- United States

- /

- Biotech

- /

- OTCPK:IMPL.Q

Investors Still Aren't Entirely Convinced By Impel Pharmaceuticals Inc.'s (NASDAQ:IMPL) Revenues Despite 50% Price Jump

Impel Pharmaceuticals Inc. (NASDAQ:IMPL) shareholders are no doubt pleased to see that the share price has bounced 50% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 76% share price decline over the last year.

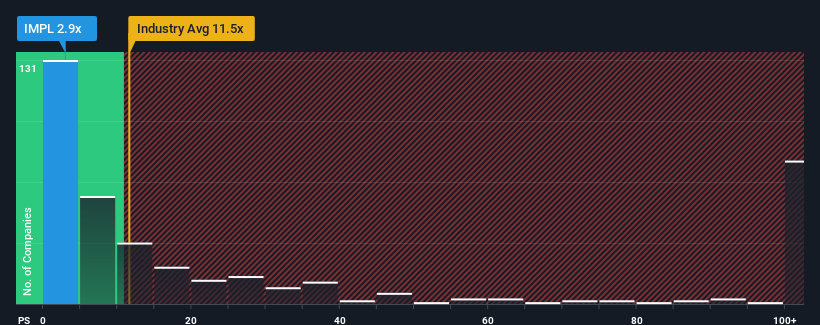

Although its price has surged higher, Impel Pharmaceuticals' price-to-sales (or "P/S") ratio of 2.9x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.5x and even P/S above 50x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Impel Pharmaceuticals

What Does Impel Pharmaceuticals' P/S Mean For Shareholders?

Recent times have been advantageous for Impel Pharmaceuticals as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Impel Pharmaceuticals will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Impel Pharmaceuticals?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Impel Pharmaceuticals' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 112% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 92% each year, which is noticeably less attractive.

In light of this, it's peculiar that Impel Pharmaceuticals' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Impel Pharmaceuticals' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Impel Pharmaceuticals' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 6 warning signs for Impel Pharmaceuticals (of which 3 shouldn't be ignored!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:IMPL.Q

IPI Legacy Liquidation Co

Impel Pharmaceuticals Inc., a commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapies for patients suffering from central nervous system disease in the United States.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives