Potential Invivyd, Inc. (NASDAQ:IVVD) shareholders may wish to note that the Independent Director, Kevin McLaughlin, recently bought US$125k worth of stock, paying US$2.50 for each share. However, it only increased shareholding by a small percentage, and it wasn't a huge purchase by absolute value, either.

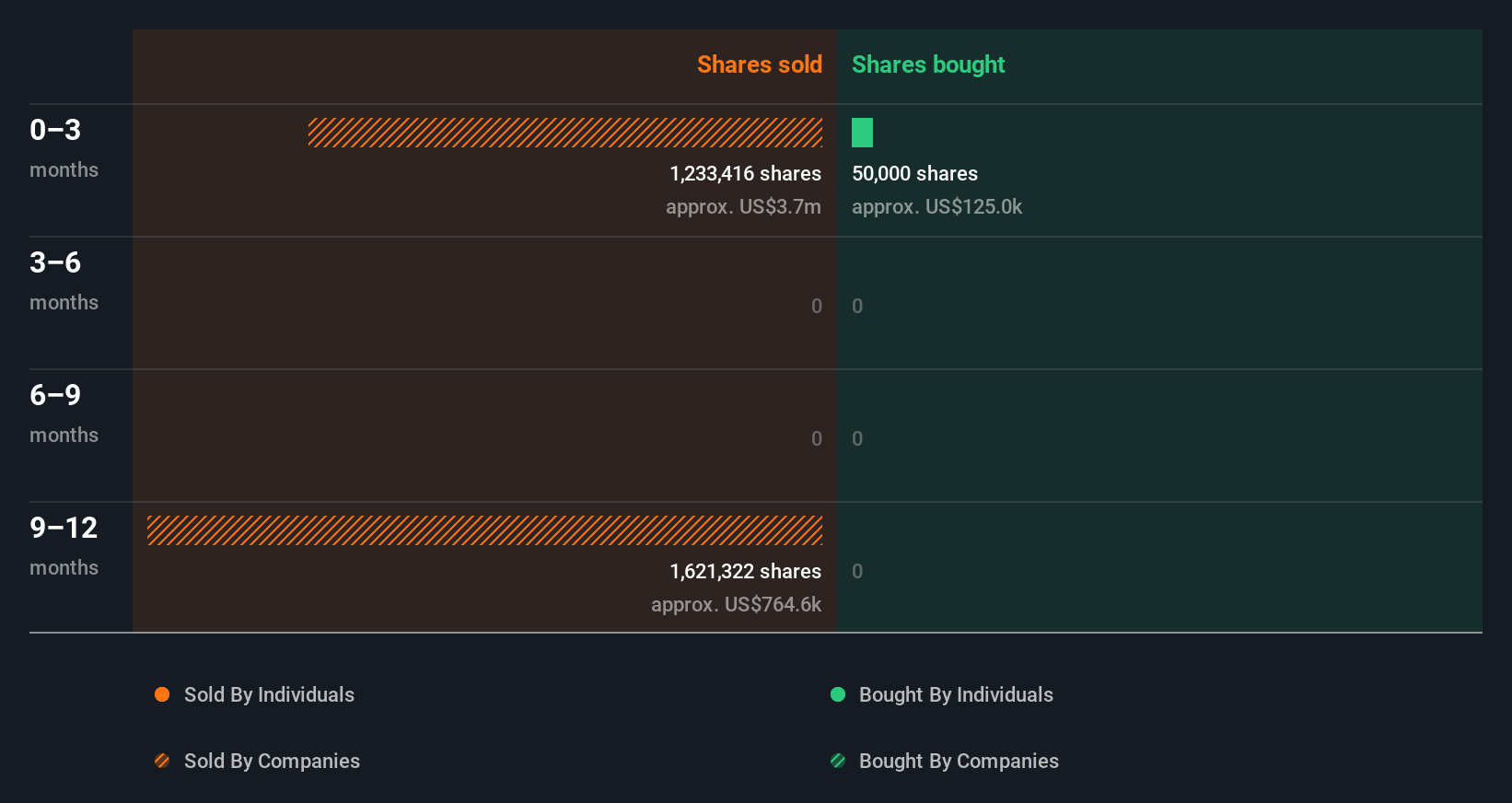

Invivyd Insider Transactions Over The Last Year

Notably, that recent purchase by Kevin McLaughlin is the biggest insider purchase of Invivyd shares that we've seen in the last year. So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$2.40). It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. Kevin McLaughlin was the only individual insider to buy shares in the last twelve months.

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

See our latest analysis for Invivyd

Invivyd is not the only stock that insiders are buying. For those who like to find small cap companies at attractive valuations, this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Invivyd Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Based on our data, Invivyd insiders have about 0.4% of the stock, worth approximately US$2.2m. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. I generally like to see higher levels of ownership.

What Might The Insider Transactions At Invivyd Tell Us?

It's certainly positive to see the recent insider purchase. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that Invivyd insiders are reasonably well aligned, and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. At Simply Wall St, we found 2 warning signs for Invivyd that deserve your attention before buying any shares.

Of course Invivyd may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IVVD

Invivyd

A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026