- United States

- /

- Biotech

- /

- NasdaqCM:IPSC

There Is A Reason Century Therapeutics, Inc.'s (NASDAQ:IPSC) Price Is Undemanding

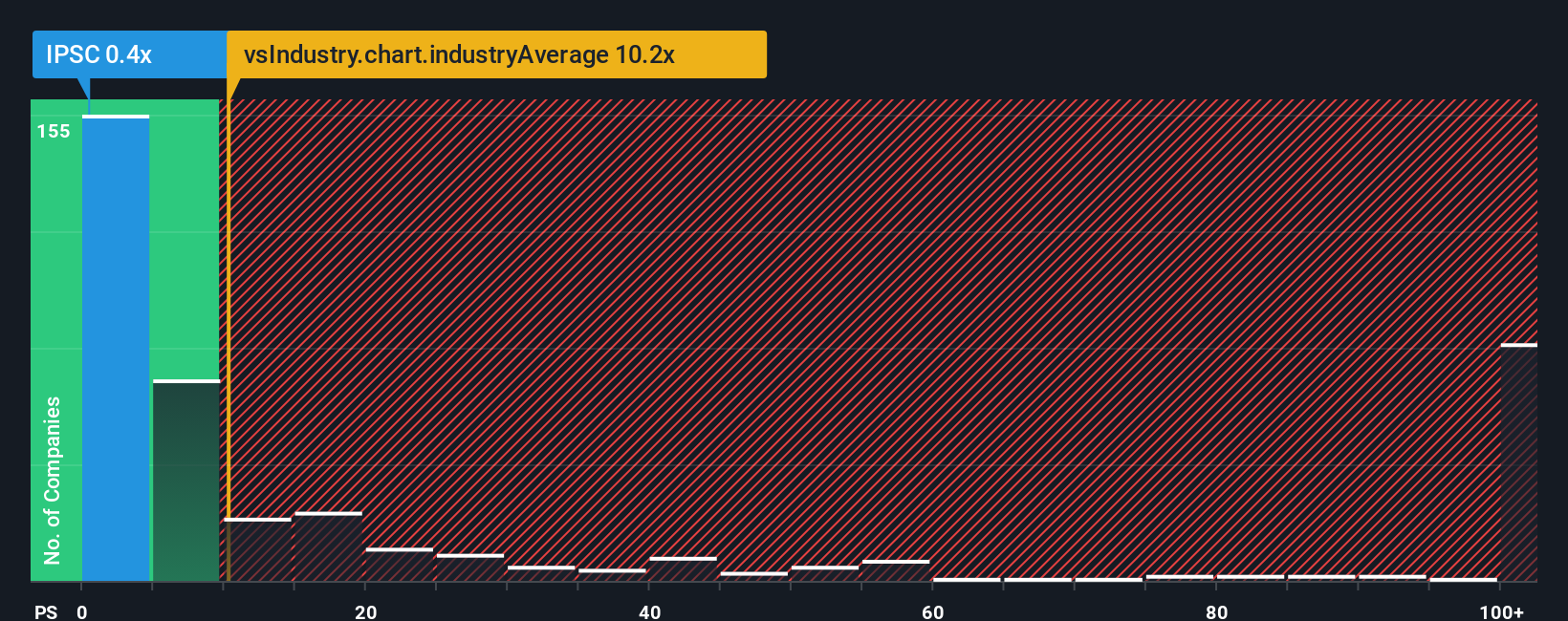

Century Therapeutics, Inc.'s (NASDAQ:IPSC) price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.2x and even P/S above 90x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Century Therapeutics

How Has Century Therapeutics Performed Recently?

Recent times have been advantageous for Century Therapeutics as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Century Therapeutics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Century Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as Century Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 100% per year over the next three years. That's not great when the rest of the industry is expected to grow by 127% per year.

With this information, we are not surprised that Century Therapeutics is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Century Therapeutics' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Century Therapeutics' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Century Therapeutics (2 are concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Century Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IPSC

Century Therapeutics

A clinical-stage biotechnology company, engages in the development of allogeneic cell therapies for the treatment of solid tumor, hematological malignancies, and autoimmune diseases.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives