- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

The Bull Case For Iovance Biotherapeutics (IOVA) Could Change Following Global Regulatory Push—Learn Why

Reviewed by Sasha Jovanovic

- Iovance Biotherapeutics recently advanced its regulatory strategy by pursuing market approvals in Canada, the UK, Australia, and Switzerland, alongside renewed discussions with the European Medicines Agency.

- This broad international focus signals an ambition to diversify revenue and reduce dependence on the U.S. market, showcasing the company's intent to unlock new commercial opportunities in oncology.

- We'll examine how Iovance's push for international approvals shapes its investment narrative and global growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Iovance Biotherapeutics Investment Narrative Recap

To own Iovance Biotherapeutics as a shareholder, you need to believe in the company’s ability to turn pioneering TIL therapies into meaningful and growing revenue streams, with international expansion providing a pathway to greater diversification and resilience. While the latest pursuit of market approvals in Canada, the UK, Australia, and Switzerland could spark fresh growth catalysts, regulatory hurdles and execution risks, especially around pipeline progress, still set the tone for near-term business risk, and the impact on immediate revenue visibility remains limited.

Among recent announcements, the approval of Amtagvi in Canada is especially relevant. This milestone marks Iovance's first market clearance outside the U.S. and underscores potential revenue benefits from geographic expansion, but it also highlights lingering questions around the pace and predictability of further international uptake in the face of regulatory complexities.

Yet, even as expansion promises growth, the outsized risk of Amtagvi dependence and shifting reimbursement dynamics is something investors need to fully appreciate before making decisions...

Read the full narrative on Iovance Biotherapeutics (it's free!)

Iovance Biotherapeutics' outlook anticipates $744.8 million in revenue and $35.6 million in earnings by 2028. This scenario assumes a revenue growth rate of 45.6% annually and an earnings increase of $425.5 million from current earnings of $-389.9 million.

Uncover how Iovance Biotherapeutics' forecasts yield a $9.10 fair value, a 312% upside to its current price.

Exploring Other Perspectives

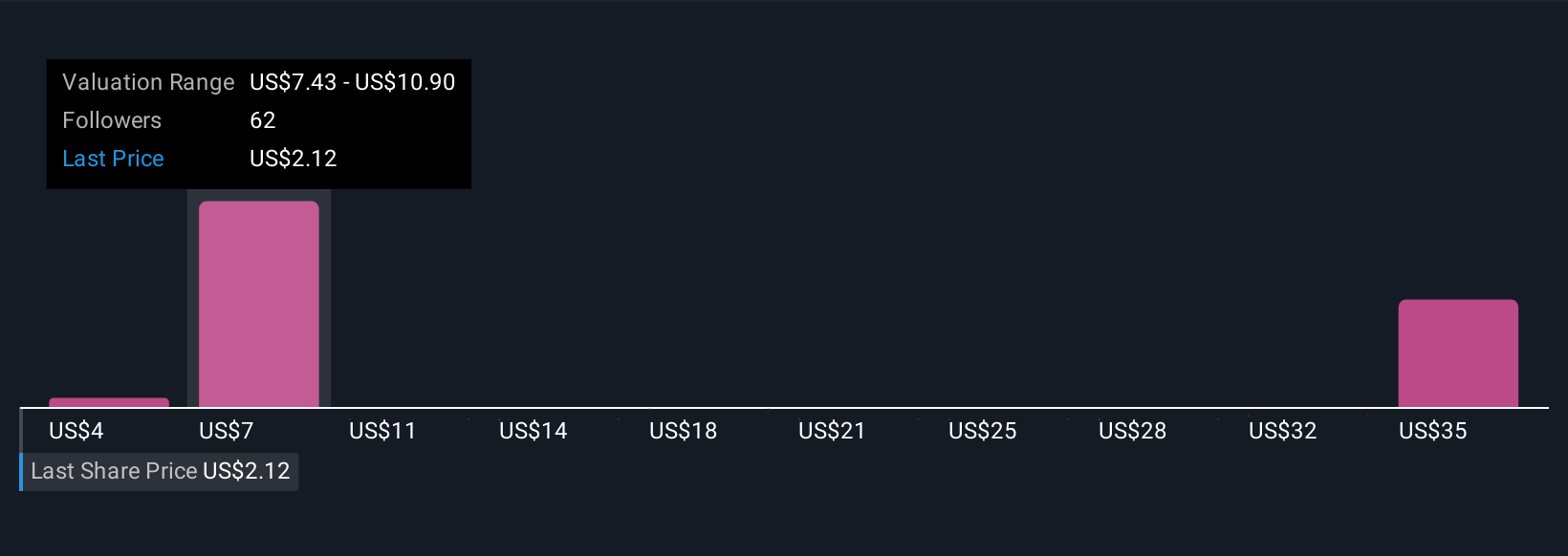

Simply Wall St Community members assigned fair values for Iovance ranging widely from US$3.97 to US$39.00, based on 11 individual analyses. This wide spectrum of outlooks sits against ongoing regulatory challenges, reminding you that opinions can vary and multiple viewpoints may shape expectations for Iovance’s future performance.

Explore 11 other fair value estimates on Iovance Biotherapeutics - why the stock might be worth just $3.97!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives