- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

ANKTIVA Reimbursement Gains and UK Approval Might Change The Case For Investing In ImmunityBio (IBRX)

Reviewed by Sasha Jovanovic

- ImmunityBio recently advanced its position in immunotherapy with UK approval of ANKTIVA® plus BCG for BCG-unresponsive non-muscle invasive bladder cancer and reported a very large boost in unit sales following streamlined reimbursement processes.

- These developments, alongside an US$80 million equity raise and new expansion into lung cancer trials, underscore the company’s broadening clinical and commercial footprint in cancer treatment.

- We'll explore how ImmunityBio’s international regulatory success and surging ANKTIVA® sales are shaping its investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is ImmunityBio's Investment Narrative?

For investors considering ImmunityBio, the central case rests on the belief that its ANKTIVA platform can secure sustained commercial traction and wider regulatory acceptance, building real value from recent scientific progress. The latest UK approval for ANKTIVA plus BCG in bladder cancer and the sharp lift in unit sales after new reimbursement codes could shift the near-term catalyst narrative, lending more weight to commercial execution and potential guideline updates in the US. While this momentum may support revenue growth forecasts, ongoing losses, high cash burn, and a recent round of equity dilution remain significant hurdles. Regulatory risks have eased somewhat with the UK progress, but the US market’s importance and the evolving FDA stance remain uncertainties investors can’t ignore. Given ImmunityBio’s ambitious pipeline and relatively high valuation compared to sales, ongoing trial outcomes and regulatory milestones are likely to shape sentiment moving forward. But with shareholder dilution and regulatory uncertainty still in play, it’s not all upside.

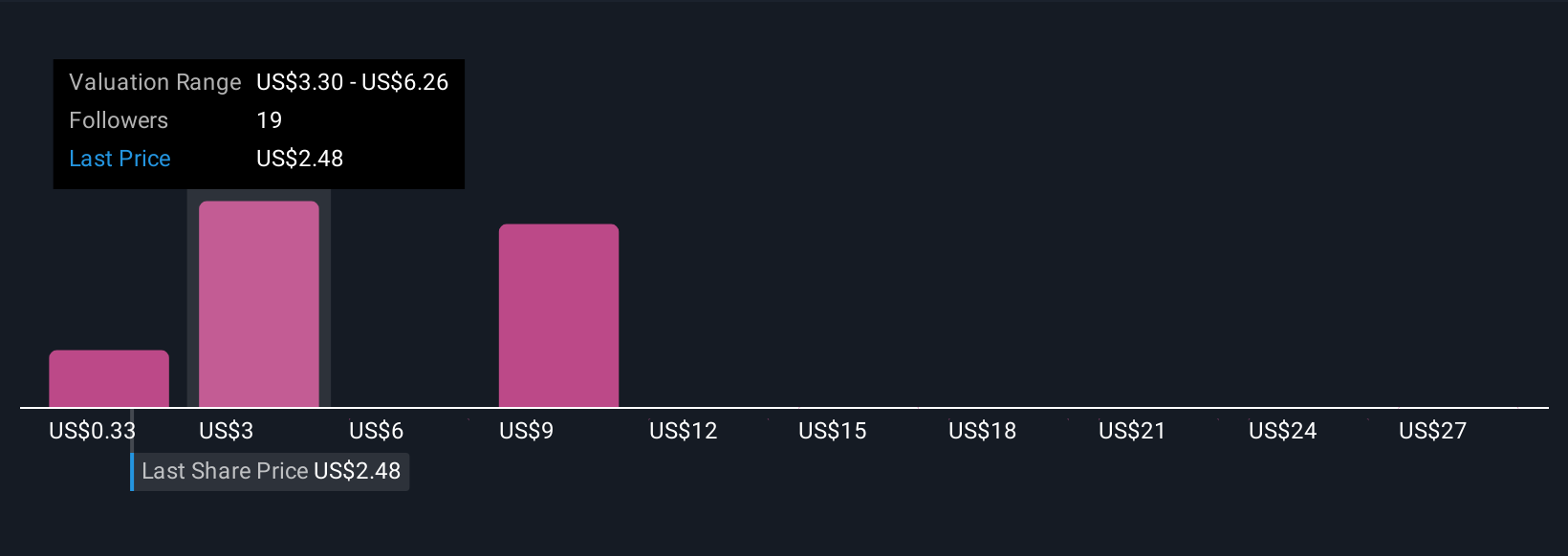

According our valuation report, there's an indication that ImmunityBio's share price might be on the expensive side.Exploring Other Perspectives

Explore 11 other fair value estimates on ImmunityBio - why the stock might be a potential multi-bagger!

Build Your Own ImmunityBio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ImmunityBio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ImmunityBio's overall financial health at a glance.

No Opportunity In ImmunityBio?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives