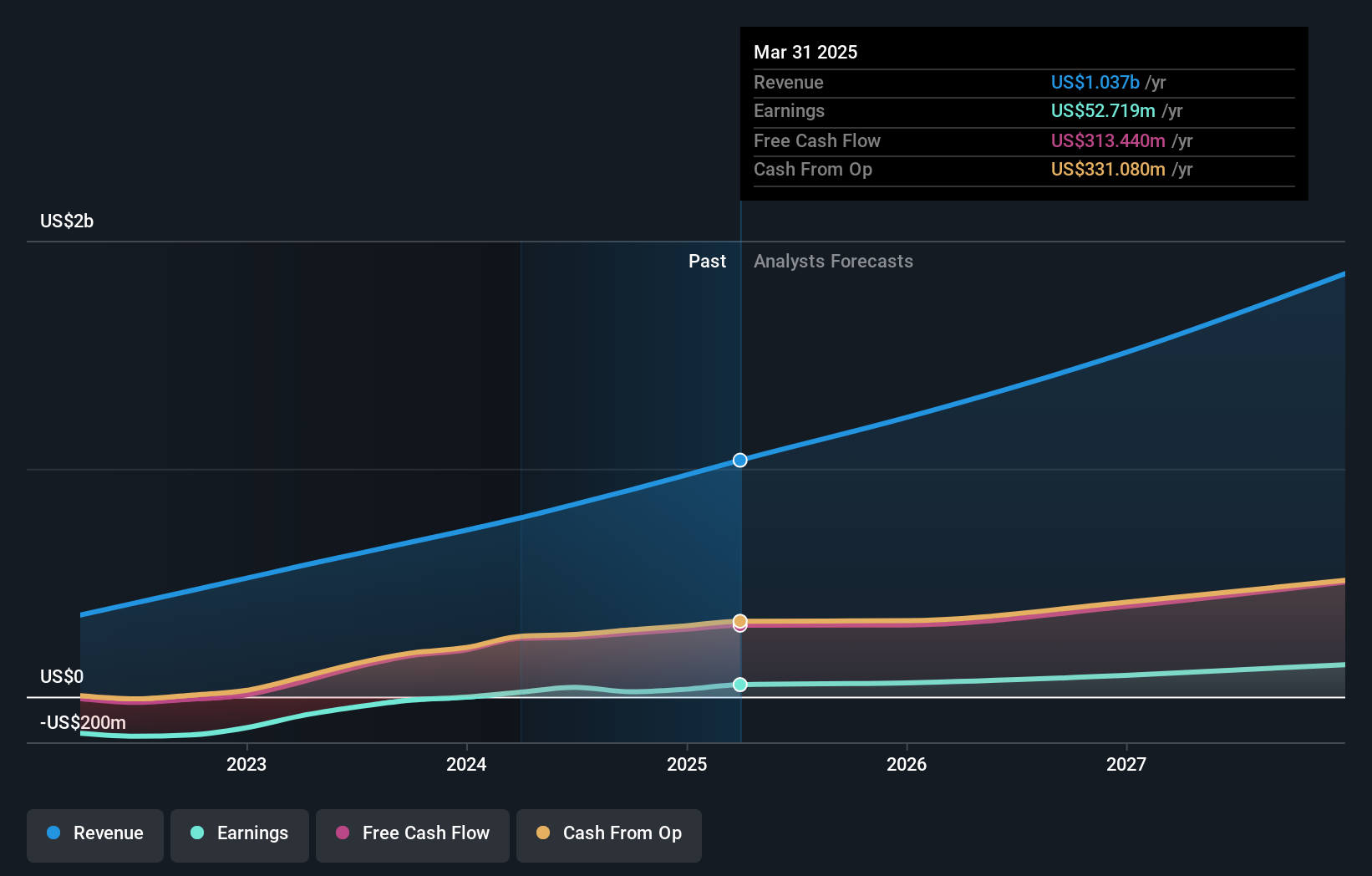

Intapp, despite its current unprofitability, is on a trajectory to reverse this trend with expected profitability within three years and an anticipated earnings growth of 107.61% annually. The firm's recent adoption by Infinedi Partners for its DealCloud platform underscores a strategic pivot towards leveraging AI to enhance operational efficiencies across the financial sector. This move not only diversifies Intapp’s client base but also fortifies its position in high-growth tech sectors by integrating advanced technologies into everyday business processes. Moreover, the company's commitment to innovation is evident from its R&D focus, where expenses are strategically aligned with long-term growth objectives, ensuring sustained advancement in software solutions tailored for professional services industries.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of $5.11 billion.

Operations: Krystal Biotech generates revenue from its genetic medicines segment, which focuses on treating diseases with high unmet medical needs, amounting to $359.21 million.

Krystal Biotech's recent FDA approval for VYJUVEK® broadens its market potential significantly, catering from birth onwards and enhancing user flexibility in application—a pivotal step for those managing dystrophic epidermolysis bullosa (DEB). This label expansion, coupled with a robust pipeline including KB707 for non-small cell lung cancer, underscores Krystal's strategic focus on innovative genetic medicines. Financially, the company has shown remarkable growth with a net income leap to $38.33 million in Q2 2025 from $15.57 million the previous year. These developments not only boost Krystal’s standing in biotech but also reflect its commitment to addressing unmet medical needs through cutting-edge research and development.

- Unlock comprehensive insights into our analysis of Krystal Biotech stock in this health report.

Examine Krystal Biotech's past performance report to understand how it has performed in the past.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd., along with its subsidiaries, creates software applications for various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom; it has a market cap of approximately $9.99 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $1.10 billion. It operates across multiple regions, including the United States and Europe.

Amidst a challenging backdrop with a slight dip in earnings growth over the past year, monday.com has demonstrated resilience and strategic foresight. The company's recent announcement at its Elevate conference showcased significant AI-driven product innovations, including 'monday agents' and expanded AI capabilities within its CRM suite, signaling a robust pivot towards integrating AI deeply into business workflows. This strategic direction is complemented by an aggressive $870 million share repurchase program, underscoring confidence in its financial health and future prospects. With annual revenue growth projected at 17.5% and earnings expected to surge by 37.3% annually, monday.com is positioning itself as a transformative force in the software industry, leveraging cutting-edge technology to enhance operational efficiency and market competitiveness.

- Get an in-depth perspective on monday.com's performance by reading our health report here.

Understand monday.com's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 68 US High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives