- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Iovance Biotherapeutics (NasdaqGM:IOVA) Sees 3% Price Increase Over Last Month

Reviewed by Simply Wall St

Iovance Biotherapeutics (NasdaqGM:IOVA) saw a 3% increase in its share price over the last month. This rise occurred amidst mixed market conditions where broader indices displayed minimal movement, as investors awaited crucial updates from the Federal Reserve on interest rates and tariff negotiations between the U.S. and China. Although the company-specific news remains undisclosed, the overall market sentiment, marked by volatility in tech stocks and investor cautiousness towards economic developments, could have influenced the stock's performance. Despite the market's static nature, Iovance Biotherapeutics managed to edge upward, possibly buffered by broader market optimism regarding future earnings growth projections.

The recent upward movement in Iovance Biotherapeutics' share price, despite mixed broader market conditions, signals potential optimism among investors. However, this should be tempered by a review of its longer-term performance, where the company's total return, comprising both share price and dividends, has declined by 77.32% over the past three years. Over the last year, Iovance's performance lagged behind the US Market's return of 7.2% and the US Biotechs industry's decline of 14.1%, highlighting significant volatility and positioning challenges.

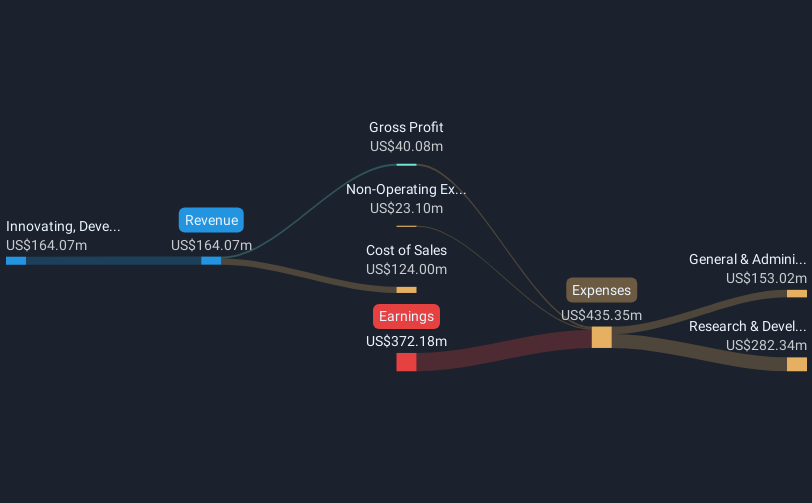

The potential U.S. launch of Amtagvi and international expansions, mentioned in the narrative, could drive future revenue and earnings, bolstering investor confidence. Analysts project an annual revenue growth of 32.1%, substantially outpacing the market's 8.4% growth. However, achieving the optimistic revenue guidance of US$450 million to US$475 million in 2025 depends heavily on successful expansions and manufacturing capability improvements.

Despite the recent price increase to US$3.56, Iovance remains significantly below the consensus price target of US$20.08, suggesting potential upside if future growth expectations are realized. This target is 82.3% higher than the current price, motivating further analysis of the company's path to profitability. Investors should weigh the company's strategic moves against industry volatility and the broader economic landscape to form a comprehensive evaluation of its potential trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives