- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

After Leaping 25% ICON Public Limited Company (NASDAQ:ICLR) Shares Are Not Flying Under The Radar

ICON Public Limited Company (NASDAQ:ICLR) shares have continued their recent momentum with a 25% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

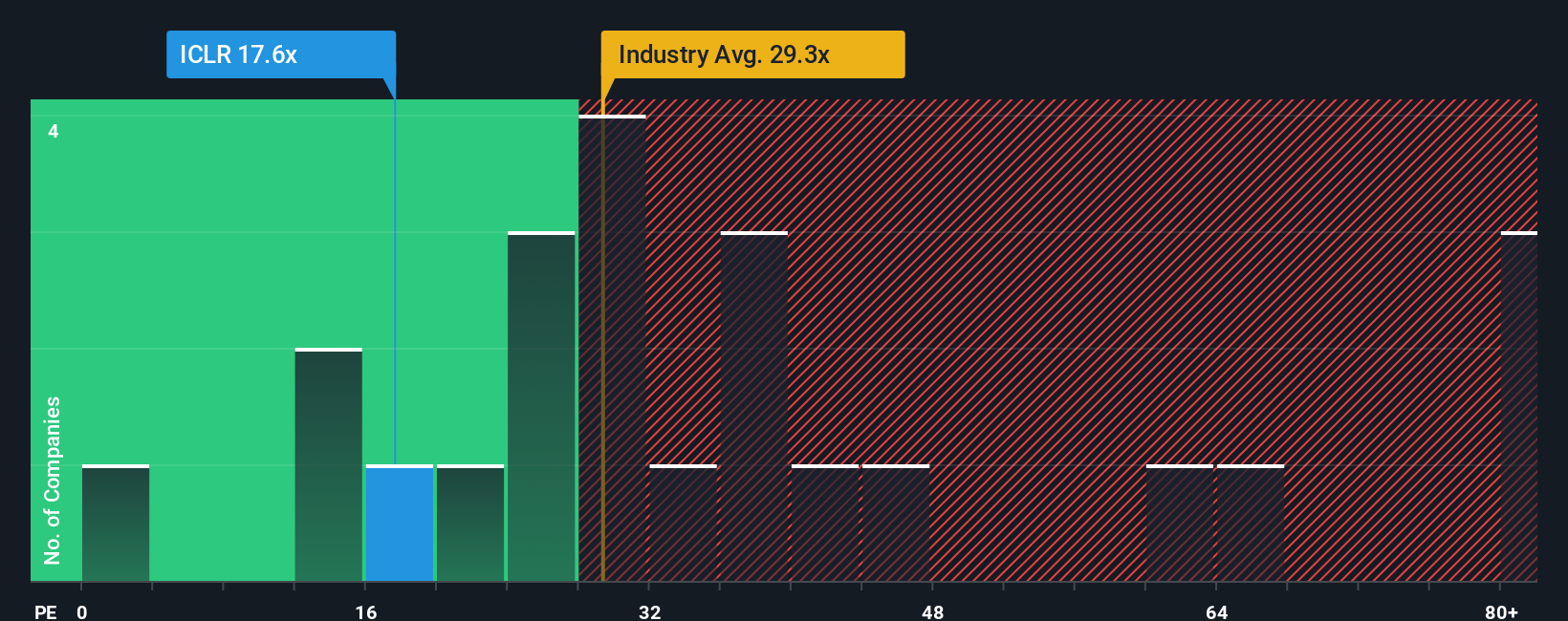

Although its price has surged higher, you could still be forgiven for feeling indifferent about ICON's P/E ratio of 17.6x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, ICON has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for ICON

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like ICON's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 296% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 11% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 11% per year growth forecast for the broader market.

With this information, we can see why ICON is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On ICON's P/E

Its shares have lifted substantially and now ICON's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of ICON's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for ICON with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than ICON. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives