- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

Exploring High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The market remained flat over the last week but is up 23% over the past year, with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies with strong innovation potential and robust financial health that can capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 54.72% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Bitdeer Technologies Group | 50.44% | 122.48% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.25% | 55.27% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Verra Mobility (NasdaqCM:VRRM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verra Mobility Corporation offers smart mobility technology solutions and services across the United States, Australia, Canada, and Europe, with a market capitalization of approximately $4.40 billion.

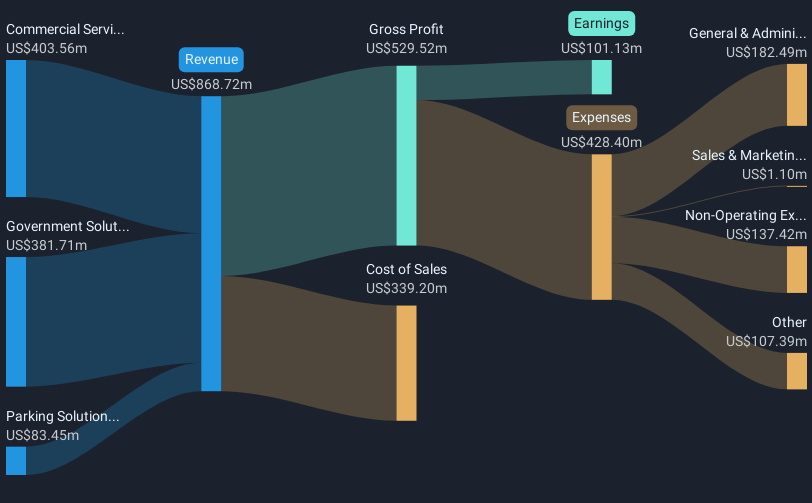

Operations: The company generates revenue through three main segments: Parking Solutions ($83.45 million), Commercial Services ($403.56 million), and Government Solutions ($381.71 million).

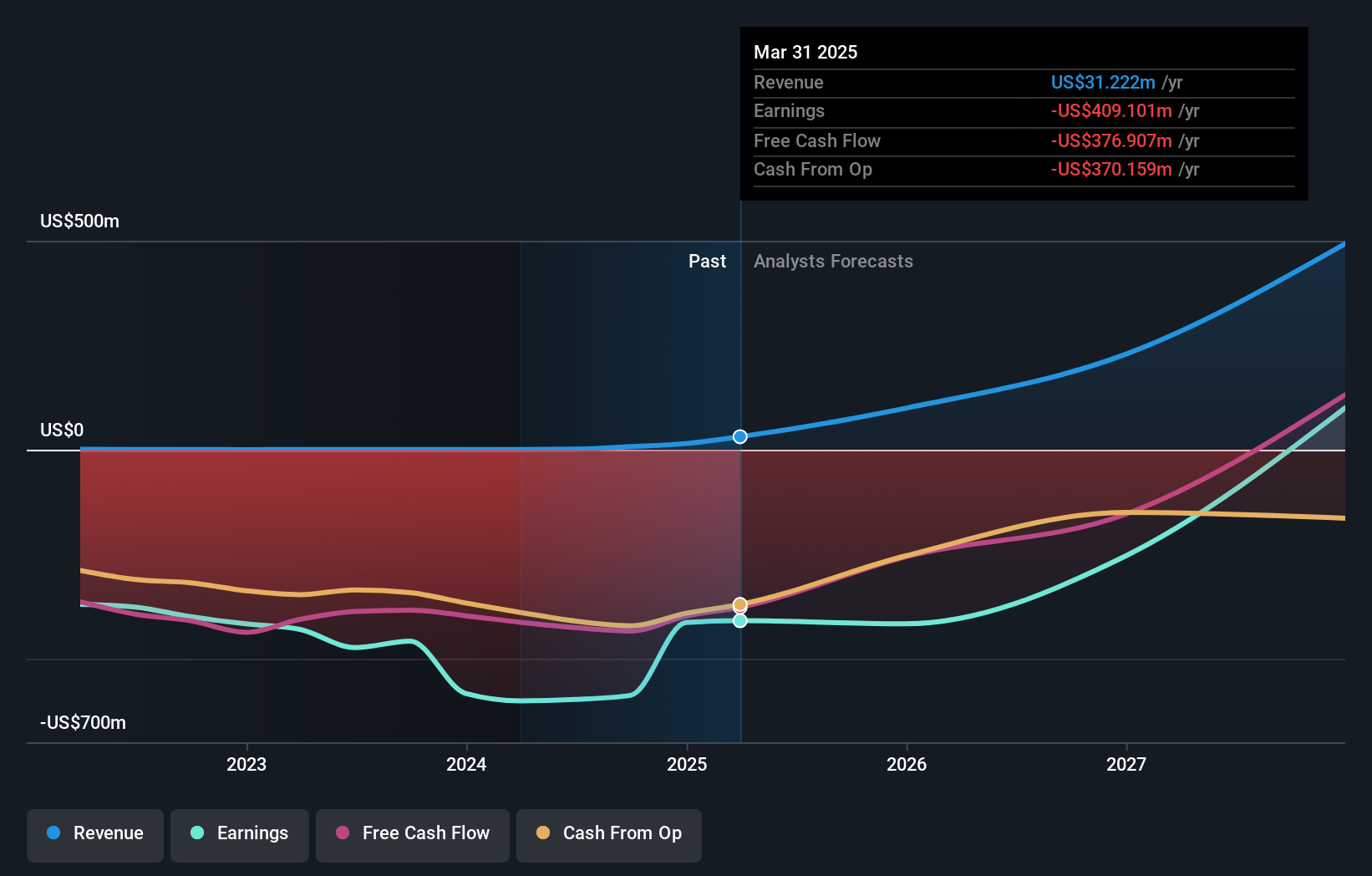

Verra Mobility has demonstrated robust financial performance with a notable 23% earnings growth over the past year, surpassing the Professional Services industry average of 9.8%. This growth trajectory is complemented by their strategic increase in buyback authorization to $200 million, signaling confidence in their financial health and future prospects. Moreover, their recent presentations at high-profile conferences underscore their active engagement with investors and commitment to transparency. While Verra's annual revenue growth rate of 6.5% trails the broader US market's 9%, its significant earnings forecast of an annual increase of 23.5% positions it well for sustained profitability. These elements collectively highlight Verra Mobility’s potential within the competitive tech landscape despite some market challenges.

- Dive into the specifics of Verra Mobility here with our thorough health report.

Examine Verra Mobility's past performance report to understand how it has performed in the past.

ImmunityBio (NasdaqGS:IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a clinical-stage biotechnology company focused on developing therapies and vaccines to enhance the natural immune system against cancers and infectious diseases, with a market cap of approximately $2.31 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $7.33 million. As a clinical-stage entity, it focuses on advancing therapies and vaccines designed to strengthen the immune system's response to cancer and infectious diseases.

ImmunityBio, Inc. is poised for significant growth with a forecasted annual revenue increase of 56.1%, outpacing the US market's average of 9%. This surge is anchored by its innovative cancer treatment ANKTIVA, which has shown promising results in clinical trials and received FDA approval in 2024 for specific bladder cancer treatments. The company's dedication to R&D is evident as it continues to expand its therapeutic offerings, with recent successful submissions to European and UK health authorities potentially broadening its market reach. Moreover, ImmunityBio's strategic collaborations aim to enhance clinical trial efficiencies and patient access to necessary treatments, positioning it well within the biotech sector despite current unprofitability and market volatility.

- Navigate through the intricacies of ImmunityBio with our comprehensive health report here.

Assess ImmunityBio's past performance with our detailed historical performance reports.

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kiniksa Pharmaceuticals International, plc is a biopharmaceutical company dedicated to discovering, acquiring, developing, and commercializing therapeutic medicines for patients with debilitating diseases that have significant unmet medical needs globally, with a market cap of $1.45 billion.

Operations: Kiniksa Pharmaceuticals generates revenue primarily from developing and delivering therapeutic medicines, amounting to $384.10 million. The company focuses on addressing significant unmet medical needs in debilitating diseases worldwide.

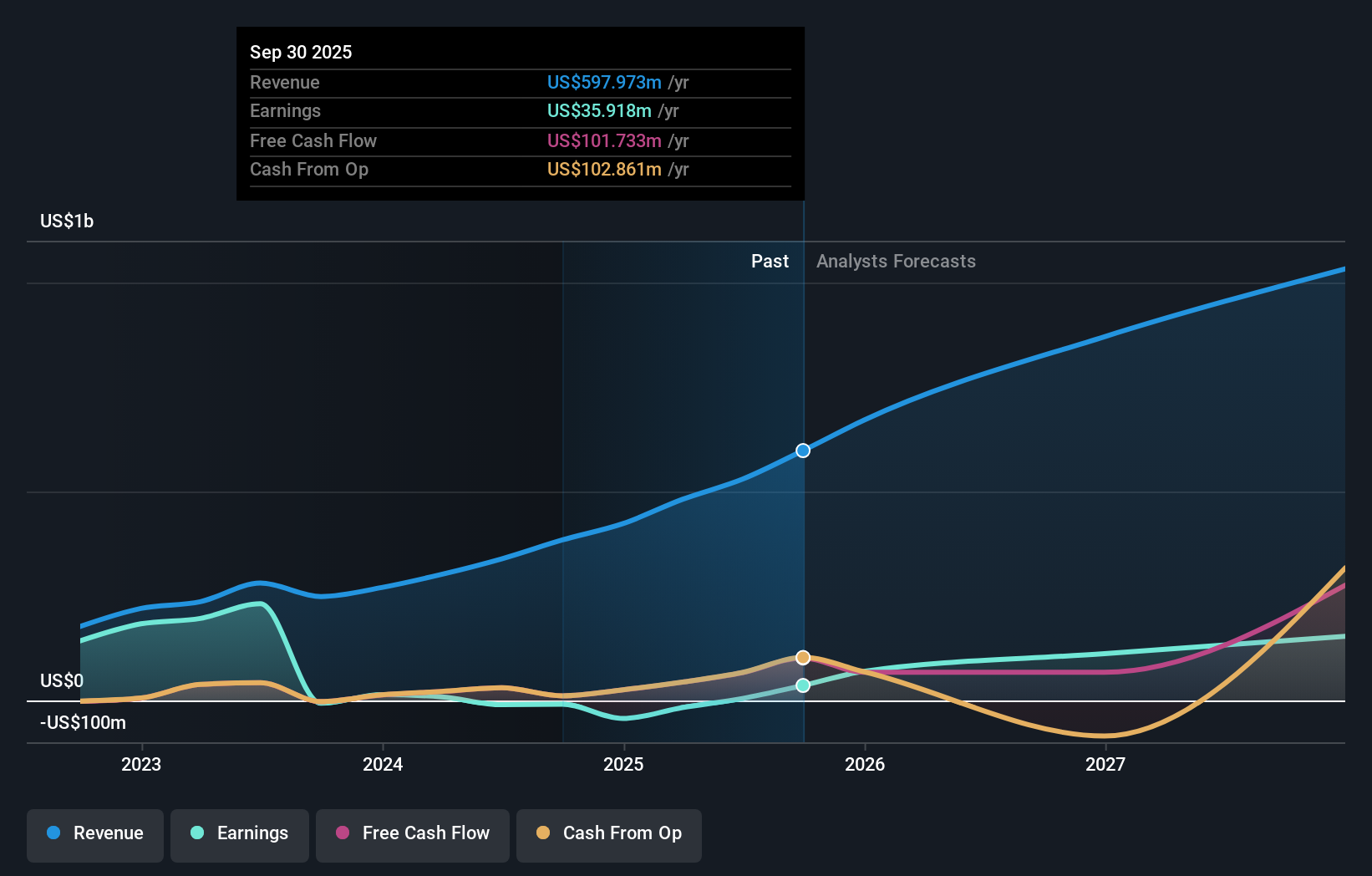

Kiniksa Pharmaceuticals International, despite its current unprofitability, is navigating a path toward significant financial improvement with an anticipated shift to profitability within three years. Recent presentations at high-profile healthcare conferences underscore the company's active engagement in the industry and its commitment to growth. Notably, Kiniksa's revenue guidance for 2025 projects earnings between $560 million and $580 million, reflecting confidence in their operational strategy and market positioning. This outlook is bolstered by a robust annual revenue growth rate of 15.8%, outperforming the US market average of 9%. Additionally, earnings are expected to surge by an impressive 46.54% annually, illustrating potential for substantial financial health improvement and shareholder value creation in the near future.

Next Steps

- Access the full spectrum of 229 US High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives