- United States

- /

- Biotech

- /

- NasdaqGS:HLVX

Rave Restaurant Group And 2 Other Promising US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a rise, buoyed by gains in the technology sector and investor focus on the upcoming presidential election, attention is also drawn to smaller investment opportunities. Though often considered a relic from past trading days, "penny stocks" continue to represent potential for significant returns when they are backed by strong financials. This article will explore three such penny stocks that stand out for their balance sheet strength and growth potential in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7995 | $5.56M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.05 | $47.83M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.05B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.67 | $526.12M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $158.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.12 | $3.26M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.44 | $128.24M | ★★★★★☆ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $3.08 | $97.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.105 | $95.79M | ★★★★★☆ |

Click here to see the full list of 754 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Rave Restaurant Group (NasdaqCM:RAVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rave Restaurant Group, Inc. operates and franchises pizza buffet, delivery/carry-out, express restaurants, and ghost kitchens under the Pizza Inn and Pie Five brands both in the United States and internationally, with a market cap of $42.96 million.

Operations: The company's revenue is primarily derived from Pizza Inn Franchising, which accounts for $10.30 million, followed by Pie Five Franchising at $1.72 million.

Market Cap: $42.96M

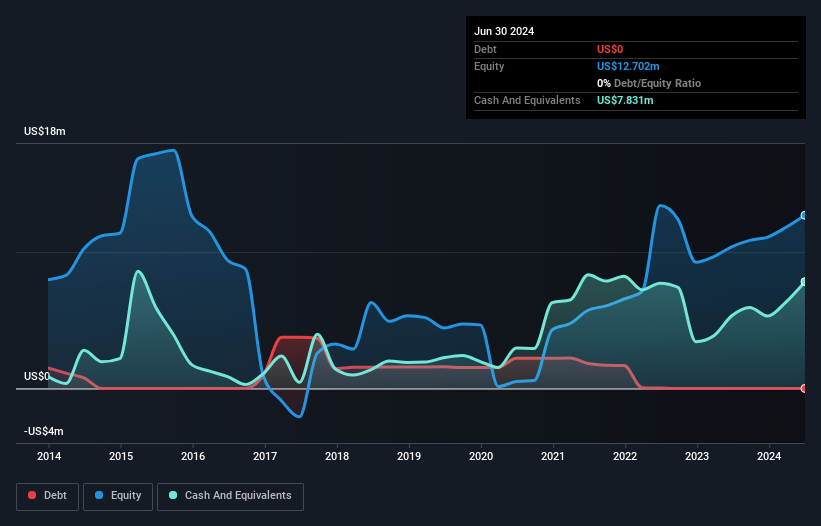

Rave Restaurant Group, with a market cap of US$42.96 million, demonstrates solid financial health by maintaining a debt-free status and covering both short and long-term liabilities with its assets. The company has shown strong profit growth, reporting earnings of US$2.47 million for the year ended June 30, 2024, up from US$1.61 million the previous year. While Rave's net profit margins have improved to 20.4%, its return on equity remains low at 19.5%. Despite a relatively inexperienced management team, Rave's board is seasoned and experienced, supporting strategic stability in this volatile sector.

- Dive into the specifics of Rave Restaurant Group here with our thorough balance sheet health report.

- Gain insights into Rave Restaurant Group's past trends and performance with our report on the company's historical track record.

Neuronetics (NasdaqGM:STIM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neuronetics, Inc. is a commercial stage medical technology company that designs, develops, and markets products for patients with neurohealth disorders in the United States and internationally, with a market cap of $31.20 million.

Operations: The company generates revenue of $72.07 million from its Surgical & Medical Equipment segment.

Market Cap: $31.2M

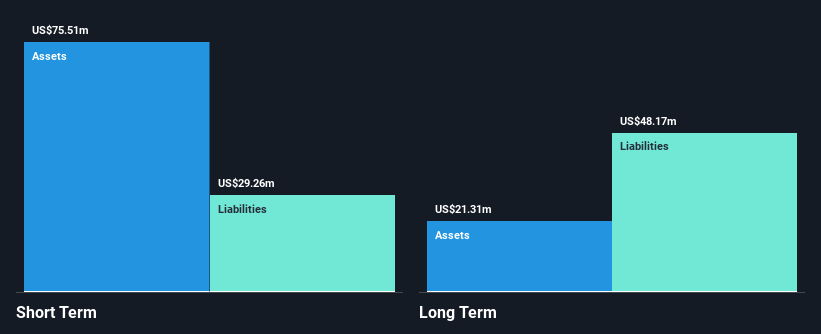

Neuronetics, Inc., with a market cap of US$31.20 million, faces challenges as its stock price recently fell below Nasdaq's minimum bid requirement of US$1.00 per share, risking potential delisting if compliance isn't regained by April 2025. Despite being unprofitable and having a high net debt to equity ratio of 88.3%, the company has sufficient short-term assets to cover liabilities and forecasts revenue growth between US$78 million and US$80 million for 2024. Recent policy updates from major payors like BlueCross BlueShield have expanded coverage for its NeuroStar TMS Therapy, potentially boosting future revenue streams.

- Get an in-depth perspective on Neuronetics' performance by reading our balance sheet health report here.

- Gain insights into Neuronetics' outlook and expected performance with our report on the company's earnings estimates.

HilleVax (NasdaqGS:HLVX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HilleVax, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing novel vaccines in the United States, with a market cap of $89.24 million.

Operations: HilleVax, Inc. does not report any revenue segments as it is a clinical-stage biopharmaceutical company focused on vaccine development in the United States.

Market Cap: $89.24M

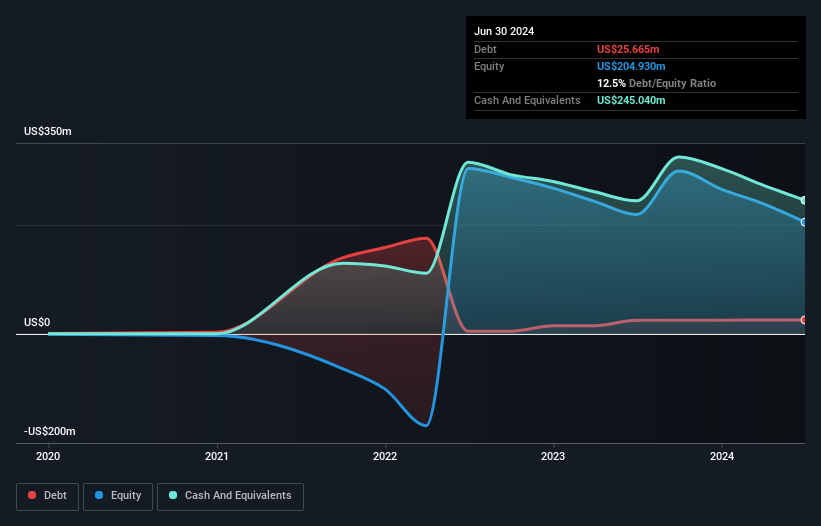

HilleVax, Inc., with a market cap of US$89.24 million, is pre-revenue and faces challenges typical of clinical-stage biopharmaceutical companies. The company has sufficient short-term assets (US$252.5 million) to cover both its short-term (US$49.2 million) and long-term liabilities (US$22.8 million), but it remains unprofitable with increasing losses over the past five years at 25.4% annually. Recent earnings reported a net loss of US$40.67 million for Q2 2024, up from US$27.9 million the previous year, indicating financial strain amid ongoing shareholder dilution and management inexperience concerns as tenure averages 1.8 years.

- Jump into the full analysis health report here for a deeper understanding of HilleVax.

- Understand HilleVax's earnings outlook by examining our growth report.

Taking Advantage

- Investigate our full lineup of 754 US Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HilleVax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLVX

HilleVax

A clinical-stage biopharmaceutical company, focuses on developing and commercializing novel vaccines in the United States.

Flawless balance sheet slight.