- United States

- /

- Biotech

- /

- NasdaqGS:IRWD

Ironwood Pharmaceuticals, Inc.'s (NASDAQ:IRWD) Share Price Boosted 33% But Its Business Prospects Need A Lift Too

Despite an already strong run, Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD) shares have been powering on, with a gain of 33% in the last thirty days. But the last month did very little to improve the 74% share price decline over the last year.

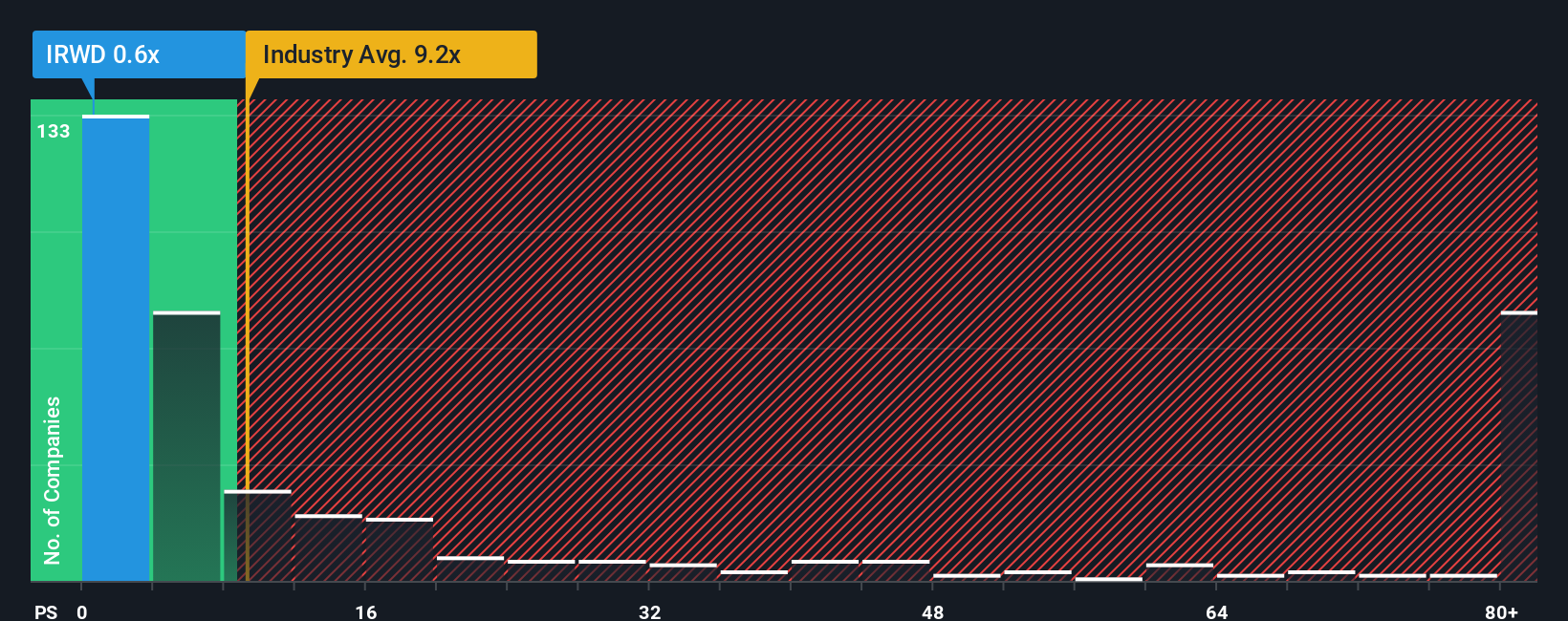

In spite of the firm bounce in price, Ironwood Pharmaceuticals' price-to-sales (or "P/S") ratio of 0.6x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 9.2x and even P/S above 66x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Ironwood Pharmaceuticals

How Has Ironwood Pharmaceuticals Performed Recently?

While the industry has experienced revenue growth lately, Ironwood Pharmaceuticals' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Ironwood Pharmaceuticals will help you uncover what's on the horizon.How Is Ironwood Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, Ironwood Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. The last three years don't look nice either as the company has shrunk revenue by 26% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 15% per annum over the next three years. With the industry predicted to deliver 121% growth per year, that's a disappointing outcome.

With this information, we are not surprised that Ironwood Pharmaceuticals is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Ironwood Pharmaceuticals' P/S

Shares in Ironwood Pharmaceuticals have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Ironwood Pharmaceuticals' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Ironwood Pharmaceuticals has 3 warning signs (and 2 which are potentially serious) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IRWD

Ironwood Pharmaceuticals

A biotechnology company, focuses on the development and commercialization of therapies for gastrointestinal (GI) and rare diseases in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives