- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Iovance Biotherapeutics (NASDAQ:IOVA) delivers shareholders favorable 68% return over 1 year, surging 10.0% in the last week alone

While Iovance Biotherapeutics, Inc. (NASDAQ:IOVA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 19% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 68%.

Since the stock has added US$256m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Iovance Biotherapeutics

Because Iovance Biotherapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Iovance Biotherapeutics' revenue grew by 12,751%. That's well above most other pre-profit companies. The solid 68% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate Iovance Biotherapeutics in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

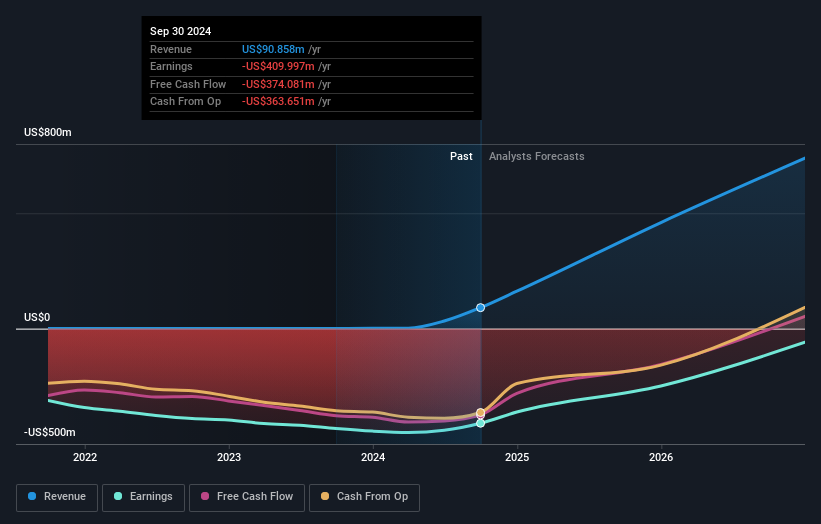

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Iovance Biotherapeutics in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Iovance Biotherapeutics shareholders have received a total shareholder return of 68% over the last year. That certainly beats the loss of about 10% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Iovance Biotherapeutics that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biotechnology company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

High growth potential with adequate balance sheet.