- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

Why ImmunityBio (IBRX) Is Up 8.3% After Promising ANKTIVA Data in Advanced Lung Cancer

Reviewed by Simply Wall St

- ImmunityBio announced new findings from its Phase 2 QUILT-3.055 study, revealing that ANKTIVA reversed lymphopenia and was associated with significantly longer median overall survival in checkpoint inhibitor-resistant advanced non-small cell lung cancer patients, as presented at the IASLC 2025 World Conference on Lung Cancer.

- These results spotlight ANKTIVA as the first therapy specifically under investigation for reversing cancer-related lymphopenia, targeting an unmet need for patients with few remaining treatment options.

- We’ll explore how ANKTIVA’s potential to reverse lymphopenia could reshape ImmunityBio’s investment narrative in a competitive cancer therapy landscape.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is ImmunityBio's Investment Narrative?

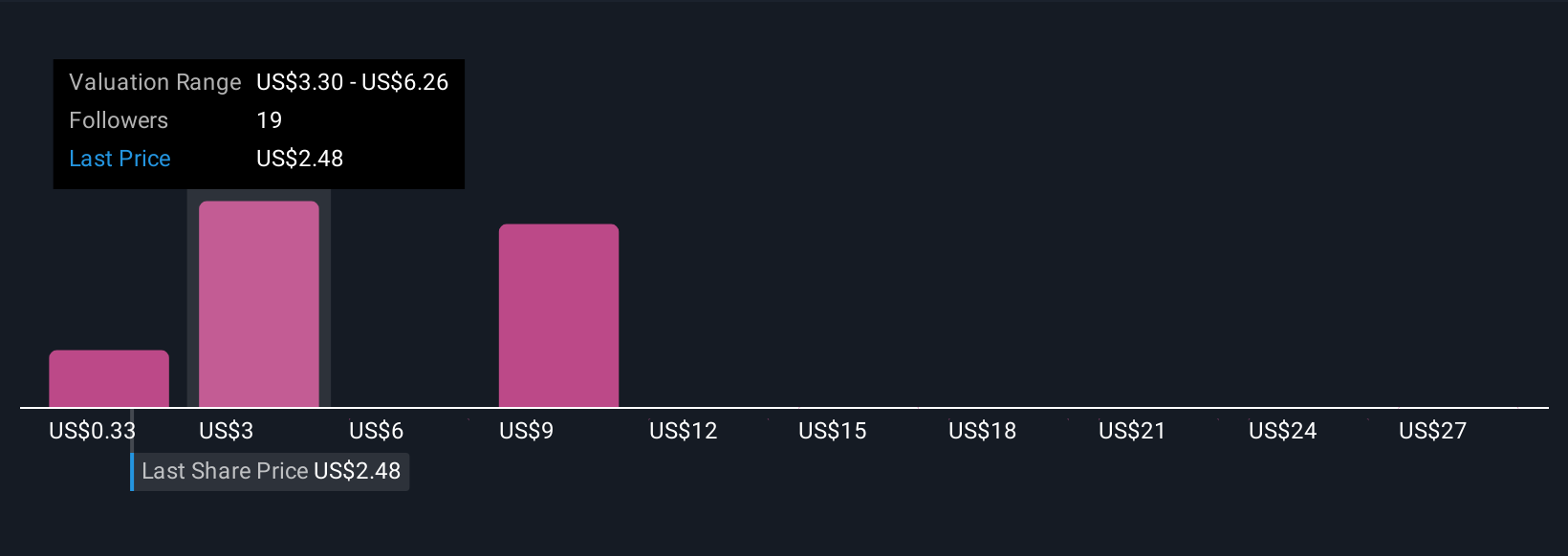

For ImmunityBio, the big-picture story that investors have needed to believe in is a platform-driven pipeline that can address hard-to-treat cancers and potentially expand into broader immunotherapeutic indications. The latest Phase 2 news from the QUILT-3.055 study may be a significant near-term catalyst, suggesting ANKTIVA’s ability to reverse lymphopenia could uniquely position ImmunityBio in a segment where approved therapies are lacking. This could raise the stakes for the upcoming Phase 3 results and support ongoing regulatory filings, while also increasing interest in the stock’s story after a period of underperformance. However, with substantial operating losses, high cash burn, and dilution from recent equity raises, execution risk remains high, and regulatory hurdles are still unresolved. The company’s lead asset is showing promise, but ImmunityBio remains relatively high-risk given its financial position and expensive current valuation compared to peers.

But there’s a real risk that ImmunityBio will need more funding long before it reaches profitability. ImmunityBio's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 10 other fair value estimates on ImmunityBio - why the stock might be a potential multi-bagger!

Build Your Own ImmunityBio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ImmunityBio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ImmunityBio's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion