- United States

- /

- Semiconductors

- /

- NYSE:SQNS

Discover 3 US Penny Stocks With Over $10M Market Cap

Reviewed by Simply Wall St

As the U.S. stock market shows signs of recovery, with major indices like the Dow Jones and Nasdaq rebounding from recent downturns, investors are keenly exploring diverse opportunities. Penny stocks, though often seen as a relic of past investment strategies, remain relevant by offering potential growth at accessible price points. In this article, we explore several penny stocks that exhibit strong financial foundations and could present intriguing prospects for those seeking investments in smaller or newer companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.11 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.838 | $5.59M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.58 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3267 | $10.67M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.62 | $42.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $23.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.01 | $84.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.66 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 726 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lifeward (NasdaqCM:LFWD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lifeward Ltd. is a medical device company focused on designing, developing, and commercializing technologies to enhance mobility and wellness for individuals with physical and neurological conditions globally, with a market cap of $15.24 million.

Operations: The company generates revenue of $25.00 million from its Medical Products segment.

Market Cap: $15.24M

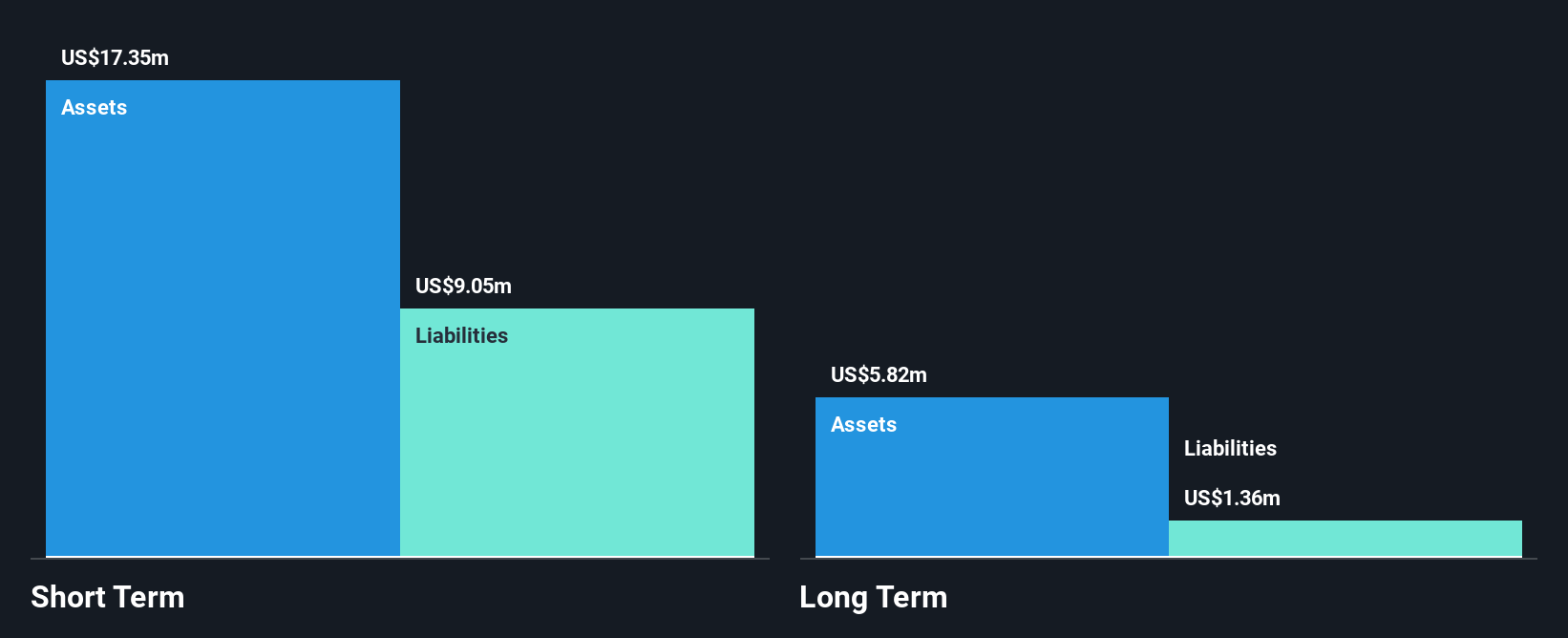

Lifeward Ltd., a medical device company, has shown significant revenue growth, reporting US$18.12 million for the first nine months of 2024 compared to US$6.97 million the previous year. Despite this, it remains unprofitable with a net loss of US$13.66 million for the same period. The company's recent strategic moves include streamlining U.S. operations and appointing Robert J. Marshall Jr., an experienced finance professional, as a director and Chairman of the Audit Committee. Lifeward's short-term assets exceed its liabilities, but it faces challenges with high share volatility and limited cash runway under one year without debt obligations.

- Take a closer look at Lifeward's potential here in our financial health report.

- Evaluate Lifeward's prospects by accessing our earnings growth report.

Kaltura (NasdaqGS:KLTR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kaltura, Inc. offers software-as-a-service (SaaS) and platform-as-a-service (PaaS) solutions globally, with a market cap of approximately $329.33 million.

Operations: The company's revenue is derived from two main segments: Media & Telecom, which generated $50.27 million, and Enterprise, Education and Technology, contributing $127.32 million.

Market Cap: $329.33M

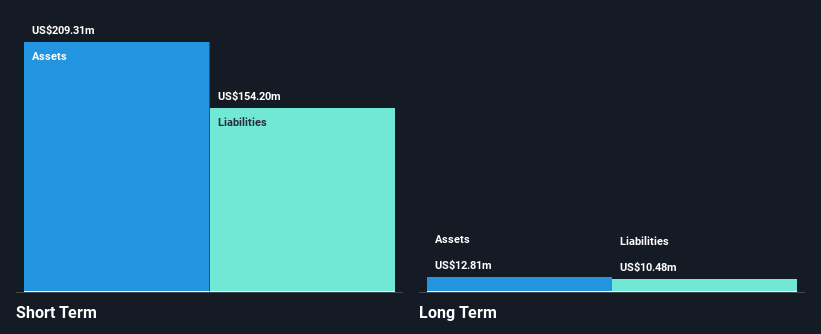

Kaltura, Inc. remains unprofitable but has demonstrated a reduction in net losses over recent periods, with a third-quarter net loss of US$3.61 million compared to US$10.73 million the previous year. Despite its volatile share price and shareholder dilution, Kaltura's cash reserves surpass its debt, providing a runway exceeding three years even as free cash flow decreases slightly annually. Recent earnings guidance suggests marginal revenue growth for 2024 between US$177.1 million and US$177.8 million, highlighting modest progress amid ongoing challenges in achieving profitability within the competitive software sector.

- Dive into the specifics of Kaltura here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Kaltura's future.

Sequans Communications (NYSE:SQNS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sequans Communications S.A. is a fabless company that designs, develops, and supplies cellular semiconductor solutions for the massive and broadband internet of things markets globally, with a market cap of $87.23 million.

Operations: The company's revenue is derived from the design and marketing of semiconductor components for cellular wireless systems, totaling $30.56 million.

Market Cap: $87.23M

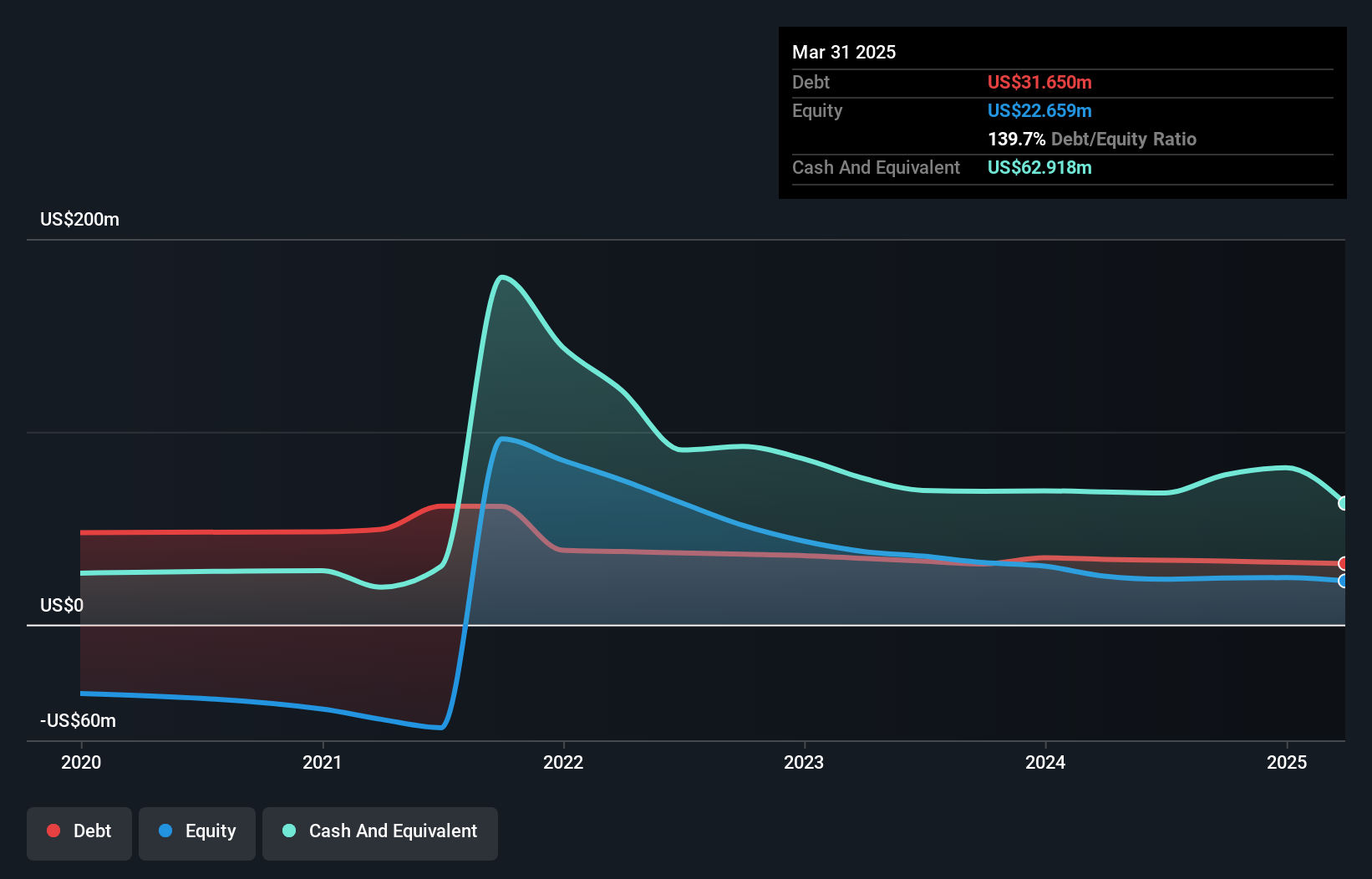

Sequans Communications has shown a turnaround by becoming profitable recently, with a net income of US$72.28 million in Q3 2024, significantly reversing from a loss the previous year. The company’s short-term assets exceed both its short and long-term liabilities, indicating financial stability. However, recent impairments of US$56.59 million raise concerns about asset valuation challenges. Despite trading below estimated fair value and having more cash than debt, earnings are forecast to decline sharply over the next three years. Shareholder dilution occurred last year but was minimal at 2.6%. Management is experienced with an average tenure of 4.3 years.

- Click here to discover the nuances of Sequans Communications with our detailed analytical financial health report.

- Gain insights into Sequans Communications' future direction by reviewing our growth report.

Next Steps

- Navigate through the entire inventory of 726 US Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQNS

Sequans Communications

Engages in the fabless designing, developing, and supplying of cellular semiconductor solutions for massive and broadband internet of things markets in Taiwan, Korea, China, rest of Asia, Germany, the United States, and internationally.

Undervalued with adequate balance sheet.