- United States

- /

- Biotech

- /

- NasdaqGS:INSM

Insmed (INSM) Valuation in Focus After Major Insider Sales and Rising Growth Optimism

Reviewed by Kshitija Bhandaru

Insmed (INSM) has drawn attention after several insiders, including the President, sold large amounts of company stock in the past quarter. No insiders made any purchases during that period.

See our latest analysis for Insmed.

Despite the insider selling, Insmed's share price has surged, delivering a 132% return year to date and recently reaching a new 20-year high. Market optimism seems fueled by investor enthusiasm for its rare disease treatments, and its three-year total shareholder return of 684% highlights the momentum that has been building.

If Insmed’s remarkable run has you rethinking what’s possible, consider broadening your search and discover fast growing stocks with high insider ownership

After such a dramatic rally and a flurry of insider selling, investors might be asking whether Insmed is now undervalued or if the current price already reflects all its future growth. Could this be a real buying opportunity?

Most Popular Narrative: 1.3% Undervalued

The narrative's estimated fair value for Insmed sits just above the latest close, hinting that the market may still be underpricing the company's growth catalysts despite recent gains. But what is really fueling this optimistic valuation?

There is a consensus that recent regulatory approvals, particularly for Brinsupri, create a multi-billion dollar market opportunity. Analysts see first-in-class status, a favorable label, and high launch pricing as supporting robust long-term growth.

Curious how analysts predict such an aggressive upside? This valuation rests on bold revenue growth, margin expansion, and blockbuster product launches. The real twist is in the numbers they are betting on. Want to know which financial levers could push Insmed much higher? Click through to uncover the projections that shape this fair value call.

Result: Fair Value of $164.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential FDA review delays or slower than expected uptake for brensocatib could dampen the current growth outlook for Insmed.

Find out about the key risks to this Insmed narrative.

Another View: A Closer Look at Valuation Multiples

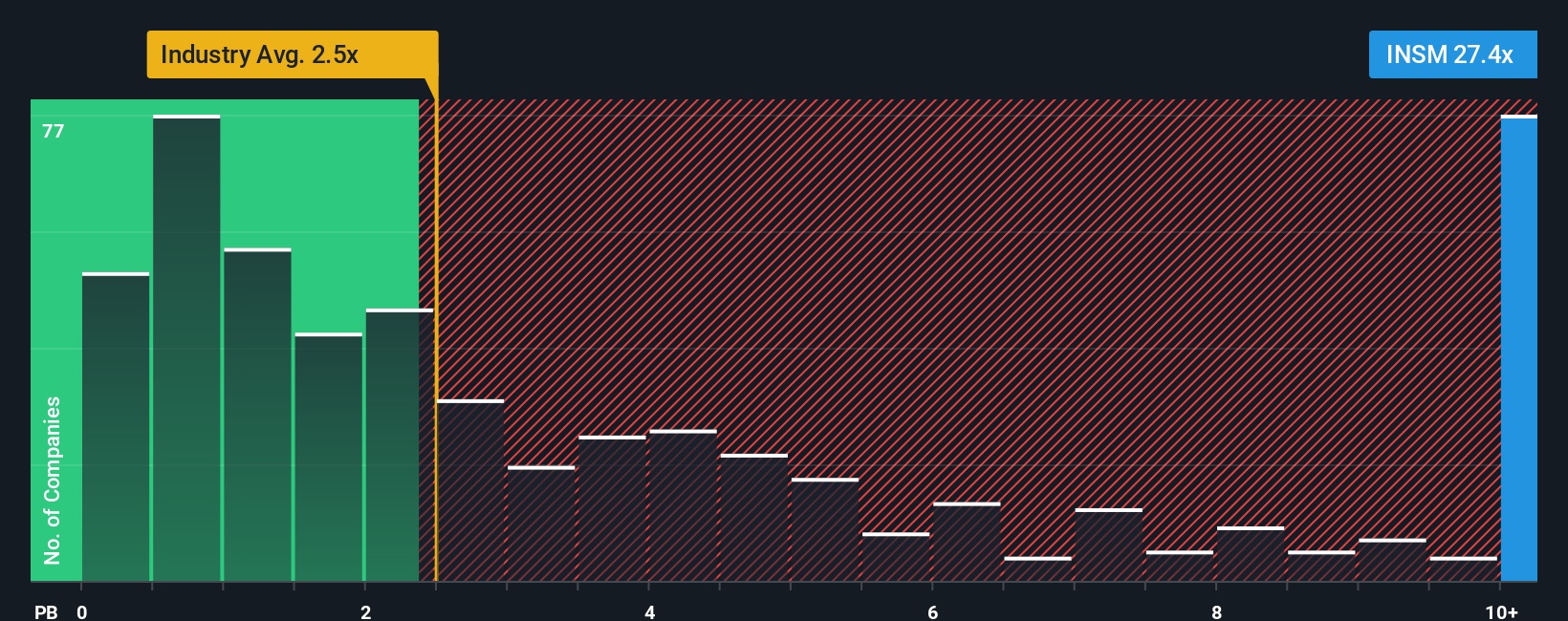

Looking from a different angle, Insmed is trading at a price-to-book ratio of 27.5x. This is well above both the US biotech industry average of 2.5x and the peer average of 67.9x. Such a high multiple signals investors are willing to pay a hefty premium, but is future growth enough to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insmed Narrative

If you want to dig deeper than the headline numbers or shape your own perspective on Insmed, you can easily create your own take in just a few minutes with Do it your way.

A great starting point for your Insmed research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

The market never stands still, and neither should you. Level up your strategy by tapping into new trends, stable returns, and under-the-radar opportunities now.

- Tap into growth by targeting these 24 AI penny stocks as these are propelling the artificial intelligence wave across multiple sectors.

- Boost your portfolio’s income potential with these 19 dividend stocks with yields > 3% that combine attractive yields with financial strength.

- Spot hidden bargains with these 892 undervalued stocks based on cash flows which are trading below their true worth, giving you an edge before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INSM

Insmed

Develops and commercializes therapies for patients with serious and rare diseases in the United States, Europe, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives