- United States

- /

- Biotech

- /

- NasdaqGS:IGMS

IGM Biosciences (NASDAQ:IGMS shareholders incur further losses as stock declines 21% this week, taking five-year losses to 84%

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding IGM Biosciences, Inc. (NASDAQ:IGMS) during the five years that saw its share price drop a whopping 84%. Furthermore, it's down 55% in about a quarter. That's not much fun for holders. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

If the past week is anything to go by, investor sentiment for IGM Biosciences isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for IGM Biosciences

We don't think IGM Biosciences' revenue of US$2,918,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that IGM Biosciences has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some IGM Biosciences investors have already had a taste of the bitterness stocks like this can leave in the mouth.

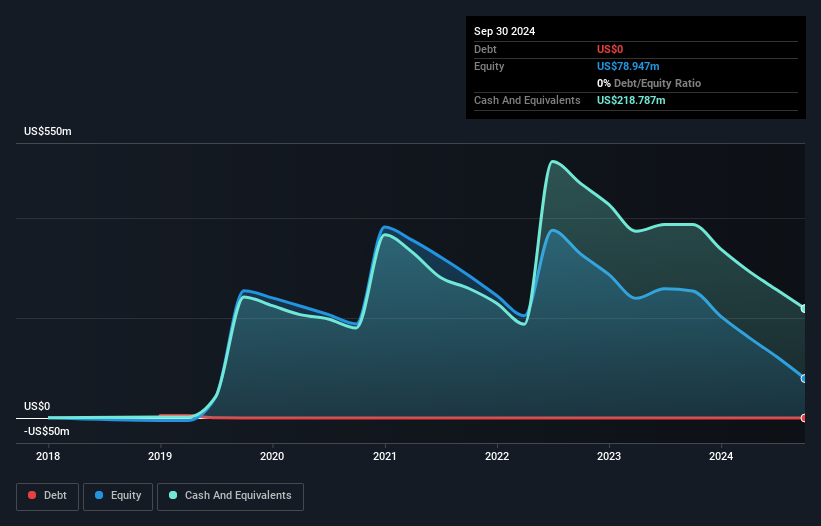

Our data indicates that IGM Biosciences had US$6.8m more in total liabilities than it had cash, when it last reported in September 2024. That puts it in the highest risk category, according to our analysis. But since the share price has dived 31% per year, over 5 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how IGM Biosciences' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

A Different Perspective

IGM Biosciences shareholders are down 3.9% for the year, but the market itself is up 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for IGM Biosciences that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IGMS

IGM Biosciences

A biotechnology company, develops Immunoglobulin M antibodies for the treatment of cancer and autoimmune and inflammatory diseases.

Excellent balance sheet low.

Market Insights

Community Narratives