- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Is There Still Opportunity in Indivior After Its Impressive 143% Rally?

Reviewed by Simply Wall St

If you are weighing your options with Indivior, you are not alone in wondering whether now is the right time to get on board, hold steady, or lock in some gains. Indivior has made plenty of headlines with its impressive long-term performance. The stock has soared 143.3% over the past year and a staggering 211.5% over five years, turning patient investors into clear winners. Even so, the past month shows a mild pullback of -1.1%, and the last week has seen a sharper dip of -6.2%. These recent moves are partly tied to changing sentiment in the pharmaceuticals space, as well as increased attention on addiction treatment products. Both of these factors can impact how investors weigh potential risks versus rewards.

While the year-to-date gain of 85.7% reflects strong conviction about Indivior’s future, not everyone agrees on what the next chapter holds. With a latest closing price of 23.21, it is natural to ask if the stock’s valuation is now stretched or if the market is still underestimating its prospects. Our valuation score gives Indivior a 3 out of 6, meaning it is undervalued by half of the trusted methods we track. Before you make your next move, let’s see exactly how the numbers stack up and dig into a smarter way to think about valuation that many investors overlook.

Indivior delivered 143.3% returns over the last year. See how this stacks up to the rest of the Pharmaceuticals industry.Approach 1: Indivior Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today, reflecting the time value of money. For Indivior, a two-stage Free Cash Flow to Equity approach is used, considering both analyst estimates and longer-term projections extrapolated by Simply Wall St.

Currently, Indivior generates $165.8 million in Free Cash Flow (FCF). Analysts project this to increase substantially, reaching $333.6 million by 2029. Over the next decade, annual FCF is forecast to continue growing, with Simply Wall St extending estimates beyond 2029 using conservative growth rates.

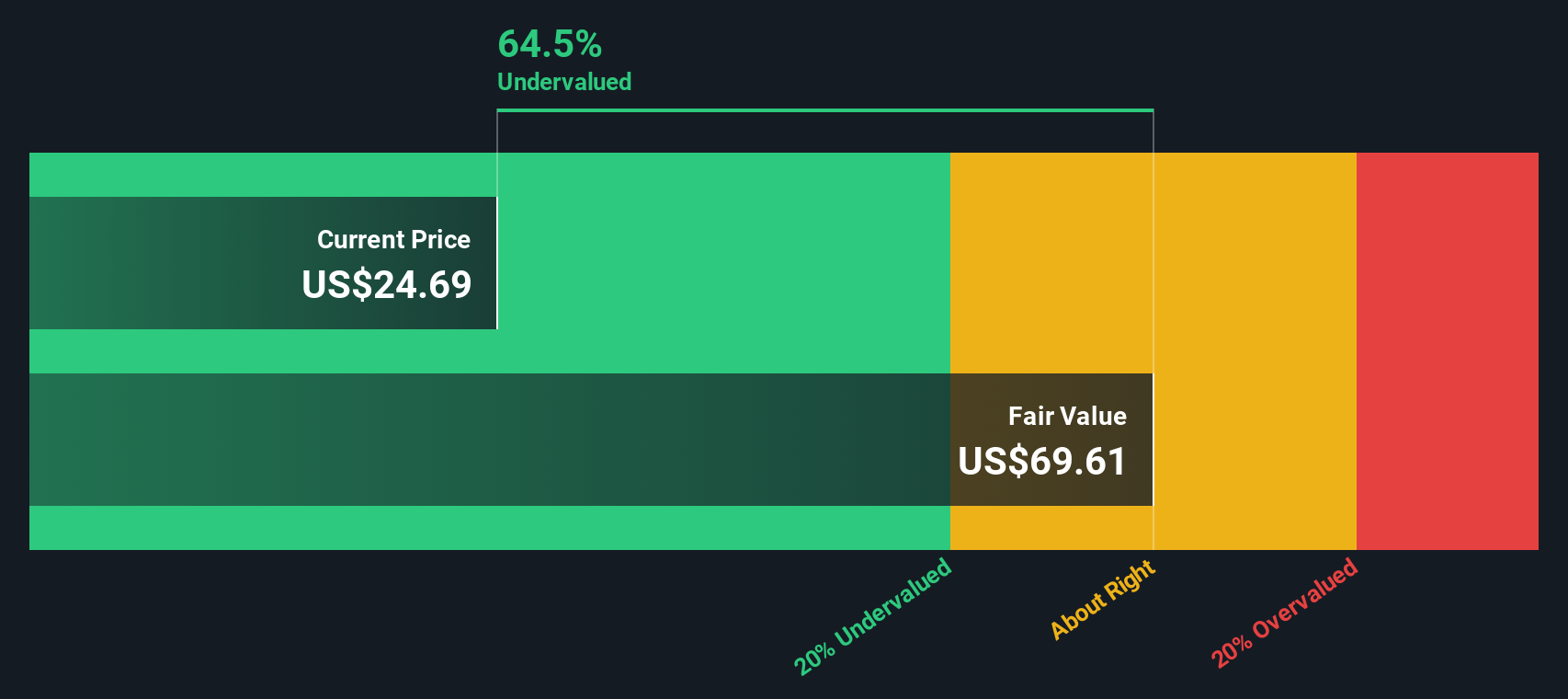

Using this DCF method, the estimated intrinsic value per share for Indivior is $69.61. At the recent share price of $23.21, this implies the stock is trading at a 66.7% discount to its calculated true worth, based solely on these cash flow forecasts and discount rates. If the underlying growth materializes as projected, the current valuation may appear attractive for long-term investors.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Indivior.

Approach 2: Indivior Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Indivior because it connects a business’s current share price to its per-share earnings. For investors, it offers a quick measure of how much the market is willing to pay for a company’s earnings power today.

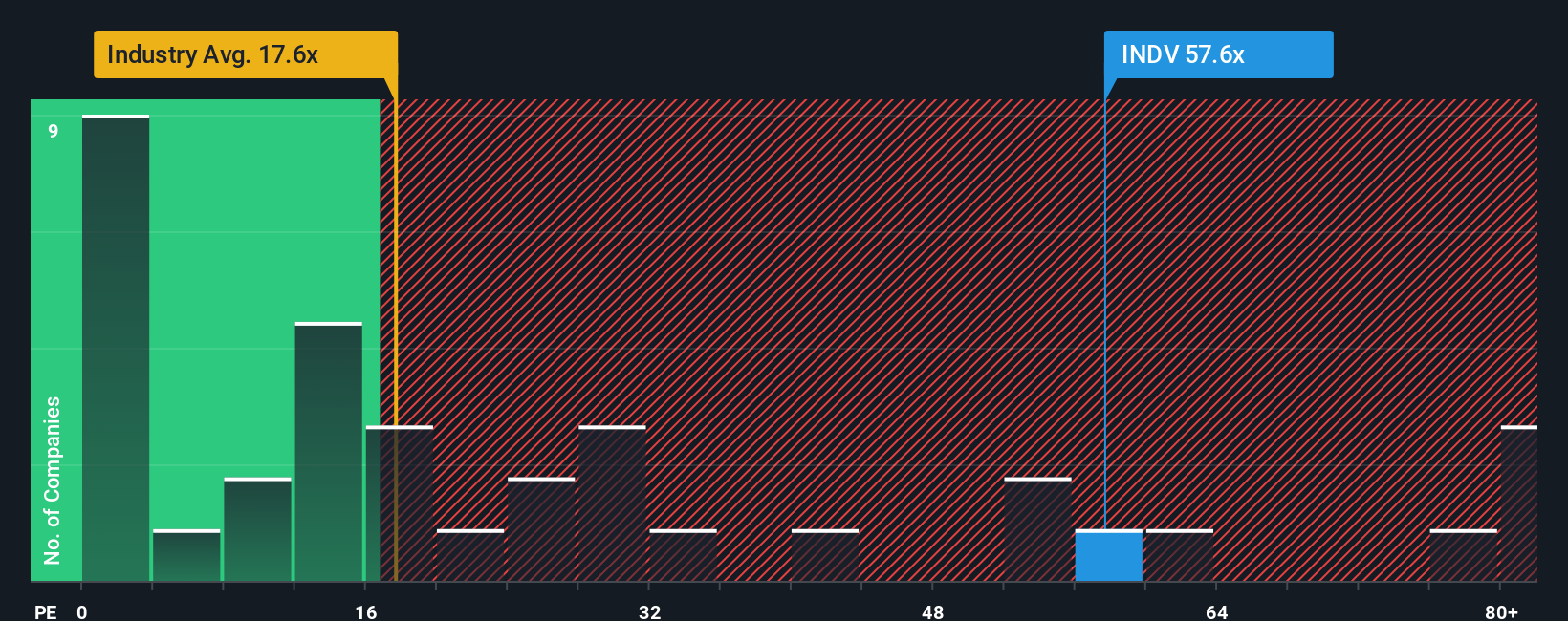

What counts as a “normal” or “fair” PE ratio can vary based on growth potential and risk factors. Companies expected to grow faster or deliver more predictable profits usually justify higher PE ratios, while riskier or slower-growth businesses often command lower multiples. With Indivior currently trading at 54.6x earnings, the stock sits well above the Pharmaceuticals industry average of 18.9x and the average for peers, which is 21.4x. This might seem high at first glance, but headline numbers do not always tell the full story.

This is where the Simply Wall St “Fair Ratio” comes in. Our Fair Ratio, calculated specifically for Indivior, suggests a PE of 31.9x based on a proprietary assessment of factors such as earnings growth, industry norms, profit margin, market capitalization, and risk profile. Unlike a simple peer or industry comparison, the Fair Ratio gives a tailored view that accounts for what actually sets the company apart. Comparing Indivior’s current PE of 54.6x to the Fair Ratio of 31.9x, the stock appears overvalued on this metric because the price requires extremely strong future earnings growth to be justified.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Indivior Narrative

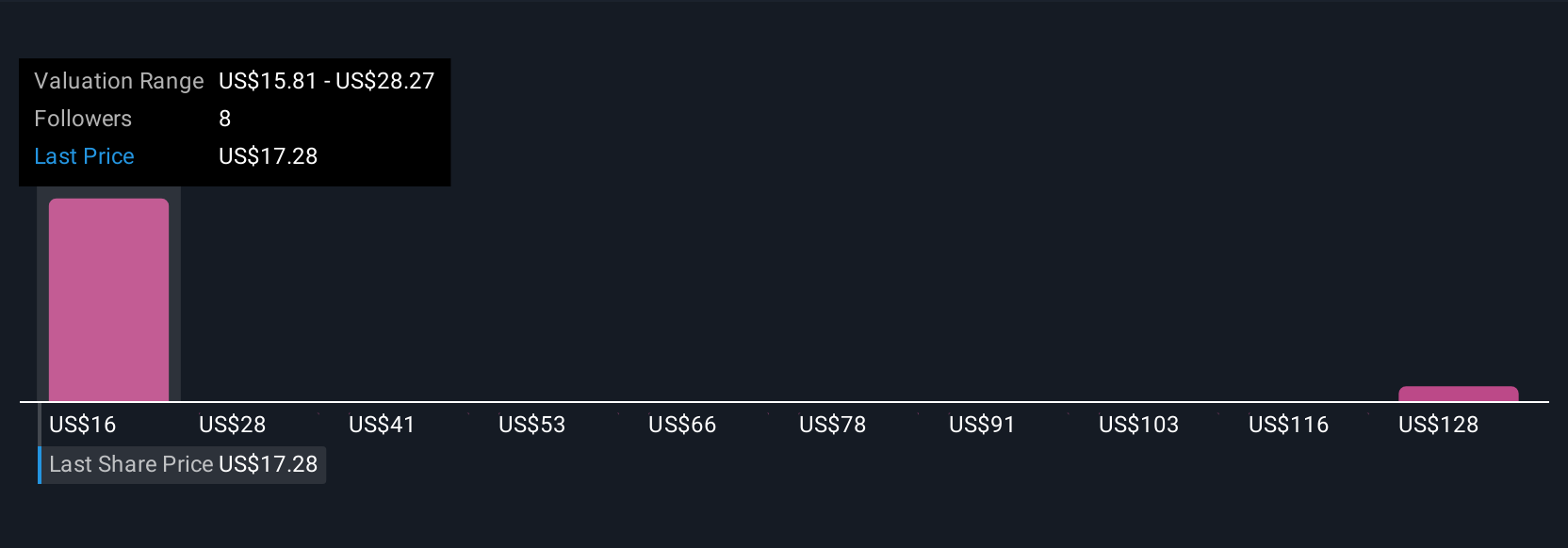

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative lets you tell your story about a company by combining your outlook, estimates, and expectations for Indivior into a single financial forecast and fair value. Think of it as an easy-to-use framework on Simply Wall St’s Community page, used by millions of investors, where you connect your research and perspective directly to the numbers behind the stock.

With Narratives, you tie Indivior’s business story to specific assumptions about its future revenue, earnings, and margins. This produces your own estimated Fair Value, which you can instantly compare to the current share price for more informed investment decisions. Narratives are regularly updated as soon as new earnings, news, or data become available, keeping your outlook relevant and current.

For example, some investors believe Indivior has a fair value much higher than today’s price due to its global expansion. Others set a lower fair value because they remain cautious about future competition. By creating and following Narratives, you make investment decisions driven by your convictions, while always staying connected to the numbers.

Do you think there's more to the story for Indivior? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives