- United States

- /

- Biotech

- /

- NasdaqGM:IVVD

Invivyd (NasdaqGM:IVVD) Surges 198% After Positive Results From VYD2311 COVID-19 Trial

Reviewed by Simply Wall St

Invivyd (NasdaqGM:IVVD) experienced a significant 198% price increase over the past month, likely driven by the release of positive clinical data for its novel monoclonal antibody candidate, VYD2311. The promising results from the Phase 1/2 trial revealed improved safety and enhanced antiviral potency, positioning the company as a potential leader in COVID-19 treatment alternatives. This advancement coincides with a mixed performance in the broader U.S. stock market, where major indices showed volatility amidst economic concerns and policy uncertainties. While the Dow Jones Index saw a slight uptick of 0.7%, the tech-heavy Nasdaq Composite experienced a 0.6% decline. Invivyd's price surge stands out against the backdrop of a 3.6% market drop over the past week, highlighting investor confidence in the clinical advancements of VYD2311. As the market anticipates upcoming economic data, Invivyd's developments offer a positive outlook amidst a volatile trading environment.

Dig deeper into the specifics of Invivyd here with our thorough analysis report.

Despite Invivyd's short-term success with VYD2311, the company's shares experienced a substantial 70.50% decline in total return over the past year. When compared to the broader market last year, which saw positive growth, Invivyd's performance was less favorable. Specifically, the US Biotechs industry had a 7.8% decline, highlighting Invivyd's even greater challenges.

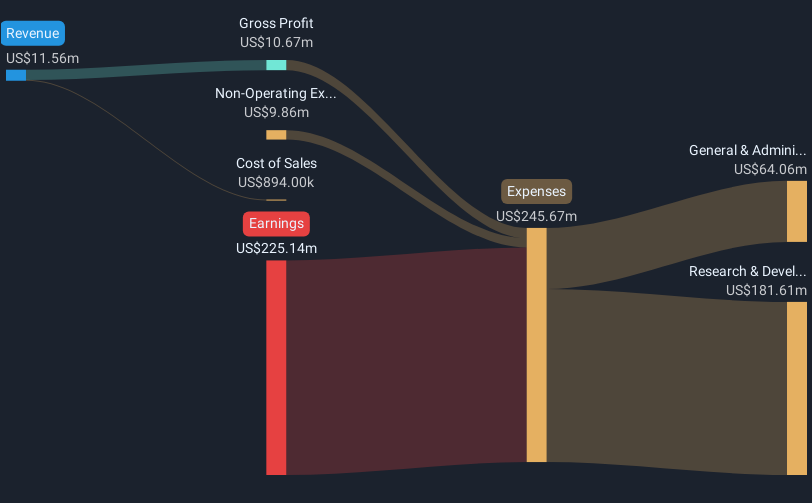

Key events over this period provide insight into this performance. In December 2024, Invivyd faced regulatory hurdles, receiving a Nasdaq deficiency notice for its stock price falling below the minimum requirement, placing pressure on its market standing. Significant leadership changes occurred, including the resignation of CEO David Hering in April 2024, replaced temporarily by Jeremy Gowler. Financially, the company reported considerable losses, such as a US$60.74 million net loss in Q3 2024, indicating underlying fiscal difficulties that may have influenced the declining shareholder returns.

- Analyze Invivyd's fair value against its market price in our detailed valuation report—access it here.

- Assess the downside scenarios for Invivyd with our risk evaluation.

- Is Invivyd part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IVVD

Invivyd

A commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives