- United States

- /

- Biotech

- /

- NasdaqGS:ICPT

Need To Know: Analysts Are Much More Bullish On Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT)

Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 12% to US$18.01 in the last 7 days. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

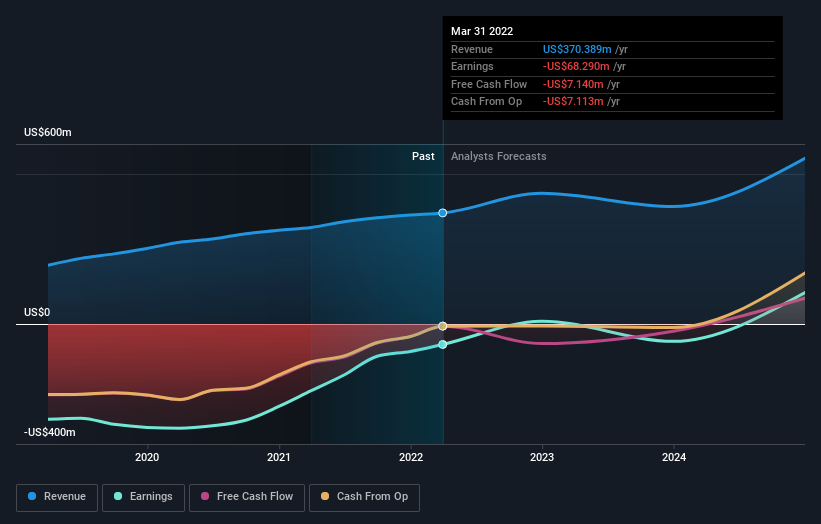

After this upgrade, Intercept Pharmaceuticals' 16 analysts are now forecasting revenues of US$425m in 2022. This would be a decent 15% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 67% to US$0.76. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$386m and losses of US$2.39 per share in 2022. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Check out our latest analysis for Intercept Pharmaceuticals

There was no major change to the consensus price target of US$27.87, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Intercept Pharmaceuticals, with the most bullish analyst valuing it at US$82.00 and the most bearish at US$10.00 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Intercept Pharmaceuticals' revenue growth is expected to slow, with the forecast 20% annualised growth rate until the end of 2022 being well below the historical 28% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 11% per year. Even after the forecast slowdown in growth, it seems obvious that Intercept Pharmaceuticals is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Intercept Pharmaceuticals' prospects. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at Intercept Pharmaceuticals.

That's a pretty serious upgrade, but shareholders might be even more pleased to know that forecasts expect Intercept Pharmaceuticals to be able to reach break-even within the next few years. You can learn more about these forecasts, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade Intercept Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICPT

Intercept Pharmaceuticals

Intercept Pharmaceuticals, Inc., a biopharmaceutical company, focuses on the development and commercialization of therapeutics to treat progressive non-viral liver diseases in the United States, Europe, and Canada.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives